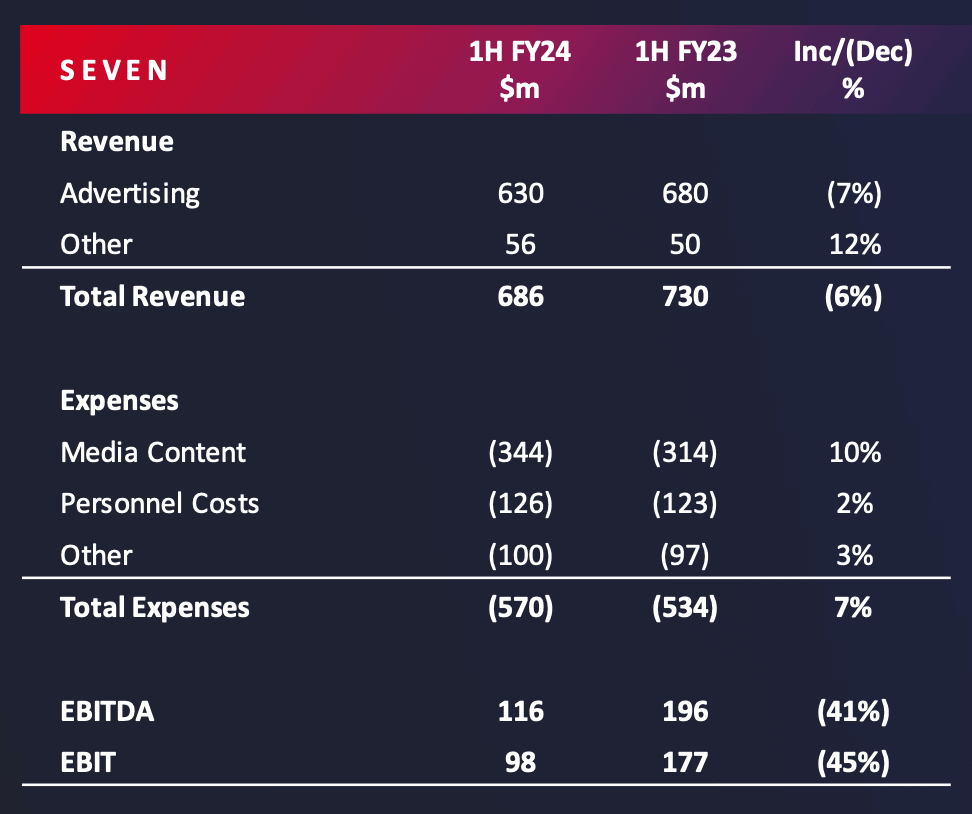

Seven West Media has reported group revenue of $775 million for the six months ending. That represents a decline of 5% on the previous corresponding period.

Earnings before interest, tax, depreciation, and amortisation (EBITDA) were $124 million, which was down 40% versus the previous corresponding period.

Net profit after tax was $54 million, while underlying net profit after tax (excluding significant items) of $63 million. That represented a decline of 49% on the previous corresponding period.

Outgoing Seven West Media managing director and chief executive officer James Warburton said: “SWM successfully executed on our strategy during the period to deliver consistent and engaging content to drive audience growth and revenue share across the total TV market. Despite this progress and our disciplined management of costs, our financial performance reflects the weakness in advertising markets, particularly as the second quarter progressed.

James Warburton and Jeff Howard

“We continue to believe in the power of television and firmly believe that the total TV industry is set to regain market share. Total TV is now growing, and Seven is leading that growth. Our view that audiences will be attracted to quality and consistent content across news, entertainment and sport is evidenced by the growth in our linear and BVOD audiences for the half year, including a linear increase of 2.2% and a 35% increase in minutes on 7plus.”

Warburton, who hands over the CEO role to CFO Jeff Howard later this year, added:

“We have grown audience in total people and have grown in four of the seven months so far in FY24. Our linear audience growth has been underpinned by the calendar year-on-year growth in our key tentpole programs SAS Australia, Farmer Wants A Wife, Dancing With The Stars and My Kitchen Rules. The major sports have also delivered, with the AFL Grand Final growing audience a remarkable 22%, and both Test cricket and BBL growing audiences on the 2022-23 summer.

Seven West Media: BVOD, Matildas and NBCU

“Our BVOD audience growth has been driven by both live and library content. The FIFA Women’s World Cup 2023 delivered extraordinary numbers on 7plus and our tentpole programs saw a 36% increase in live minutes watched year-on-year. We are also seeing good growth in our news, with an 18% increase in live viewership on 7plus year-on-year. Our NBCUniversal content now accounts for 16% of our total BVOD minutes and is attracting new younger female audiences as expected when we made this investment.

“Thanks to our audience growth, we were able to record a total TV revenue share of 41%, achieving the number one position in the market, an increase of 1.7 points on the previous corresponding period. Our share growth was achieved across each month of the half and partially offset the 9.1% decline in the total TV advertising market during the period. We gained share in metropolitan and BVOD markets and remained in line in our regional markets.

“We see a significant opportunity to grow our digital earnings with the recent launch of VOZ finally pushing TV audience measurement into a comparable position versus other media channels. We are also excited by the game changing addition of digital rights for the AFL and cricket later this calendar year; together, they will add an estimated four billion minutes of content a year to 7plus and allow us to capture an estimated 45% revenue share.

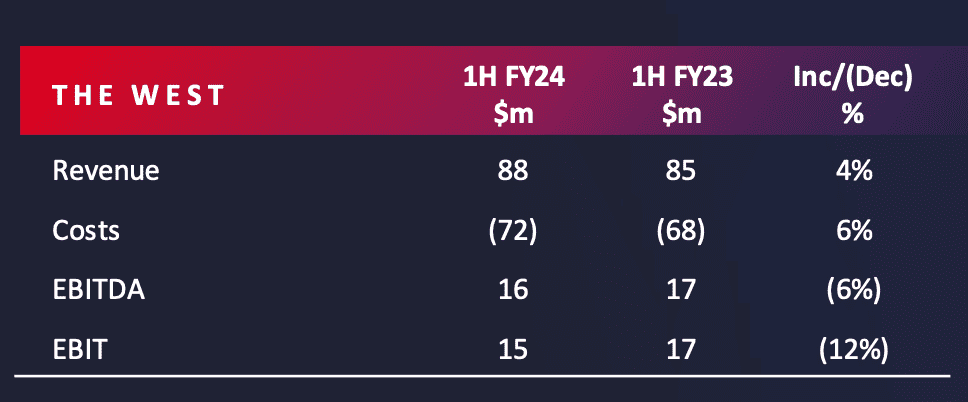

The West grows digital audience

“West Australian Newspapers once again delivered a solid result, with strong growth in digital audiences and the launch of new digital products resulting in 4.4 million unique monthly audience, up 18.5% in the past year. Revenue increased, largely attributable to new commercial print opportunities, albeit with higher costs.

“We continue to be disciplined on our cost outlook. Costs for the half were in line with our expectation, with the majority of our FY24 content investment weighted to the first half. We are well progressed on implementing our $60 million cost initiative program and are on track to deliver $25 million this year. Expect FY24 cost growth to be limited to 1-2%. We will, however, revisit the current cost initiatives program if advertising markets remain weak for the remainder of the year and will act decisively to meet such challenges.

Seven’s radio investment

“Our investment in ARN Media Limited in November 2023 was a meaningful step to position our business to deliver commercial partnership and collaboration with the market-leading radio business in Australia and we continue to monitor industry consolidation.”

Seven West Media: Outlook and priorities

Discussing the market outlook, Seven West Media shared the Q3 market decline rate was moderating. It is currently pacing better than 1H FY24 (Q3 FY23 market down 11%). It noted the BVOD market expected to maintain double-digit growth.

At this stage there is limited visibility into Q4. Seven West Media is expecting further moderation in decline vs Q3 FY24.

The company reported Seven continues growing total TV share. It is forecasting the full year will be holding above 40%.

Second-half costs are expected to be 4% ($20-25m) lower than 2H23.

Warburton concluded: “We have delivered on the commitments we have made, driving our content strategy to deliver strong operational results across the metrics that we can control, delivering audience growth and total TV market share growth.

“The company has also demonstrated financial discipline as we closely manage our costs while investing for the future. Our investment in 7plus and the new Phoenix trading platform will drive user experience, converged audience trading and drive yield.

“We are well capitalised, have growing audiences and revenue share, and have significant upside for growth as we pursue our digital future.”