Growing out-of-home player QMS is closing in on its first decade of operation after launching in 2014. The company boasts a market share of 15%, but that climbs to 20%+ when counting only market segments where it competes. After launching with just five staff, it now boasts over 250.

The company officially launched the City of Sydney network less than 12 months ago in what looks like a case study of how to promote and monetise prime outdoor assets.

QMS chief executive John O’Neill (pictured above) spoke with Mediaweek just before he left for the World Out of Home Organisation’s Annual Congress being held in Lisbon this week. While away, O’Neill will also attend Royal Ascot to see his horse Coolangatta run in the King’s Stand Stakes on June 13.

Part of the QMS City of Sydney network

City of Sydney network

QMS launched the network in August 2022 and O’Neill updated on sales so far.

“In out-of-home in Australia, and even around the world, it is one of the most sort-after assets. For us to get a footprint 26 kilometres around the city of Sydney has been fantastic. “The uptake and support from clients have exceeded expectations.

“With the data sets we have and the quality assets, we are able to have much deeper conversations with clients. There was a focus to work closely with the City of Sydney to make sure the quality was there. There were a few delays along the way due to Covid, but we have worked through those and we now have 500+ digital locations across the city in addition to some static sites.”

O’Neill said QMS chief customer officer Mark Fairhurst led the push into agencies and direct clients. “We got feedback on how best to package it and the subsequent support from a variety of categories has been extraordinary.

“Having an opportunity to work closely with the City on placement and design has given us a major digital network that allows us to target events, work with retail clients, update news pieces that allow streaming services, radio and television networks to use the platforms to keep things fresh. The data coming out of it is making out-of-home more accountable than it has ever been.

“Rolling that platform out across the city has given us more confidence in what we can do from a digital communication piece. It is such a sort after asset and is possibly the envy of our competitors.”

The QMS chief executive made special mention of the design and operations teams that worked on the network.

See also: QMS neuroscience study reveals City of Sydney network produces greater impact and efficacy

QMS site in Tempe

QMS billboard network

As to the rest of the QMS business, O’Neill explained: “We were predominantly a large format digital company until we bolted the City of Sydney asset on. We now have a very balanced portfolio with about 93% of our revenue driven by digital. The OOH market in general sits at about 68%.

“Our focus in the early days was also to look at the opportunity that digital would provide. It is now all about the quality of the asset, any wow factor we can add and we are looking for areas we can add additional reach to make it easier for clients to deal across our platform.

“We have enjoyed solid growth over a long period of time. We started with close to 20 large format signs and we now have 250+. We compete at the top level with the best quality in the market.”

New business growth

“There are always opportunities in the market,” said the optimistic O’Neill. “We were fortunate to win the ARTC tender which is eight new locations in Sydney. We are going through the process of applying for digital permits in those environments. They will add some terrific reach and quality assets in the Sydney market for us.

“It’s also been documented that oOh!media have some of their assets up for tender. If they add to the offering we’ve got and provide an easy solution for clients and are fully digital and offer significant value, we will look at it. We are always keeping our eyes open for any opportunity we have to provide greater reach that is cost-effective through quality assets.”

As to assets on the QMS wish list, O’Neill referred again to the City of Sydney which he branded the best asset in Australia. “It was an important stepping stone for the business. Any large format wow factor digital location in environments that are sort after by advertisers is great.

“We would love to have three or four massive landmark 3D digitals, almost like the Piccadilly Lights you see in London.

“We are very strong around airports in Melbourne and we have some great sites in Sydney.”

Market outlook

There is still plenty of money changing hands this year. O’Neill explained: “For the City of Sydney, high-end luxury brands have been spending, accounting for more than 20% of the total revenue. The streaming services are very active as are radio and TV networks. As more motor vehicles are coming back after supply issues clients are getting behind those and spending.

“Telcos are still spending too. TV audiences are being challenged so that provides an opportunity for us with new data sets to provide a different level of consideration for advertisers.

“When things get tough, clients are looking for different ways to communicate. Out of home has never been in a position until now where we have a wonderful connected digital piece that provides immediacy and flexibility. Clients can buy long-term, short term and in different environments with different pieces of creative at different times of the day.

“We are well equipped as an industry to be able to put some solutions in front of advertisers that will make a real difference.

“The challenge for the industry is to educate. This medium isn’t what it used to be. As money comes back clients are looking for different ways to communicate and I think we are well-equipped to pick that money up.”

For the rest of 2023, O’Neill said the forward bookings are looking pretty good. “The industry has changed though. The days of having to lock clients away long-term on static buys are over. Most outdoor companies would be writing a fair percentage of their revenue in the month for that month.

“While traditional out-of-home executives might think of that as a challenge when it comes to managing yield, for me it is an absolute joy. I might be chasing money on the 15th of a month and still have an opportunity to offer solutions for that month.”

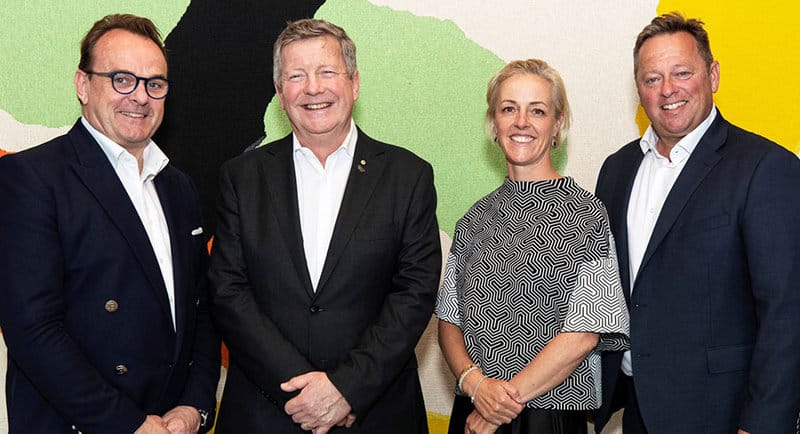

Olympic deal announced: John O’Neill with Matt Carroll (CEO Australian Olympic Committee), Jess Hurford (Head of Commercial at Australian Olympic Committee) and Mark Fairhurst (QMS)

Olympic partnership

The deal to partner with the Australian Olympic Committee makes O’Neill confident about what it might bring the business. “It will be very critical for the business and is a big step for us to be locked in as the major partner. We are having so many conversations with people about Paris 2024 and it will start to impact in the back quarter of this year.”

See also: QMS partners with Australian Olympic Teams for Summer and Winter Olympics

How OOH is selling share of digital

John O’Neill explained the industry standard adopted to dictate how digital share of time is being carved up.

“The industry has been working closely with the Outdoor Futures Council which is a group of senior advertising executives representing the majority of clients and agencies. We have come up with a currency around a share of time.

“It allows clients to buy an amount of time on every loop consistently. Large format operates on a 1-in-10 share. Small format runs on a 1-in-6 share. If clients want heavier weight then they can increase the buy.

“Most of the data and research suggests at those levels you get the best cut-through. There will always be an issue around standardisation as some councils have different rules and regulations around times.”

Streaming customers are clients for QMS outdoor media

Outdoor competition

The different media sectors are all looking to increase ad revenue. That can come from increased client budgets or diverting spend from other sectors. If outdoor is to grow, where can that money come from?

Is television in the sights? “TV has always been and always will be a wonderful medium,” said O’Neill. “One thing I love about our medium and why people continue to use it is because of the benefit it provides. Some of our biggest spenders are TV stations and streaming companies. It obviously works for them when it comes to cost-effective reach.

“We would love the tide to rise everywhere and see clients investing more money across all categories of the industry. There might be some asset categories that will drop off. I’m not game enough to say we are going to defeat TV. They have been the leaders with mass reach for years and years. We are happy to play in the mix and as we continue to educate agencies and clients around what we can do, you will see us grow significantly. It will be interesting to see where there might be a decline elsewhere.”