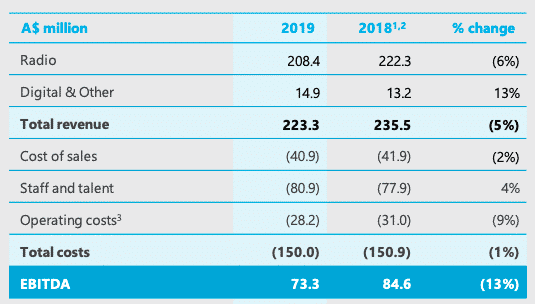

HT&E has released its results for the 12 months ending 31 December 2019.

The business now almost purely a radio group and is home to ARN’s Pure Gold and KIIS networks, The Edge in Sydney plus the iHeartRadio business.

Highlights from HT&E results presentation:

Chairman Hamish McLennan said, “HT&E is in a very strong position delivering great results and winning market share in a tough cyclical advertising market.

“The company is highly profitable, cash generative with a new lean corporate structure that leaves it poised to capture upside in any recovering ad market.

“We have made some difficult but correct decisions regarding selling non-core assets and on top of this the potential sales process for Soprano and Lux Group could deliver substantial uplift for shareholders.

“We have increased our dividend and are now paying between 60% and 80% of our profit to shareholders, with the continuation of our on-market buyback which is earnings accretive for shareholders. We also have the flexibility to explore the right strategic opportunities in a market that may consolidate further.”

A strategic review of the business last year shutdown the Gfinity Australia business. While it is noted above it is planning to sell Lux Group and Soprano, HT&E has decided to retain Emotive where it has a 51% shareholding.

CEO and managing director Ciaran Davis said, “ARN finished the year as the #1 metropolitan network in Australia. In a difficult market we have the highest audience reach in the history of ARN with 5.3 million listeners every week, and our commercial offering is winning share.

“This result reflects the success of our investment in talent and locking in the early extension of key long-term contracts across breakfast slots in Sydney and Melbourne provides assurance for our advertisers and great content for our listeners.

“We are also delivering a clear and unique digital strategy providing radio, music streaming and podcasts all on the one platform, iHeartRadio. This licence, extended to 2036 on an exclusive basis, gives us an incredible competitive edge that simply cannot be replicated, and augments our investment in data and technology to grow our share of the digital audio advertising markets. The future of podcasting is particularly exciting, and we are well placed in this growing market as a result of launching iHeart Podcast Australia, now offering the most comprehensive podcast content offerings for listeners and advertisers that is currently delivering 30 million download impressions a month.

“Our focus for 2020 is on strengthening our position as a leader in audio entertainment and I am confident we have all the building blocks in place to grow audiences, expand distribution and gain market share.”

Australian Radio Network

• Extension of iHeartRadio licence to 2036 – complementary digital strategy to deliver meaningful growth over the next three years

• ARN’s highest reach in history – 5.3 million listeners every week

• Multi-year contract extensions secured for Kyle & Jackie O, Jonesy & Amanda, Christian O’Connell and Jase & PJ

• Ongoing dominance of Sydney duopoly, KIIS and WSFM complemented by significantly improved ratings in the key focus markets of Melbourne and Perth

Leveraging podcasting has significant potential for ARN, providing advertisers with the opportunity to amplify campaigns using broadcast to podcast strategies powered by enhanced data and targeting capabilities. Podcasting is currently a small contributor to total adverting revenues in Australia however with high levels of awareness and uptake by Australians, its significance will grow relatively quickly.

During the year ARN entered into an agreement with iHeartMedia that gives ARN exclusive commercial rights across podcasting inventory available from the iHeart Podcast Network, the #1 commercial podcast publisher in the United States.

Trading Update

In radio, market trading conditions in January were consistent with H2 2019. ARN remains ahead of market with mid-single digit declines. Strong cost management is being maintained as we continue to assess market conditions. Overall cost growth limited to CPI as savings in core operations are offset by incremental investments in digital audio content, audiences and revenue growth strategies.