Australian ad spend is expected to grow by 1.8% to reach USD$13 billion this year, according to dentsu, following a decline of 0.8% in 2023.

The latest dentsu Global Ad Spend Forecasts also reported that at 4.2%, growth in Asia-Pacific is faster than the 2023 pace of 3.7%, with China, the biggest ad market in the region, expected to increase by 4.8%, and India remaining the most dynamic market of the region at 6.8%.

Ken Lam, national head of investment at iProspect, said of the APAC region: “Ad spend is such an important indicator of broader economic health and it is wonderful to see Australia, and the broader Asia Pacific region growing despite a year of economic uncertainty.

“The Reserve Bank of Australia’s recent comments highlighting the stablisation of real incomes, with growth expected later this year, which will drive growth in consumption is positive for the marketing and advertising industry.

“With it likely that interest rates will remain on hold for the remainder of the year, with a cut potentially on the horizon in December, there should be greater optimism for advertisers in H2 2024 with opportunities for brands to accelerate growth in a more buoyant market which will be driven by major events across EU (Euro 2024), Globe (Paris Olympics) and the US (Presidential Election) boosting advertising investments locally and globally.”

Ken Lam

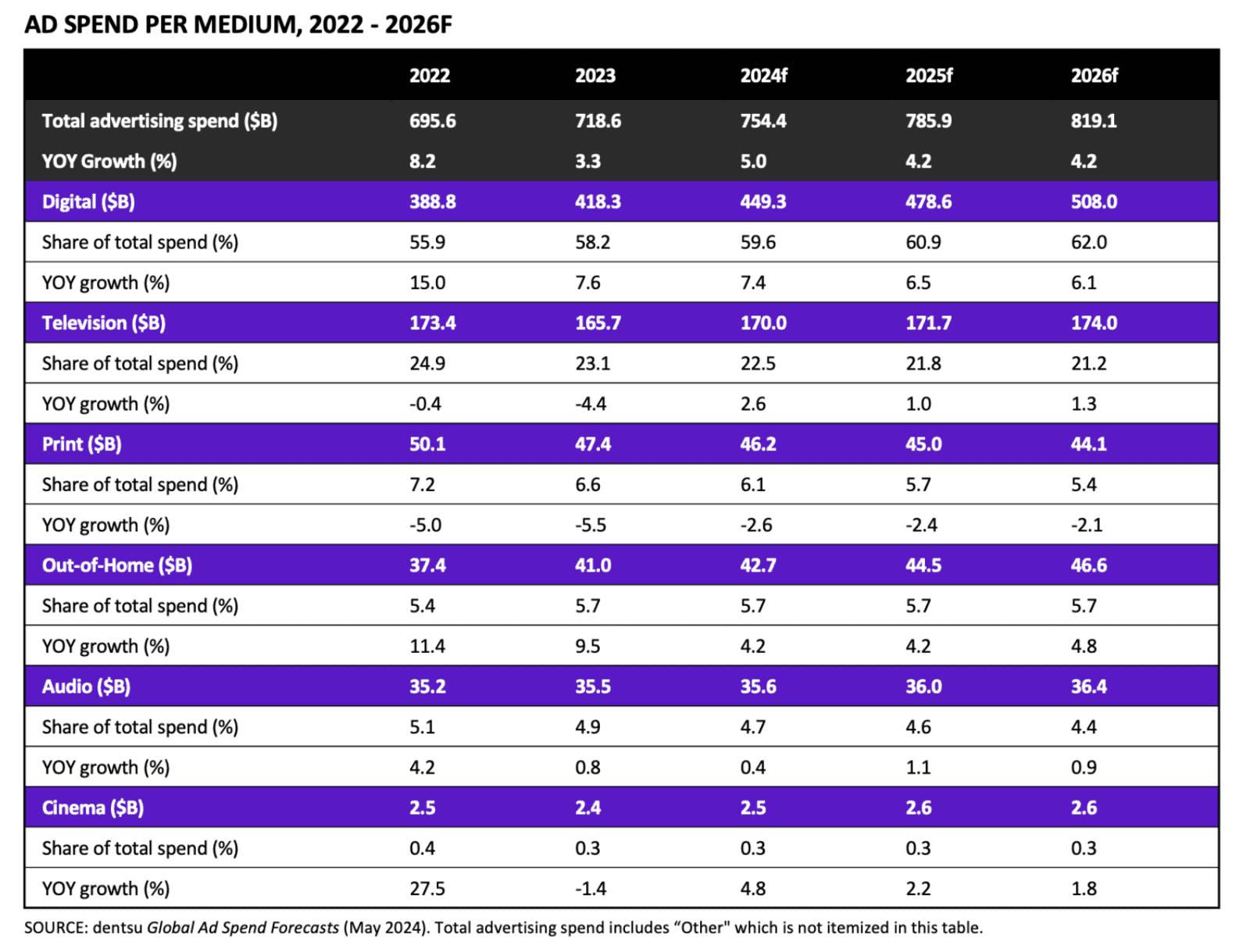

Dentsu’s Global Ad Spend Forecasts, which examines major shifts in ad spend by geography and media channel across 56 markets, has also predicted advertising spend will grow by 5% globally in 2024 and reach USD$754.4 billion.

The year-over-year increase is not only more rapid than observed in 2023 by the Japanese holding company but also beats the pace of the global economy.

In the top 12 markets, inflation-adjusted growth is projected at 2.6% in 2024 (vs. 5.2% at current prices).

Will Swayne, global practice president – media of dentsu, said: “The year has started at a faster pace than previously anticipated, and we predict spend to maintain momentum in the second half of the year with major sporting events drawing global attention. The November US presidential election alone is forecast to account for about a third ($11 billion) of the incremental ad spend in 2024.”

Digital is expected to remain the fastest growing channel at 7.4% to reach USD$449.3 billion and 59.6% of global ad spend.

Substantial ad spend increases are forecast for retail media (+32% YOY), paid social (+13.7% YOY), and programmatic (+10.9% YOY), while paid search (+7.7% YOY) and online video (+6.7% YOY) are also set to maintain strong growth.

Although its share of spend is predicted to slightly contract to 22.5%, television is forecast to rise by 2.6% and attract $170 billion in investment in 2024.

Growth is driven by spend in connected TV (+24.2% YOY), as streaming platforms ramp up their advertising offerings, and is currently enough to counter the decline in broadcast television spend (-0.4% YOY), dentsu said.

Print advertising spend is forecast to continue contracting (-2.6% YOY), but out-of-home should grow by 4.2%, audio by 0.4%, and cinema by 4.8%.

The report revises the forecast delivered in December 2023 based on improving outlooks in some of the biggest advertising markets: the US, Japan, the UK, Germany, and France.

Swayne added: “Our forecast underscores media’s importance in the world, as a sensor for changing consumer behavior and the economic landscape. As the media ecosystem becomes increasingly digital and data driven, there are unbounded opportunities to connect people and brands. Innovating new opportunities for brands and businesses to grow.”