Omnicom confirmed it will acquire The Interpublic Group of Companies, Inc. on Monday, with its board of directors for the holding companies unanimously approving the agreement.

The acquisition of Interpublic will make the combined holding companies the industry’s deepest bench of marketing talent, and the broadest and most innovative services and products.

Mediaweek spoke with industry figures to get their thoughts and opinions on the acquisition, the global and local impact, and what it means for the future of the media and marketing industry.

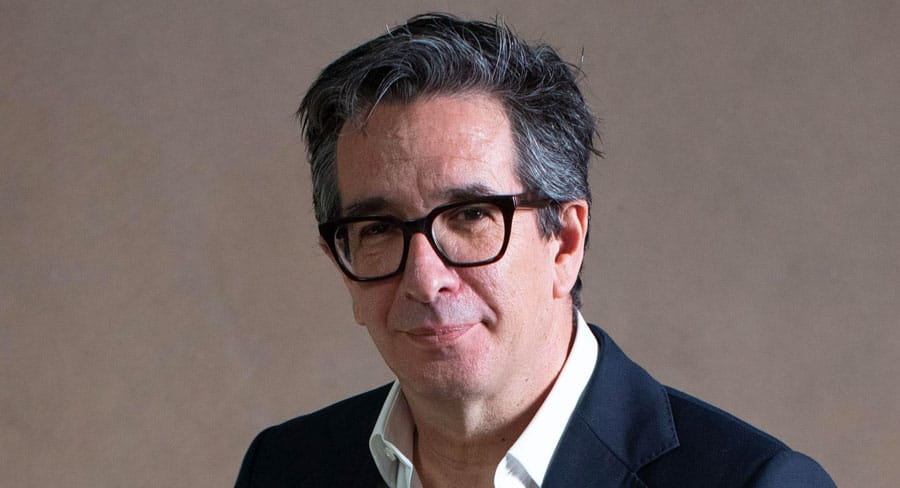

Mat Baxter

Media industry veteran Mat Baxter told Mediaweek that at a global level, it was a “complementary acquisition”, while from a geographical and historical perspective, it plugged IPG’s market and geographical weaknesses

“IPG has never been super strong in Europe or Asia, but Omnicom is particularly strong in Asia, particularly in China, where they have a stronger footprint. South American markets have historically been very, very strong markets for IPG. They’re both strong in the US.

“It’s a potent combination to be bringing those two networks together. In terms of creating geographical global dominance in all critical marketplaces, the two combined are a powerful force.”

Baxter also highlighted IPG’s strong healthcare capability matched up with Omnicom’s healthcare group, to which he said will “supercharge their healthcare credentials.”

“IPG was already a very dominant force in health. I think in this instance, IPG will be helping Omnicom on that side as opposed to Omnicom helping IPG. IPG’s health operations will be significantly accretive to Omnicom’s existing capability and revenue performance in that area specifically.”

John Wren and Philippe Krawkowsky

Baxter forecasted the potential for synergistic brand mergers among some agencies, mainly on the media side – not creative. Baxter said: “My guess is all the media agency brands are not going to continue as they are now – PhD, OMD, Hearts & Science, Annalect, Kinesso, Initiative, UM – yhat wouldn’t make a huge amount of sense, at least to me, to maintain that many media agency brands in a newly merged in a takeover of IPG.

“I think you’ll see some media agency brand consolidation. I think you’ll see less of it on the creative side because let’s be real, Omnicom’s creative asset base is it’s the jewel in the crown. They’ve got the best creative agency brands in the world.”

When asked about what the seismic change in the industry signals in the market, Baxter said: “Consolidation.”

“The market continues to have tough trading conditions, procurement continues to drive down fees, and agencies continue to be disintermediated to some extent by technology players like Google and Facebook.

“It signals to me a new period of consolidation. I don’t think this will be the first. I think there’ll be more,” he added.

Darren Woolley

Darren Woolley, CEO of TrinityP3, said: “Let’s call this for what it is – a takeover. The Omnicom IPG Group ‘merger’ is continuing evidence that the major holding companies are pursuing a strategy of scale and efficiency in the face of multiple business and economic challenges.”

He said that while consolidation across the new larger group is evident, “here are still plenty of options for advertisers going to market on a global or regional basis, not just with the remaining networks but with the rise of the independent networks, too.”

“The deal will make 2025 very interesting. Let’s remember that OMG and Publicis tried a “merger of equals” in 2013 before cultural and client conflicts scuppered the deal. This is a takeover that will provide the opportunity to rationalise the underperforming media agency brands.

“Locally, you have significant challenges on both sides, with Peter Horgan stepping down from the lead at OMG and Initiative recovering from the loss of their leadership team earlier this year to Accenture Song.

“Amid this local disruption, the takeover creates momentum for significant change in the media agency landscape. Who knows, it could see Mark Coad return to lead a unified OMG comprised of the best of the two groups. Anything is possible,” Woolley added.

Julia Vargiu

Julia Vargiu, director Australia, SI Partners, also concurred with the impact on Australia of the Omnicon-IPG in light of significant consolidation across agency services over the past six months.

“The reality is, there are too many agencies chasing a finite pool of clients, and we can expect more mergers across different sectors as businesses streamline their offerings.”

Vargiu said the integration process will dominate Omnicom-IPG’s focus over the next 6 months and create opportunities for indie agencies to win clients and talent “as the dust settles.”

She added that as clients increasing value flexibility, personalisation, and local understanding, indies will need to act fast and strategically in firming up relationships with any shared Omnicom-IPG clients while looking for ways to differentiate themselves.

“Indies provide direct access to top talent, including founders, and their responsiveness and fresh thinking are particularly appealing as clients seek alternatives to the scale-driven models of holding companies.”

Vargiu said she expects to see the next hotshop rise from the change as “top talent takes the opportunity to leave the network life and flex their own muscles by doing the work in a different way.”

She highlighted Akcelo, Howatson+Co, Thinkerbell and RyanCap as prime examples of thriving indies led by ex-network talent.

Vargiu said that independent agencies may struggle to keep up with the tech innovations the larger networks have the capital to invest in. However, she noted that indies may be able to bridge that gap by incorporating tech consultancy services and automating processes in addition to agility and innovation.

Much like Baxter, Vargiu also noted the acquisition signals a broader trend for 2025. “The rebound of M&A activity is alive and well, and Omnicom’s strategy reflects this,” she said.

“They’ve focused less on smaller acquisitions in recent years, saving their resources for transformative deals like this one. It’s a formidable strategy, designed to create a dominant global entity rather than piecemeal expansion.”

“As consolidation continues, we’ll likely see the industry streamline further, with weaker players phased out and a healthier, more dynamic market emerging. For independents, this moment is a chance to capitalise on their strengths – agility, creativity, and client-centric service – to thrive in this evolving landscape,” Vargiu added.

–

Top image: Mat Baxter, Darren Woolley, Julia Vargiu