The Australian advertising market’s Covid downturn is officially over, according to an analysis of ad spend for April 2021.

SMI reports April ad demand soared a record 39.7% year-on-year to $584.4 million which along with stronger Q2 data ensures the market will report growth this financial year.

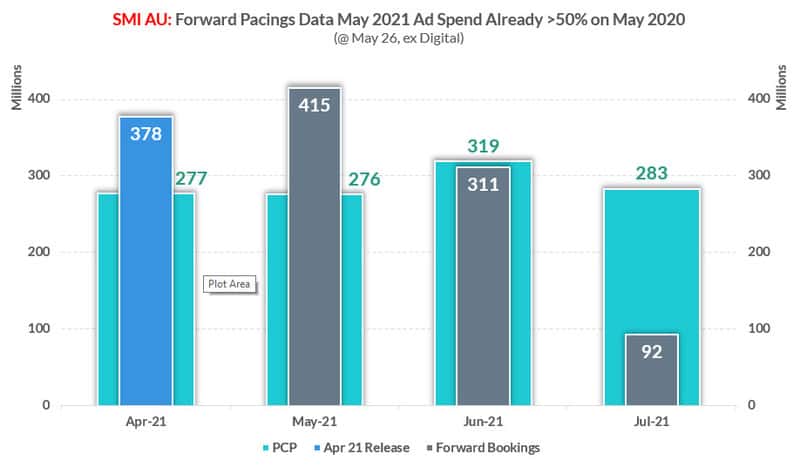

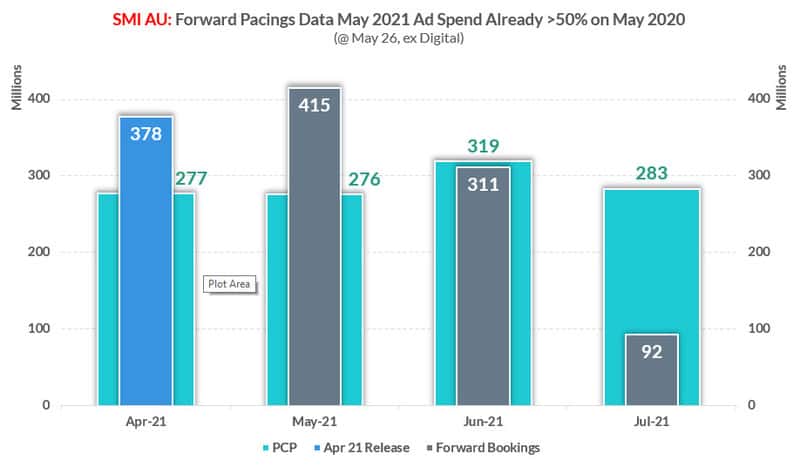

SMI AU/NZ managing director Jane Ractliffe said the recovery will improve even further with SMI’s forward bookings data showing the level of advertising demand in May is already stronger than that recorded for April.

“Australia’s advertising recovery is being characterised by explosive growth as we can already see the value of confirmed ad spend for the month of May is well above what we saw in April with the total so far 50.4% above that achieved in May last year (ex-digital media),” Ractliffe said.

“Outdoor media is leading the early May growth with bookings more than doubling year-on-year (+126.2%) while bookings to the cinema media are also rebounding after the forced cinema closures last year with total bookings for May already up 88%.”

Ractliffe explained the stronger demand was also continuing into June with the total value of June bookings now just 2.3% (or $7.2 million) below that reported for all of June 2020.

For the month of April five of the seven major media are reporting strong double-digit growth with TV bookings up 44.2%, digital bookings growing 45.8% and outdoor returning strongly to the market with growth of 48.7%.

“Australia’s advertising market is in unchartered territory as we’ve never before seen such levels of meteoric growth,” Ractliffe added.

“We all know these huge gains are coming from a very low base but even so it’s hugely encouraging to see advertising revenues flow strongly across our major media after such a prolonged period of reduced advertising demand.”

The huge advertising growth rate being reported in Australia in April is still below what SMI is reporting in most other sophisticated media markets, with the Canadian market leading the way with April growth of 74.9%. The Canadian ad market was the worst affected by Covid last year – followed by NZ where ad demand in April soared 56.1%, then the US (+43.2%), with Australia and then the UK (+24%).

Television is continuing to report large growth in May, but it will increasingly face more pressure as rival media re-emerge from Covid.

“In May we can already see travel will report mind-boggling growth with total ad spend so far up 525% year-on-year, representing an extra $15 million in ad spend. SMI’s data also shows TV’s share of this growing category is waning (back to 53% from 57.4%) as outdoor audiences return (pushing its share of travel one percentage point higher to 19.4%) and other media like radio also become more aggressive in seeking the returning ad dollars,” Ractliffe said.

The stronger April results have now pushed Australian ad spend this calendar year up 9.2% on last year and the total is just 6.1% shy of the level achieved for the same period in 2019.

Financial year-to-date results have also significantly improved with ad demand now relatively stable at -0.9%, ensuring a positive financial year result once the higher May and June data is added.

“Given the Australian media market has suffered through the toughest financial year in its history the fact we will report higher ad demand for the financial year is simply incredible,” Ractliffe said.

See also: SMI March: Adspend roars into recovery plus April & May forwards strong