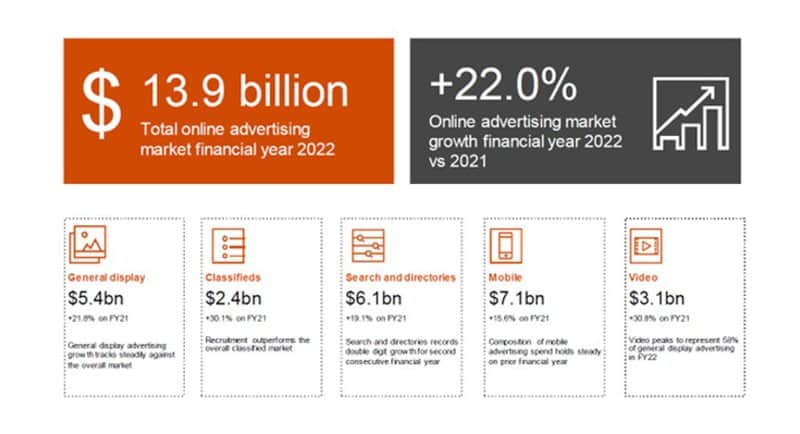

The Interactive Advertising Bureau (IAB) has found the local online advertising market recorded a 22% increase year-on-year to reach $13.9 billion for the financial year ending 30th June 2022

The IAB Australia Online Advertising Expenditure Report (OAER) prepared by PwC noted that all categories recorded double-digit growth year-on-year, with video advertising peaking at 58% share of general display advertising, fuelled by the Federal Election as well as both the summer and winter Olympics.

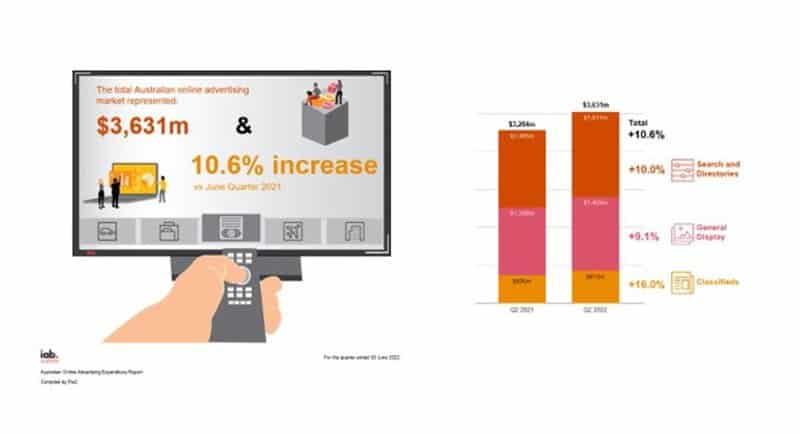

However, the data from OAER highlights a more modest growth of 10.6% in the June quarter, reflecting market changes and a recalibration of activity.

For the financial year, classifieds investment was up 30.1% and increased its share of online advertising one point to 17% ($2,414million) with growth across all categories but particularly driven by a surge in recruitment advertisements.

Search and directories share decreased slightly from 45% to 44% of the market ($6,068million), though the category recorded double digit growth for the second consecutive year. General display advertising remained consistent at 39% share of spend ($5,432million).

Mobile advertising regained ground for the financial year as mobility increased post-pandemic, while CTV video advertising’s share of spend softened slightly though it still represents the largest share of video device revenue.

Programmatic buying of general display advertising for content publishers’ inventory remained steady at 70%, with a shift towards guaranteed deals.

Gai Le Roy, CEO of IAB Australia, said: “Although revenue for the Australian digital advertising market in the June quarter was softer than the previous three quarters, growth was still robust at 10.6%.

“There were strong results across the market for the financial year, with growth of 22% versus 2021, buoyed by investment for the Olympics, Federal Election, and an incredibly strong bounce back for classified listings.”

For the quarter ending 30th June 2022, the total online advertising market represented $3,631m, with all categories recording year on year growth for the quarter, and general display, driven by video advertising, increasing its share of the advertising spend by 3%.

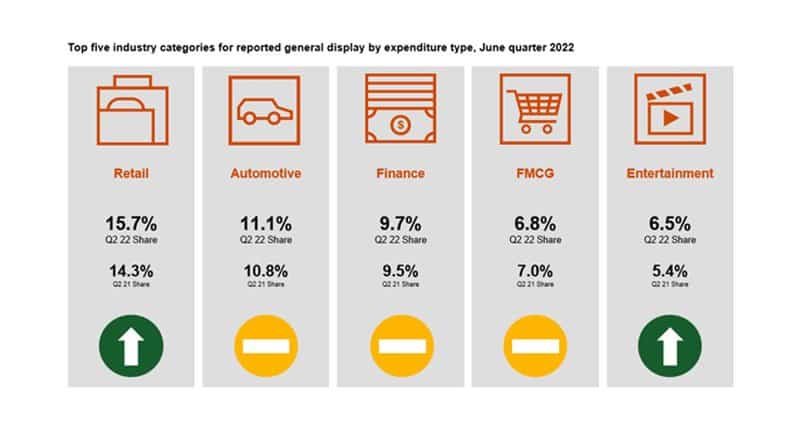

Within the quarter, retail strengthened its leading position, with automotive, finance and FMCG advertising remaining consistent and entertainment entering the top five industry categories.

–

Top image: Gai Le Roy