At first glance, publishers could be forgiven for thinking that putting their magazines on a low-cost digital aggregation platform like Readly could be a bad decision.

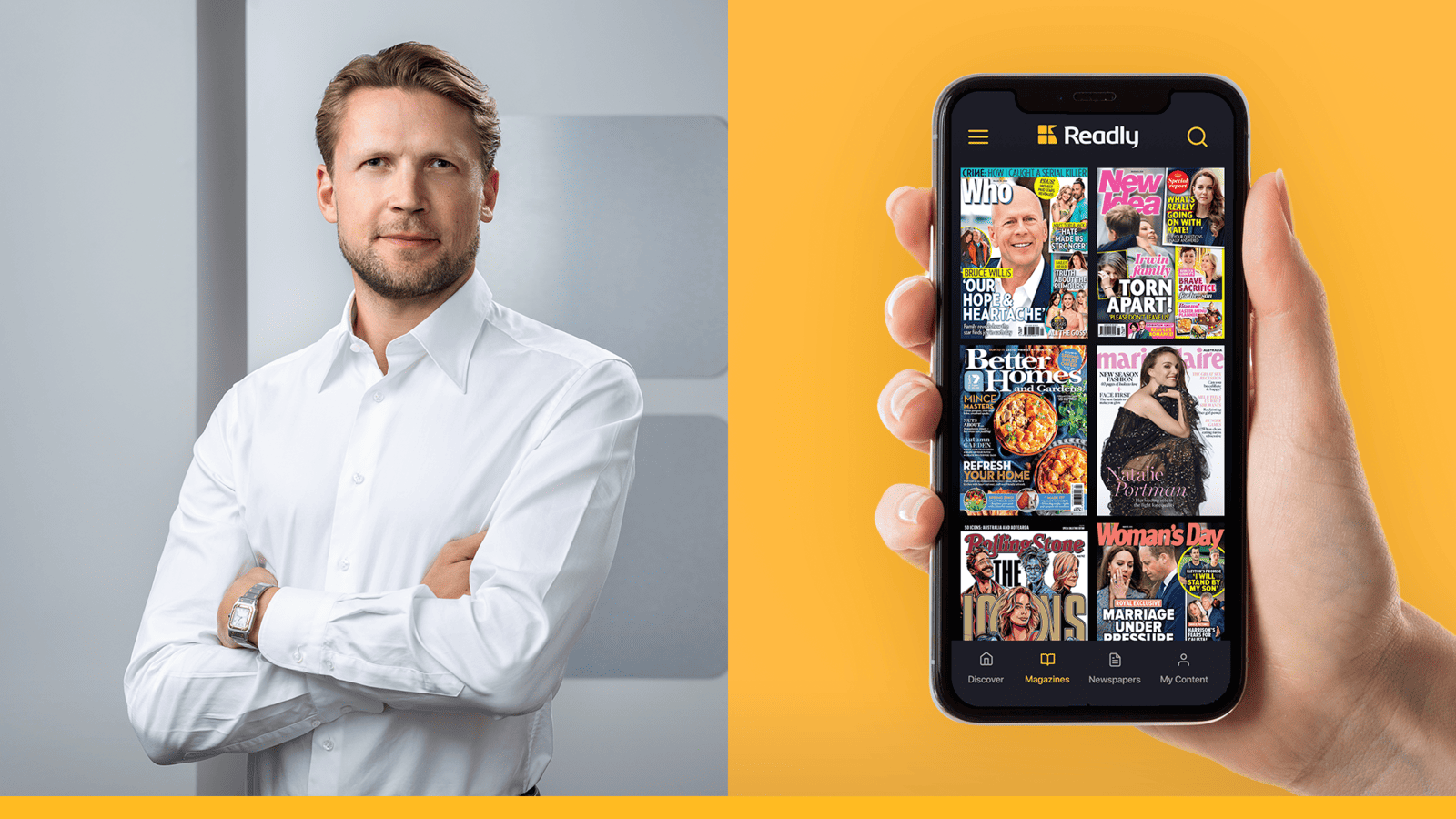

Not so. The Stockholm-based Readly CEO Philip Lindqvist told Mediaweek they have had good success attracting Australian publishers to their platform.

Lindqvist explained why publishers are signing up. He also shared some of the details about revenue splits. One of the attractions to publishers is a new revenue stream. But there’s a lot more to it than that.

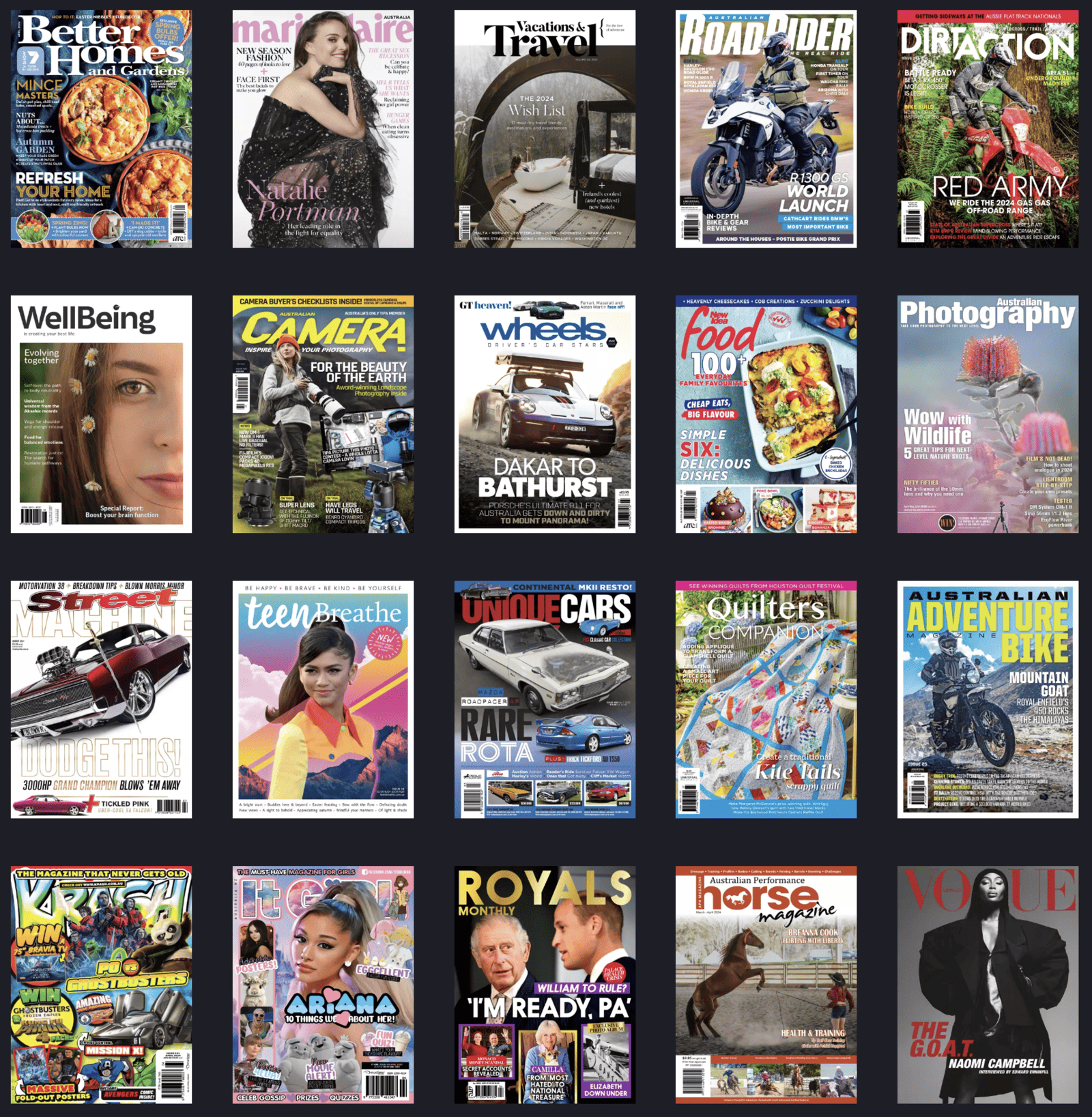

If you are a lapsed magazine reader, the lure of Readly is hard to resist. For $15 a month, users get access to 7,000+ titles and over 35 categories. Brands from all the biggest publishers – magazines and newspapers – are represented. Getting one month free when you join gives you time to explore the offering before your first payment is due.

See also: Mats Brandt steps down as Readly CEO, Philip Lindqvist to take the role

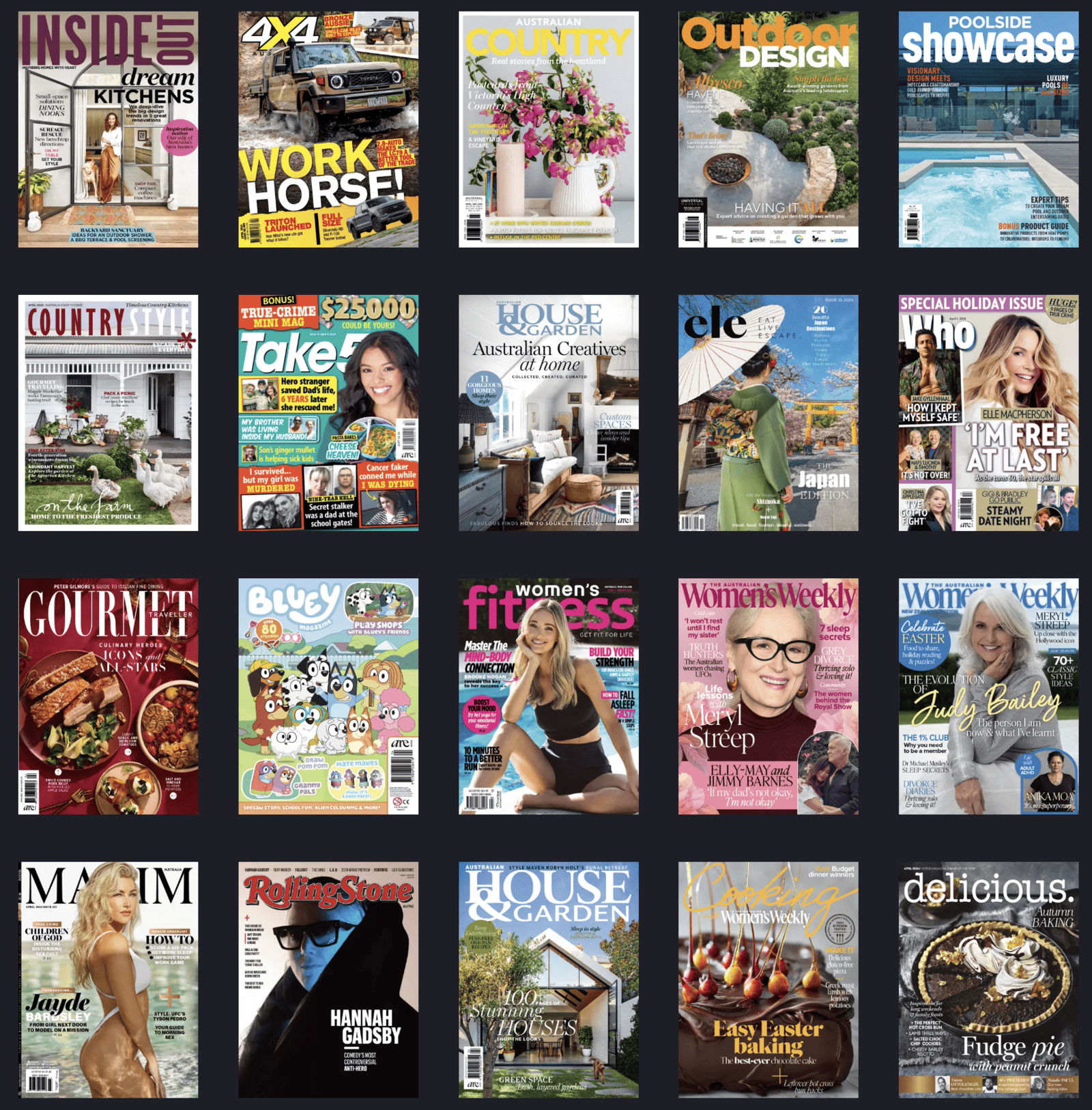

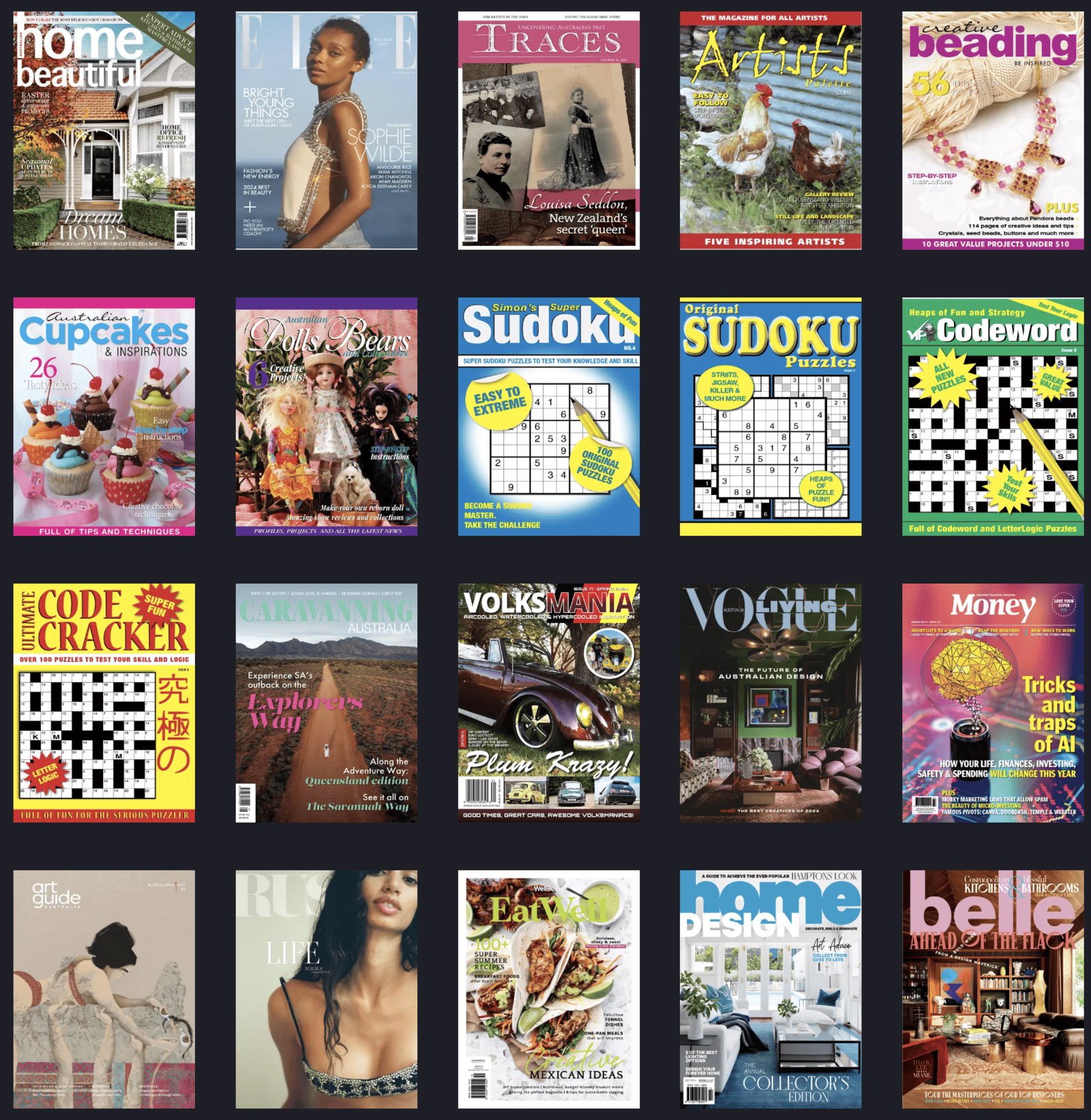

Readly content available in Australia

Lindqvist detailed just how big the Readly gallery of Australian titles is. “We have a strong portfolio of some 30 publishers. That’s almost 200 local Australian titles.”

But having local content on Readly is only part of the attraction for users, explained Lindqvist. “It’s important to keep in mind being a big English-speaking market, we have a global portfolio. Unlike some other players, our portfolio is truly global. We have a lot of UK and US titles that are very popular in Australia. Looking at the numbers, we can see that just over half the time spent on Readly by Australian users is with international titles, mainly from the UK and US.”

The pitch to publishers

Just how does Readly convince a publisher to join its ranks? There are a few components to the pitch, said Lindqvist. “One is extending a title’s reach – digital and print combined – which these days is a consolidated number.

“Another factor is revenue. Even though a direct subscriber with a publisher generates more cash for that publisher, the revenue they get from us is accretive to that business.

“If you go back 10 years when Readly was founded, there was a bit of ambiguity among publishers. Would we cannibalise or contribute to their existing business?

“Over the years, it’s been proven multiple times that we bring new revenue. New subscribers that aren’t currently customers of the publisher. It’s an additional revenue stream that we generate.

“We also have vast data access in terms of readership behaviour, interaction with titles, and interaction with advertising. We provide that to publishers, and they learn about user behaviour in a more granular way.”

Market penetration

When it comes to attracting subscribers to the platform, Lindqvist admitted: “Our penetration in Australia is lower than some other markets. That’s partly a function of the willingness to pay for magazines. It’s also a function of the amount of time we’ve been present with a proper strong portfolio of local content.”

The size of market penetration in Sweden leads Lindqvist and his team to believe there is scope for growth in Australia.

“Readly is a service. Historically, we weren’t as clear on the positioning. It’s a service for a target group with an established willingness to pay for editorial content. We’re not for everyone. We’re not like Netflix which was able to target the majority of households viewing.”

Lindqvist indicated Readly penetration into the target market here is still quite low.

Educating consumers about digital publishing

Part of Lindqvist’s brief when he joined in May 2023 was to make the platform profitable.

Until now, Readly has been loss-making. “Part of that is we had to educate users and explain what this category is about.

“From a consumer perspective, it was easier to understand streaming and video as the digital version of the channel. Video streaming television, where my background is, is essentially an aggregation or collection of video content from different sources.

“In the magazine publishing space, there was never a linear or analogue aggregated magazine service. This type of offering is new. It’s not only a digital transformation, it is a completely new way of interacting with content. That’s why it takes time, and we have to be patient.”

Are magazines making a comeback that is sustainable?

Just how real is the apparent growing interest in magazines? It’s a question publishers and advertisers have been throwing around. So what does Lindqvist think?

“It’s too early to tell,” he admitted to Mediaweek. “I see trends pointing in the same direction on a macro level. There seems to be some resilience in the willingness to pay for editorial content.

“There was a longer-term trend where the willingness to pay for editorial content was declining over many years. That was fuelled by the internet, where all content was made available for free.

“When consumers are accustomed to not paying for content, it takes a long time to get them back.

“Another factor historically has been this commingling of quality editorial content with non-editorial, fake news. Content on social media has made it difficult for users to understand what sources they can trust. What type of content is worth paying for?”

Lindqvist said he thinks those questions are now being answered as consumers realise what a real brand and editor can achieve.

“The interest in paying for an aggregated service is growing. The user knows that all content on this platform, whether you like the content or not, is proper journalism. Is proper editorial content, with an editor-in-chief behind every title.”

Where do new Readly customers come from?

Lindqvist: “One question from a publisher typically is if we gain one subscriber at Readly, have we taken that user from a direct relationship with a publisher?

“We have done extensive mapping of user behaviour. The answer to that question is typically no. We can also see that some users coming to Readly used to be magazine subscribers, maybe five, maybe even more years ago.

“For some reason, they left. It could have been that the print magazine didn’t really fit their lifestyle anymore. Maybe they felt that the digital alternative of that magazine didn’t fulfil their needs. Or they just found some other activity or media to engage with.

“We can see now that we have managed to get some of those ex-subscribers back. Subscribers that publishers haven’t managed to get. That’s one example of how the revenue we bring is accretive to these publishers. It’s new money.”

Building a publisher’s income stream

“We’ve increased prices across the board, not just in Australia, but in all our markets over the past few years, said Lindqvist. “We see so far, strong resilience in our customer base. Readly has to be a profitable company. We have taken some significant steps to that already. The reason we need to be profitable is that we need to grow to continue providing revenue to publishers.

“We’ve increased prices successfully over the past few years. We’ve also improved our marketing efficiency.”

Revenue split with publishers

Without detailing exactly how much publishers get, Lindqvist said company revenue of around 60% is going to publishers. “We keep roughly 40%. Out of that, we pay for all marketing, customer acquisition, product development and so forth.”

Cracking the mobile user experience

The best user experience is on a tablet device. Readly wants to make it just as good too on other devices.

“Our users are satisfied with the tablet experience,” said Lindqvist. “They are less satisfied with the [Readly] experience on smartphones. We need to improve that user experience.

“We’re also now experimenting with text-to-speech so that you can listen to certain articles. But the big one is cracking that mobile user experience.”

See also: Newsagent Mark Fletcher gives view on Readly, and what’s ahead for magazines at retail