Investment in digital video advertising across mobile, desktop, and connected TV (CTV) is now a regular part of marketing activity for 92% of respondents, according to IAB Australia’s Video Advertising State of the Nation Report.

Now in its fourth year, the report marks ten years of the IAB Australia Video Council, during which video advertising revenue has grown from $196 million in 2013 to $3.78 billion in 2023, with a 175% increase over the last five years. The report also explores, for the first time, the usage of digital video on OOH screens and retail media formats.

Brand building remains the dominant objective for all digital video and TV advertising, however, agencies are engaging in full-funnel strategies that include driving sales and conversions.

The report noted a substantial increase in the usage of nearly all digital video ad formats. Screen strategies have expanded to include digital OOH video ads and digital video retail media formats. Nearly two-thirds of agencies reported buying digital video on CTV, mobile, and desktop in combination with digital OOH.

As OOH inventory continues to digitise and be made programmatically, planning across digital video and OOH is becoming more prevalent, with 64% of respondents looking at the screens holistically for some of their activity.

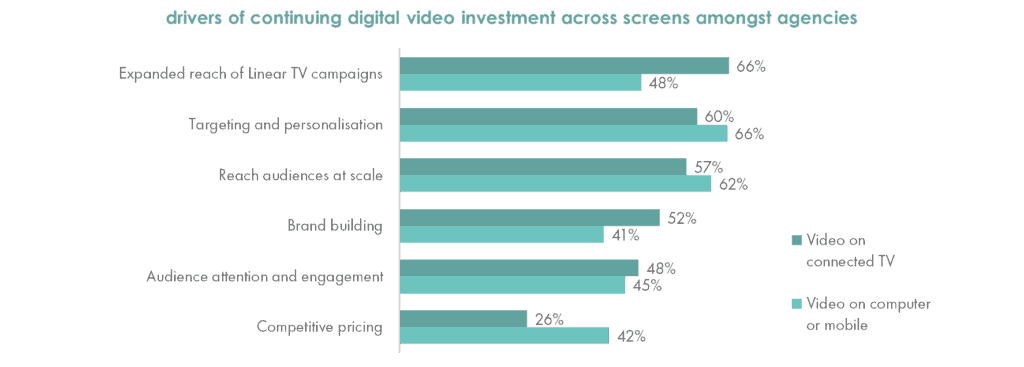

While investment drivers across different screens show many similarities, 66% of agencies report that CTV plays a major role in extending the reach of linear TV campaigns. In contrast, the top drivers for mobile and desktop inventory are targeting (66%) and the ability to reach audiences at scale (62%). CTV usage is more often driven by brand building, and video on mobile or desktop by competitive pricing.

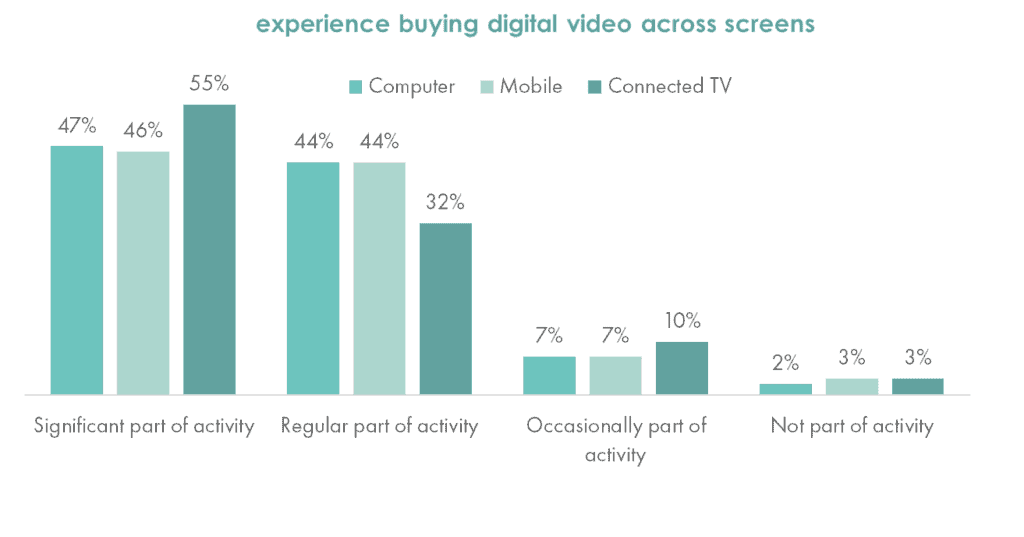

The findings highlighted an increase in the frequency of CTV advertising over the past year. More respondents than ever before consider CTV a significant part of their advertising activity (55%) compared to mobile (46%) and desktop (47%).

Further, a screens-planning approach is in place with most agencies, with only 22% indicating that linear and digital video is planned and bought by separate teams.

“In a year where cost of living pressures are impacting consumer sales, agencies have increased their usage of digital video for brand building, as well as to stimulate purchase intent, and to prime consumers for when stronger spending returns,” said IAB Australia CEO, Gai Le Roy.

“However, it’s clear that agencies are facing challenges such as standardisation in metrics across screens, now including different DOOH, retail media platforms and CTV environments.”

See also: IAB urges industry to reduce ad spend on Made for Advertising sites