The Interactive Advertising Bureau (IAB) has found political and government spending has dominated the first quarter of 2022 in digital advertising following the Federal Election, while the local online advertising market has continued to grow.

The Australian online advertising market has grown and reached $3.449 billion for the quarter ending 31st March 2022, an increase of 19.2% on the same period in 2021 according to data from the IAB Australia Online Advertising Expenditure Report (OAER) prepared by PwC.

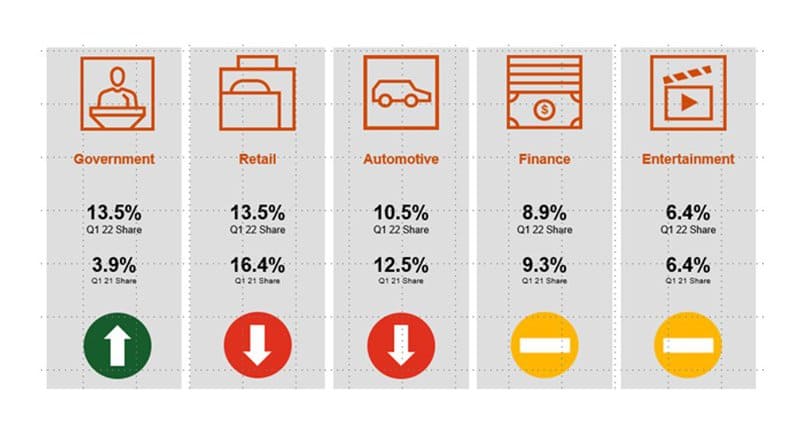

The most significant shift during the quarter was in spending around the Federal Election, resulting in Government being elevated to the number one advertiser category, representing 13.5% share of the general display market for the quarter, up from 3.9% in Q1 2021.

By contrast, retail experienced the largest decrease in share, dropping from 16.4% to 13.5% share of general display advertising.

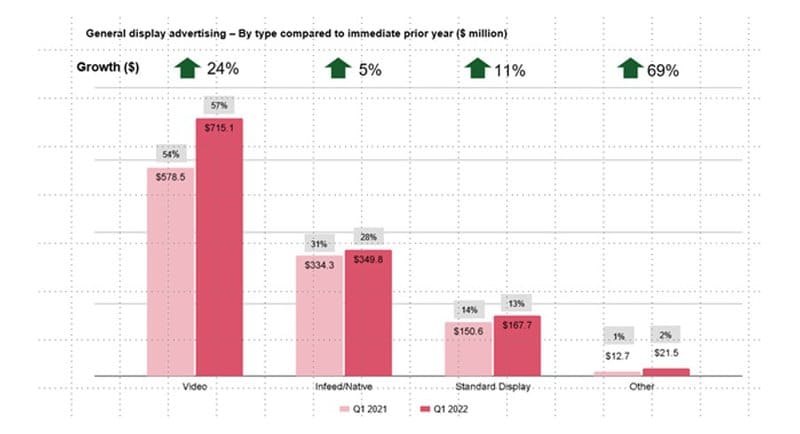

All general display categories recorded growth on the previous year, with video advertising increasing 24% to reach $715.1m for the quarter, infeed/native by 5% to reach $349.80m, standard display by 11% to reach $167.7m and other advertising by 69% to reach $21.5m.

Spending on classifieds and search & directories grew quarter on quarter, increasing 4.3% and 3.6% respectively while general display advertising seasonally contracted by 15.1% as it does each year. Interestingly, search & directory spend in the quarter seized share from general display advertising as the recovery of travel accelerates.

Gai Le Roy, CEO of IAB Australia, said: “The digital ad market saw solid investment growth for the March quarter compared to the previous year with the standard slight seasonal decline from the December quarter.

“The make-up of the top advertiser categories was greatly disrupted by significant ad spend from the political parties and independents early into the campaign for the Federal Election,” she added.

The share of content publishers inventory bought programmatically grew by 1% on the immediate prior quarter bringing it to 42% of spend, equal to the percentage of agencies buying by IO, while direct bookings remained relatively stable at 16%.

–

Top image: Gai Le Roy