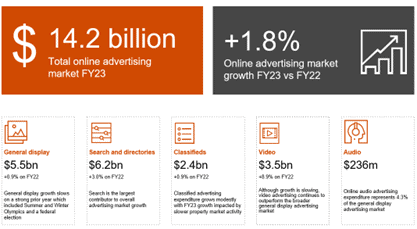

Findings from the IAB Australia Online Advertising Expenditure Report (OAER) prepared by PwC has revealed the local Australian online advertising market reached $14.2 billion for the financial year ending 30th June 2023.

All categories recorded growth despite challenging economic conditions and a strong comparative period which included the Summer and Winter Olympics and a federal election. However, overall growth slowed to 1.8% year-on-year, compared to the 22% year-on-year growth recorded in FY 2022.

Video advertising, up 8.9% on FY22 ($3.5 billion), continues to outperform the broader general display advertising market with its growth offsetting declines in other formats of general display according to the trade association’s report. The audio category totalled $236 million and represented 4.3% of the general display advertising market, no comparative trend data is available for audio as reporting started in CY22.

Search and directories is the largest contributor to overall advertising growth, up 3% on FY22 ($6.2 billion), while classified advertising investment grew modestly by 0.9% on FY22 ($2.4 billion) impacted by slower property market activity. General display, which includes video, audio, and other forms of display advertising, also grew by 0.9% on FY22 ($5.5 billion) on a strong prior year which included the Olympics and Federal Election.

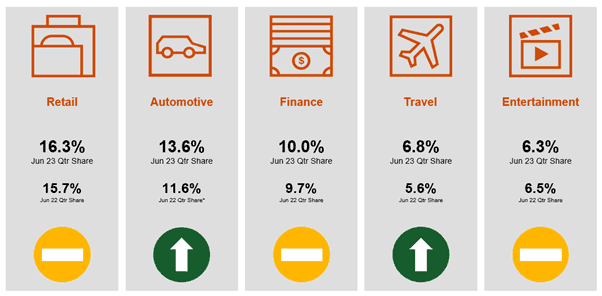

Connected TV yields the greatest share of content publishers’ video inventory investment, regaining ground compared to FY22 and taking share from mobile. Entertainment replaces technology in the top five industry categories for financial year 2023, whilst automotive general display advertising continues to recover after two years of economic concerns and production disruptions. The real estate and technology industry categories had the largest drop in share of spend in FY22.

Gai Le Roy, CEO of IAB Australia, said: “In a challenging financial year, the digital advertising industry still achieved modest grow. This is a solid result in the current economic conditions, particularly given the strong prior year with events such as the Olympics and a Federal Election driving investment. Both digital video and audio options are attracting a larger share of marketing budgets, and the search sector continues its steady growth. It is pleasing to see spend by automotive and travel brands pick up over the last few quarters.”

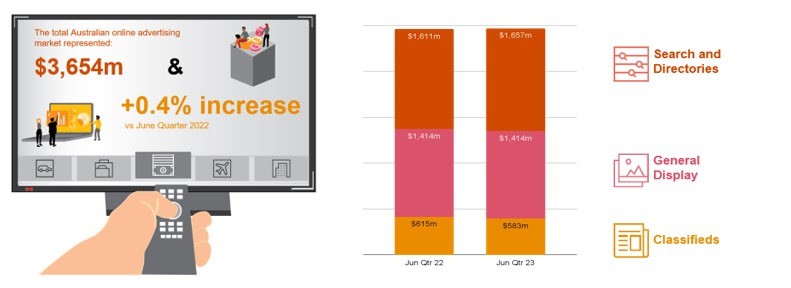

For the quarter ending 30th June 2023, the total online advertising market represented $3,654m, with all categories’ share of the total online advertising market remaining relatively stable with June 2022 quarter. Growth in search and directories against the prior year (2.9%) offset the declines in classifieds listings expenditure, whilst general display remained flat.

Both video and audio formats within the general display category experienced double-digit growth compared to the same period last year, 12% and 14% respectively. The highest growth format for the digital advertising sector in the June quarter was podcast advertising ($27.5m) which was up 24.0%, according to the IAB report.

Within the quarter, automotive and travel’s share of reported general display advertising increased after being two of the hardest hit industries throughout the pandemic. Retail’s share of general display expenditure remained stable.