Craig Hutchison, the CEO, key on-air talent aka Hutchy (above), and chief motivator at Sports Entertainment Group [SEG], has been the subject of further examination in a look at the group’s business model.

In September, the Herald Sun looked at the sports media group and its recent full-year results under the headline ‘Craig Hutchison’s business woes after $9.2m loss’.

This week it was The Age and The Sydney Morning Herald that probed the business model under the headline ‘Craig Hutchison’s sports and media empire on the ropes as directors, auditor sound alarm’.

Hutchy: What the Herald Sun said

After the September alarm sounded by the Herald Sun, Mediaweek reported on an episode of the Sounding Board podcast that Hutchy hosts with Damian Barrett where Hutchy went into some detail.

When asked by Barrett to deal with the specific inaccuracies of the Herald Sun report, Hutchison started:

“We made $4.8m profit EBITDA. There were some markdowns and impairment of assets that created a paper loss. We have made money every year. We haven’t had a year where we haven’t made money. Would we have liked to have made more? Yes. Is it my job to make more for our shareholders per annum? Yes.

“This was the last year of our audio build and our radio build in conjunction with our stakeholders to finish the job we set out to do five years ago.

“We have been playing a long game on assets, as opposed to a short-term game on earnings. That job is finished and we have no more audio stations to buy or build. We have a two-country platform that will serve us well.”

When asked if SEN was a deal away, or a day away, from going under, Hutchison replied:

“Goodness. We are in fantastic health. We have made money and built at the same time.”

Hutchy: What Nine newspapers reported

The report stated:

Craig Hutchison’s media and sports empire is at serious risk, as company directors and auditors warn about his group’s ability to survive if it does not find a cash injection or new investors in the next nine months.

The article continued:

The company is now seeking fresh capital, pitching to high-net worth private investors, in an attempt to reduce its comparatively large borrowings before the deadline, according to multiple sources with knowledge of the process not authorised to speak publicly.

Mediaweek has reported on Sports Entertainment Group ever since the Crocmedia reverse takeover back in 2017 and on Crocmedia for much of the decade prior to that.

As we covered the aggressive expansion years Hutchison has been patient in explaining the process. At the end of 2021, Mediaweek reported:

Using the traditional method of measuring radio success you’d have to call SEN Sydney an underperformer. The ratings for 2CH’s final two surveys as a music brand saw station and breakfast shares over 4%. In SEN’s first year the station peaked at 0.7% and breakfast at 0.5%.

But ratings only convey part of the SEN story. “Because we distribute our content in so many ways it can take some people a little while to get used to our model,” Hutchison explained.

For people who do get it, he added: “It has been highly effective and really successful with advertisers which is one of the reasons we have had such good client retention.”

The recently released SEG Annual Report again goes into great detail in a lengthy report from chairman Craig Coleman and CEO Hutchison.

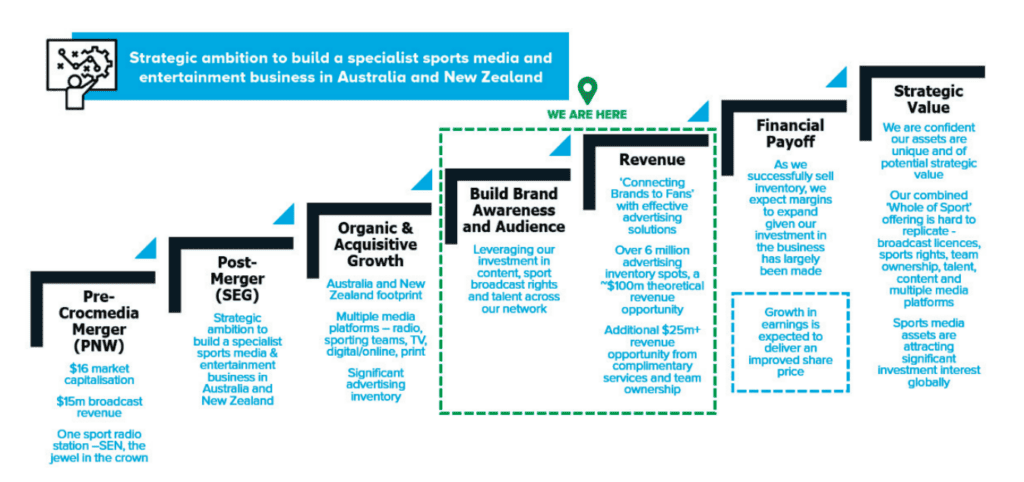

As this chart below shows, the company has finished its aggressive build of assets and its touting a new period of increased revenue ahead of what it has labelled a “financial payoff”.

What might make investors nervous

As chief executive and in effect the chief sales officer as well, the health of the company is intrinsically linked to Craig Hutchison. SEG without Hutchy is unthinkable. Investors might feel more comfortable with a broader team carrying the management load.

In addition to a leadership team under Hutchy, a refresh of the SEG board might help build confidence. The same unfamiliar board members have been rubber-stamping investment opportunities pitched to them for some time. A recently retired media, sales or marketing executive would be a good addition.

Although many marketers buy into the narrative of SEG’s digital reach, it doesn’t get much of a run in mainstream media. Should the SEN broadcast and digital play be pushed harder across the market. SEG has many of the country’s best broadcasters from Gerard Whateley to Garry Lyon, Kane Cornes and Andrew Voss, Matty Johns and David King, Andy Maher, Gerard Healy, Jimmy Smith and many more. How compelling a product is Trade Radio and how good was the late-night Ashes coverage on SEN? Does the public and the ad market fully appreciate the depth of the talent?

Time for assets to deliver

The SEG Annual Report notes:

Over the last four years, SEG has invested $53.3 million in strategic acquisitions and $17.2 million in capital expenditure.

We are confident we have created a suite of assets with long-term growth and in strategic value. Our significant investment to establish multiple media platforms – radio, TV, digital, print, teams – supported by broadcast rights, talent and extensive content is unique and hard to replicate.

It’s time for that suite of assets to deliver. From each of the 60+ radio stations to the collection of sporting teams, to the growing list of print assets.

It’s going to be an interesting FY24 for SEG. As the company reported in late October, the latest quarter is heading in the right direction: “Revenue for the first quarter of FY24 has been positive with 9% growth on the previous corresponding period.”