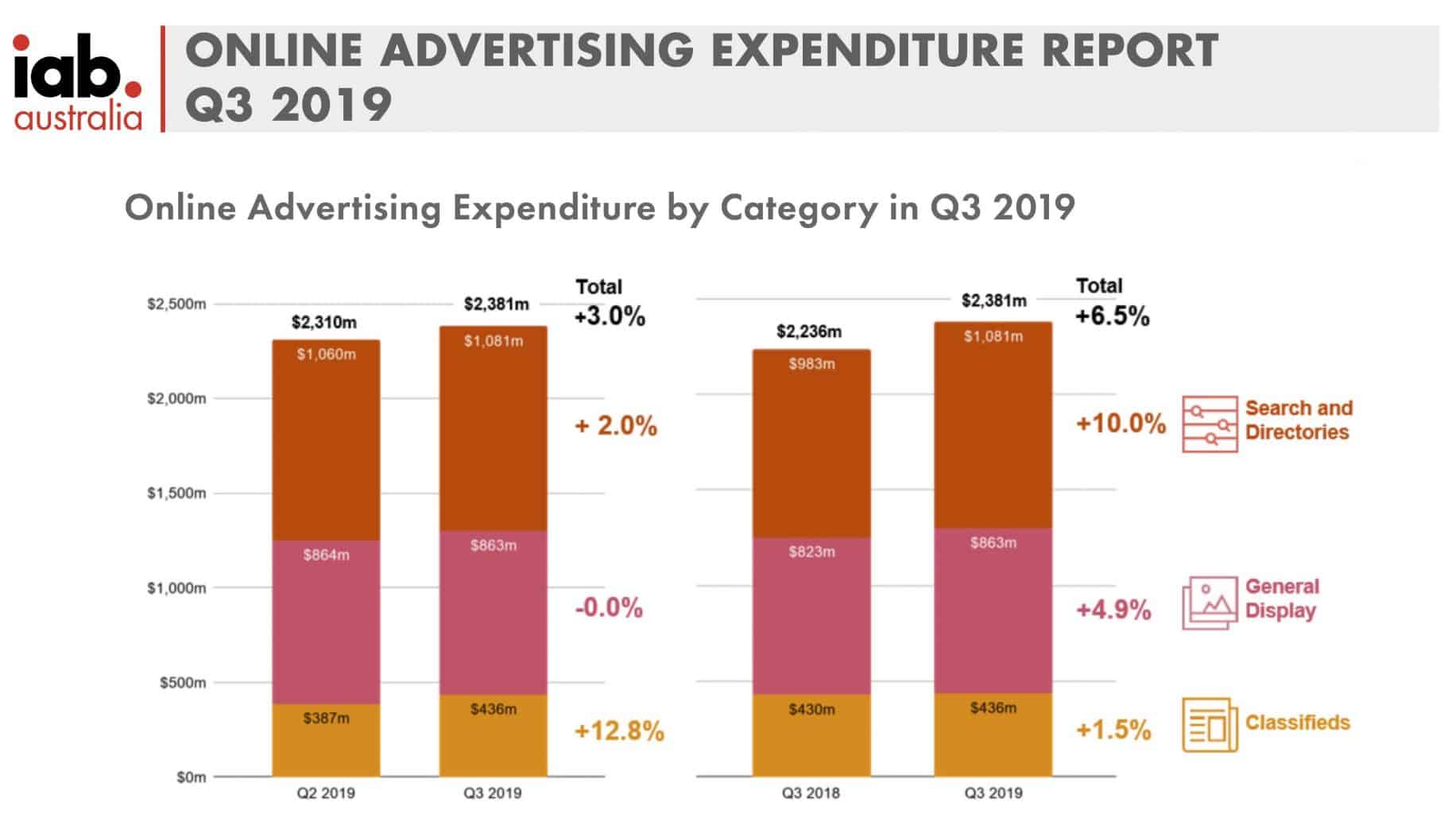

Although growth is slower than in previous years, digital has bucked the overall advertising slowdown, with the latest IAB Online Advertising Expenditure Report prepared by PwC revealing the market grew 3% quarter on quarter and 6.5% year on year to reach $2.381b for the September quarter.

The three advertising categories, general display, classifieds and search & directories all recorded year-on-year growth, broadly maintaining their respective share of market spend.

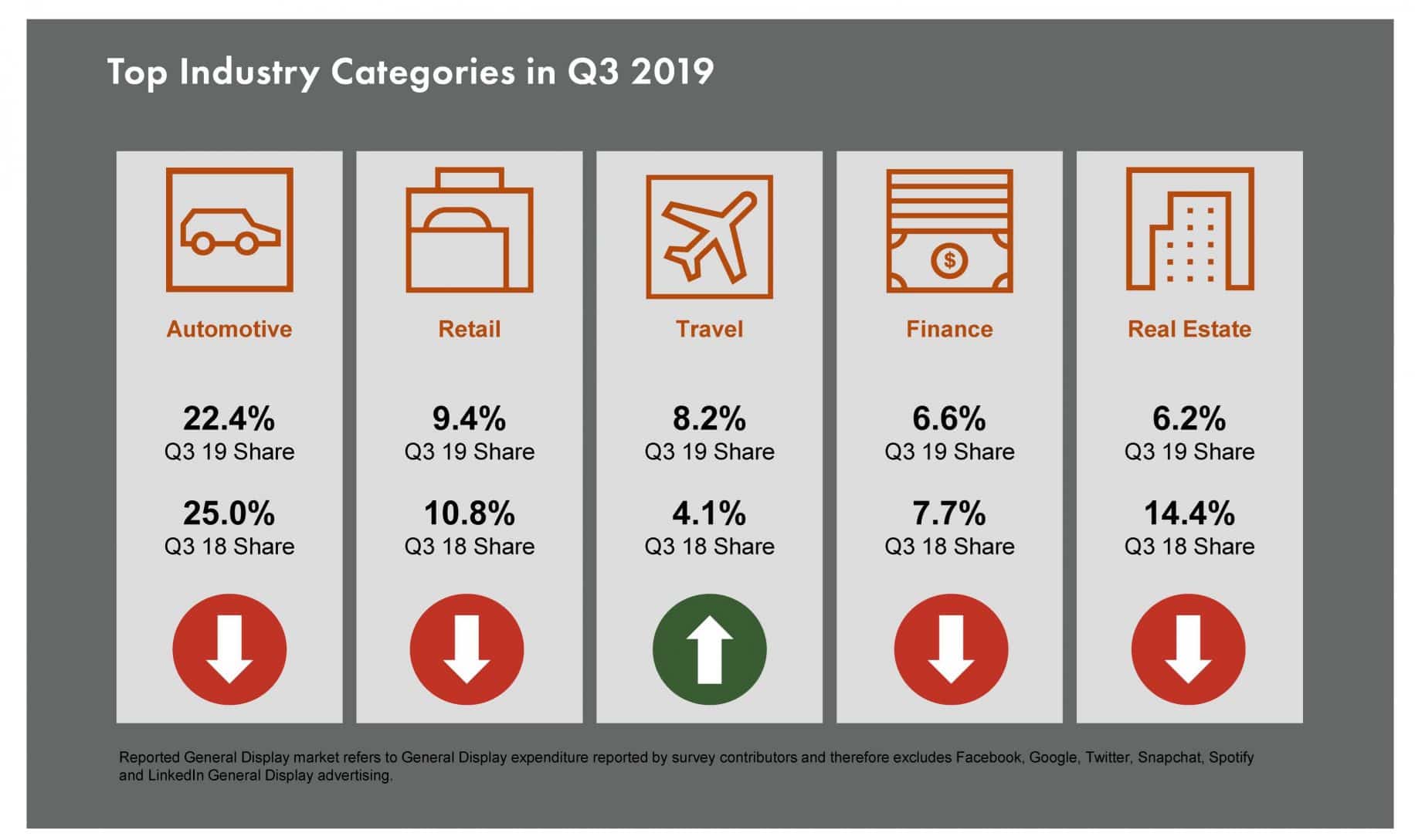

Within general display, the travel sector is now within the top three industries, almost doubling its share of spend to 8.2% of the total general display market for the quarter. Automotive remains the top spending advertising category representing 22% of display revenue for content sites.

Video was the main driver within general display advertising, growing steadily through the September quarter to reach $413m and 48% of the total display spend, fuelled by the retail, FMCG and Technology sectors.

Connected TV is now the dominant device for video inventory expenditure, increasing to 38% from 31% for the September quarter, while desktop (34%) and mobile (28%) expenditure both slightly decreased.

Programmatic trading continued to increase, with content publishers reporting that 36% of all general display advertising inventory was sold programmatically in the September quarter.

By contrast, agency direct buys, via insertion order, which is the dominant buying method for general display advertising, reduced to 47% of inventory. Within video inventory, some 49% was bought programmatically versus 46% via agency buys.