Seven West Media this week presented its half-year results. The tough ad market battered the business with lower revenue and profit. But outgoing chief executive James Warburton and his replacement Jeff Howard argue the company is well-placed for the expected recovery.

When asked if Warburton would have preferred a stronger set of numbers for his last presentation, he told Mediaweek: “Yes and no. You can’t control the market. We are not alone in finding it pretty tough out there.

“When you look through every underlying point about what is important for this business, it is absolutely set to explode. The operating leverage will come back. We have seen it in previous cycles.

“The share shows how dominant we are in what is really a two-player market. With the impact of digital, changes to anti-siphoning, prominence and VOZ, we are in a very strong position.

“We grew $26m worth of share and are back $50m in market. That is a pretty strong result.”

Can the market recover?

Seven mapped out total TV ad market results across the past 30 years in its financials this week. Down markets can persist. After 2013 there were seven consecutive falls in total market ad revenue.

“Old-fashioned telecast broadcast is actually growing,” said Warburton. “Seven and Nine are growing audiences. There was a big spike during Covid and then we had a correction. That was blamed on trouble for the sector with pressure from streaming et cetera.

“That has now moderated where we have grown in four of the last seven months. The BVOD service is now being measured, we have growth and there is digital upside.

“The market is restarting, and we are excited by some of the briefs we see coming through, particularly for Q4 of FY 2024. People are asking if rates have peaked and the impact that might have on getting retail going again.”

FTA stacks up well against options

As to the ever-growing list of potential threats to FTA revenue, Warburton said Seven is now well-placed to be compared to the alternatives. “And it is a pretty favourable comparison. The efficacy is interesting. Consumers have to watch a minute of broadcast or 15 seconds of BVOD [to be counted in OzTAM reach data]. On any other platform, it might be whenever you click on it or just one second of viewing. They are measuring themselves too, it is not independent.

“The fact that we are now putting out the numbers we should have been using for some time will regain share back to the television platform. I have no doubt about that. Some people don’t like change, but this is something that is critically important to our industry.

“We are all pretty passionate about getting it into currency in the not-too-distant future.”

As to the public release of data at 11.35am each day, Warburton is sure it will get earlier eventually.

Growing premium video market

Incoming CEO and current CFO, Jeff Howard, talked about the growth of BVOD. He told Mediaweek it currently accounts for a little over 10% of ad revenues. The current growth has seen some ad dollars moving from FTA to BVOD.

“One growth opportunity is growing the premium video-on-demand market. That is looking beyond the Seven-Nine-10 VOD platforms. Looking at all the other ad operators in the subscription space that have ad tiers. We make sure we are capturing a bigger share of that bigger market.”

More viewers continue to engage with Seven via 7plus

The Nightly

Seven West Media hasn’t revealed officially its new digital play The Nightly. There is no guidance on whether it will be part of The West or part of Seven’s digital operations. “Everyone keeps writing about it. If and when we have something to say, we will say it,” said Warburton, shutting that down.

Has the market been too tough on Seven?

For the past five years, the Seven share price has peaked at 75c briefly at the end of Covid. It traded as low as 6c at the start of Covid and for the past 18 months has bobbed around under 50c. Current market cap is $370m.

Warburton: “The market is waiting for the recovery. When you look at our discipline and focus and the strength of what we have been able to do, we are ready for that. The introduction of [ad platform] Project Phoenix will also help. In the past, television has been one of the most difficult mediums to deal with.

“That is the feedback we get from some buyers. We have been working to make it easier and the sales team, far and away the best in the country, have been working hard on that.

“All those things coming together will help in a whole range of ways. It is the deals we don’t do [like the Olympic Games] are the ones the market should value. There are no surprises at Seven.

Seven stepped away from Olympic rights when the cost was out of reach

“We have shown with things like the FIFA Women’s World Cup when we acquire certain rights to top up an already impressive sporting schedule, we can offer an unbelievable return for advertisers.

“If things are loss-making and make no long-term sense, we have no interest. The summer of cricket is a great example and we should congratulate Cricket Australia and also Foxtel.

“We worked together to improve the BBL and we grew broadcast. What could have been a challenged cricket summer, with Tests against Pakistan and West Indies, it also grew. We are licking our lips about next summer with five tests against India to be followed the next year with The Ashes. And remember we will have digital rights by then.”

Radio investment

Despite being a big shareholder at ARN, Seven West Media had no comment about the proposal to take over SCA. Jeff Howard said: “It’s not for us to talk about their plans.”

Warburton said: “We are supportive of the deal. Those two [SCA and Anchorage Capital] will need to work it out.”

When asked about Anchorage’s commitment to the deal, Warburton said: “We have spoken to Anchorage. We take it at face value what they are saying. It’s really a question you have to put to ARN.”

Streaming: Last mover advantage

Seven West Media has long talked about potentially being a player in the SVOD market. But as yet, it has remained on the sidelines. “I am not a great believer in last mover advantage,” said Warburton. “It’s not in my personality type. In this case [it has been worthwhile].

“We continue to have a very strong partnership with NBCU and we work well with Foxtel. As the world consolidates we will have the right opportunity presenting itself. We have no interest in tearing up tens of millions of dollars every year. I find it hilarious when you hear global chief executives saying they are moving from subscriptions at any cost to profitable subs. It makes me giggle a lot.”

What’s next for Warburton?

This just might have been the last-ever profit result Warburton will present for a listed company. Or is it? After a pause and a sigh, Warburton shared: “Who knows? There are a number of things I am exploring. None of them are necessarily in [the broadcast] space. Jeff and I have worked together for a long time and the transition is going well.

“Jeff has been recruiting [for a new CFO] and I will be focussed on the transition for the next couple of months.”

James Warburton with Seven West Media CFO Jeff Howard

Seven under Howard

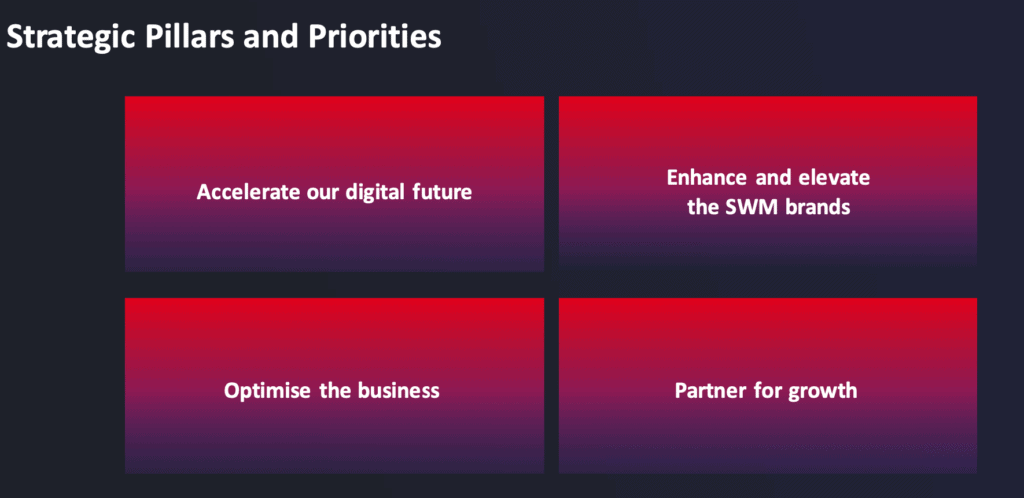

Don’t expect sector diversification under the next leader. “Publishing and broadcasting remain fundamental to who we are and what we do,” said Howard.

“A vigilance around costs and efficiency will remain in place. If you see any change it might be that the focus on digital will be even stronger than it is today. Particularly with additional digital sports rights and the arrival of our sales platform Phoenix.”