The Craig Hutchison-led sports media content and entertainment business Sports Entertainment Group (SEG) has reported its FY24 financial year.

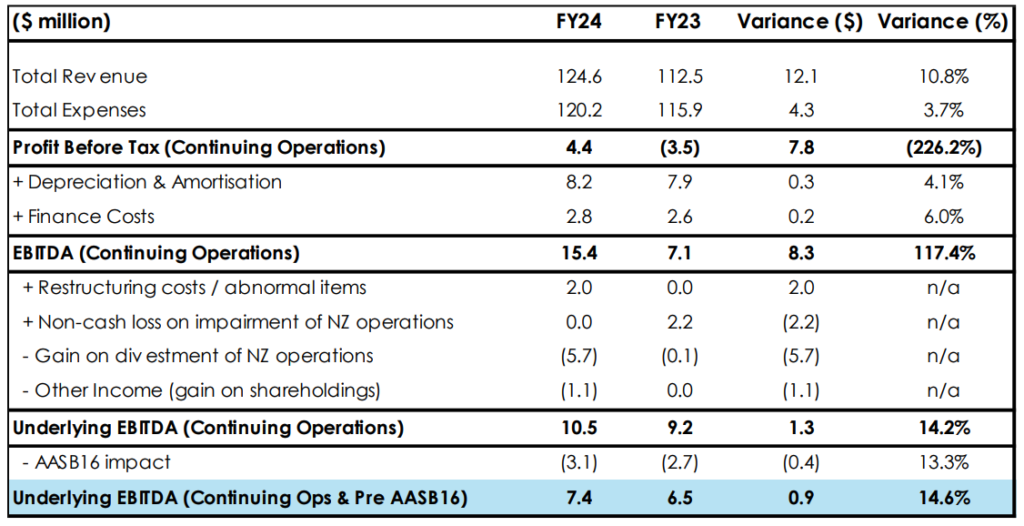

FY24 revenue from continuing operations of $124.6m was up 10.8% on the prior corresponding period (pcp).

The Australian business revenue growth was driven by its complementary services divisions which includes sports teams.

Combined, those business units grew by 21%.

The biggest news at the group this year has happened since the end of FY24. In mid-August Craig Hutchison confirmed receipt of $21m as the first payment in the $40m sale of the NBL team Perth Wildcats. A profit on the sale will be reported in subsequent FY25 financial statements.

See also: Hutchy’s sale of Perth Wildcats secures future of SEG including SEN radio network

Digital dollars climb

FY24 digital audience consumption via the SEN app, www.sen.com.au, podcasts and social media platforms experienced 1.2 million monthly average users. The introduction of the SEN Stadium and SEN Sync increased the streaming audience and had a positive impact on revenue.

Group revenue up 14.6%

FY241 underlying EBITDA of $7.4m was 14.6% up on the pcp. This excludes the impact of the SENZ audio and digital business which was sold on 29th February 2024. The loss after tax of discontinued operations in FY24 was $1.9m. EBITDA loss from discontinued operations was $2m.

FY24 cash flow from operating activities was $4.3m. Net debt as at 30 June 2024 was $13.3m significantly down from $22.8m at 30 June 2023.

SEG noted post June 30 it had reduced its CBA debt facility to $11.5m (from $27m as at 30 June 2023).

The SEG board also declared a fully franked special dividend of 2 cents per share payable on 3 October 2024.

Future planning

The SEG commentary about its performance included:

We continued to build our asset base through FY24 with minor acquisitions and new inventory unlocked. As we move into FY25, with a reduced debt position and stronger balance sheet, we are well-positioned to expand margin and grow our earnings.

We do not envisage significant new asset purchases in FY25 unless opportunities that are aligned to our broader strategy exist and we will maintain a strong focus on cost governance.

Sports team ownership: Mavericks arrive

FY24 saw the integration of the Melbourne Mavericks into the SEG stable of teams. The team finished the 2024 season ranked five out of eight teams with six wins and eight losses. SEG reported the Mavericks were able to make a positive EBITDA contribution to the group.

SEG currently administers the management of the Perth Lynx Basketball club, who play in the WNBL. As part of the management agreement, SEG holds the rights to purchase the franchise. These rights are valid up to 31 March 2025.

Trading outlook

Looking at July 2024, SEG is reporting revenue growth was up 2% on pep, with EBITDA $1m better than pop.

ASX statement: “Our current forecasts remain positive with the AFL & NRL finals expected to be stronger than previous periods and the expectation that Q1 will outperform pop by double digits. We are forecasting FY25 underlying EBITDA to grow by single digits.”