Australia’s total advertising revenues are forecast to grow by 6.5% to AUD 30.5 billion in 2025, according to MAGNA’s latest Global Ad Forecast. Digital advertising continues to dominate, with digital media owners projected to generate AUD 23.7 billion—78% of total advertiser budgets—by growing 8.9% year-on-year.

Digital advertising leads the way

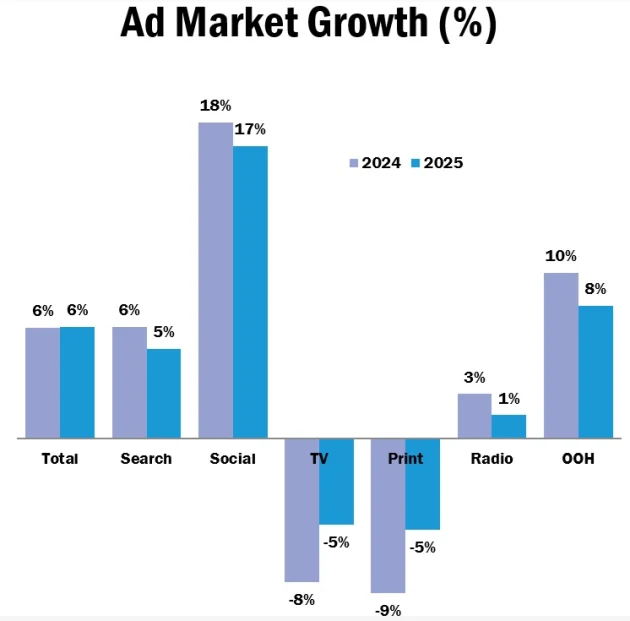

Within digital, search remains the largest driver, forecast to grow by 5.2% to AUD 11.1 billion. Social media is the standout performer, set to rise by 17% to AUD 8.9 billion, while digital video revenues are expected to increase by 4.6% to AUD 2.5 billion.

This digital growth contrasts starkly with traditional media, where revenues are forecast to decline further in 2025. Linear TV, radio, and publishing are feeling the pinch as audiences and ad dollars continue to shift online.

Magna December 2024 ad spend forecasts.

2024 Review: A year of contrasts

MAGNA’s analysis of 2024 reveals strong growth for digital and outdoor advertising but a challenging year for traditional media. Total advertising revenues in 2024 grew by +5.8% to AUD 28.6 billion, driven by a +9.9% increase in digital ad revenues, which reached AUD 21.8 billion.

Social media saw standout growth of +18.4% to AUD 7.6 billion, while search climbed +6.5% to AUD 10.6 billion. AI-powered innovations and the rise of retail media played pivotal roles in reallocating ad spend within digital platforms.

Outdoor advertising thrived in 2024, buoyed by increased site digitisation, new infrastructure projects, and the rise of retail-focused OOH formats. Meanwhile, traditional media saw revenues fall -3.3% to AUD 6.8 billion. Television revenues dropped -8.4%, marking a tough year for the medium despite robust Olympic viewership.

Election year brings temporary relief

The upcoming Federal election in 2025, expected in March or May, is projected to provide a short-term boost for traditional media. Regional TV is better positioned to capitalise on election spending than metro markets, but MAGNA warns this will not reverse linear TV’s overall decline.

As inflation eases back within target ranges and consumer confidence stabilises, MAGNA expects a modest recovery for traditional media in the first half of 2025. However, long-term growth remains concentrated in digital channels.

APAC: A digital powerhouse

Across the broader APAC region, advertising revenues grew by +7.5% in 2024, reaching USD 289 billion. Digital pure players accounted for the lion’s share of growth, with revenues increasing by +9.7% to USD 221 billion. Traditional media growth was minimal at +1.0%, buoyed by high-profile events like the Paris Olympics.

Leigh Terry, CEO of IPG Mediabrands APAC, said: “The future is bright for digital advertising in APAC, with its share of total budgets projected to reach 82% by 2029. Despite economic uncertainties, the market remains stable and poised for growth.”

Australia exemplifies this shift, with digital representing 76% of advertising spend in 2024 and set to rise to 82% by 2029. Social media, search, and digital video are driving this growth, underpinned by mobile-first strategies and new premium entrants in video.

As Australia’s advertising market transitions into 2025, the focus will be on adapting to digital innovations, sustaining growth in social media, and navigating the shifting sands of traditional media. While digital continues to set the pace, challenges remain in ensuring measurement and ROI for platforms and advertisers alike.

With a Federal election on the horizon and consumer confidence on the mend, 2025 could offer a mixed bag of opportunities—but one where digital remains firmly in the driver’s seat.