Nine Entertainment Co. has released its financial results for 2022 with the media company revealing revenue of $2.7b and a net profit after tax of $315m.

See also: Nine FY22 results: A record year for radio, streaming, and print

Mediaweek caught up with the Nine Entertainment CEO, Mike Sneesby, to discuss what this result means for the company.

“The really positive thing in our results was the fact that it was all parts of the business that were contributing,” said Sneesby. “Every part of our business had a strong result which contributed to a fantastic result for Nine across the board.

“The contribution in all parts of the business shifted based on the very clear strategies to generate digital and subscription revenue. That helps us as we start to talk about the future and how market cycles are playing out.”

Nine’s TV strategy

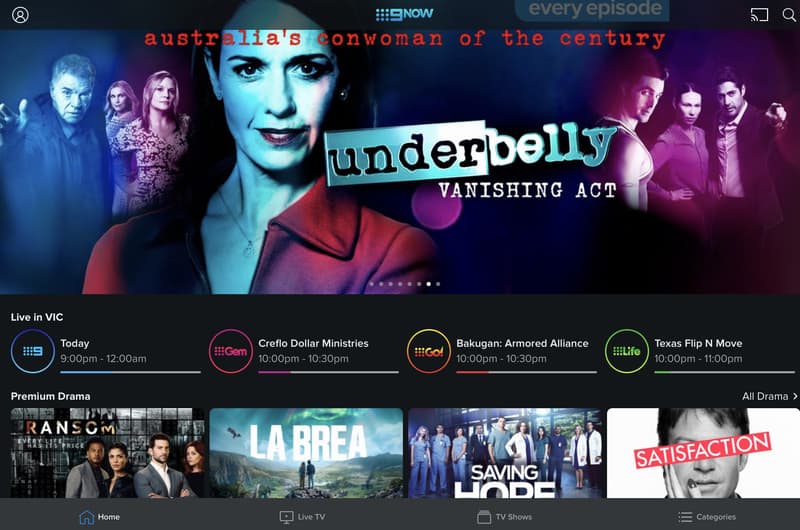

In Nine’s financial results, the company pointed to its success in the Total TV space as EBITDA grew by 19%. Sneesby said that this came from a consumption shift from linear TV to the internet.

“9Now sits at the forefront. As we shift our business focus into that internet delivered environment, we’re also bringing audiences back into 9Now and growing audiences. All of our top-tier tentpole programming is seeing a growth in absolute audience on a year-on-year basis. We’re not just seeing audience pick up on free-to-air and shift over to 9Now, we’re seeing 9Now actually grow the total pool. That’s enabling us to operate in a very new space. and it also demonstrates just how big that opportunity is.”

The company’s streaming service, Stan, also reported strong numbers, with a 22% growth in revenue being one of the leading figures to come out of the report. When asked how the concurrent growth of 9Now and Stan affect each other, Sneesby’s answer was simple: they don’t.

“Stan operates as a standalone business. There’s no crossover of people or resources, they operate based on the opportunity that sits in front of them. Neither is constrained. One of the things in my time as chief executive here that we’ve focused on with 9Now has been looking at that business through the lens of total opportunity.”

Nine Radio

Nine Radio touted a record cumulative audience in the most recent radio ratings survey, with the company having a cume of over 2 million.

Sneesby said that radio often looks like a small part of Nine’s business on a financial basis, but that the survey results demonstrated the audience reach for advertisers and the total media proposition of Nine Radio.

“In this year’s result, we saw for the first time radio streaming ad revenues being a part of the contribution – albeit a small part part of the contribution – to radio’s total revenue. In digital we’re seeing an increase in the volume of people that are consuming radio through an internet pipe rather than through the broadcast pipe. With that is coming the opportunity to digitally insert advertising into the audio stream for the first time. We started digital insertion in pre and post roll and through 2023 we will roll out digital ad insertion into the ad break stream.

“If you are streaming on Nine Radio you’re inside of that Nine ecosystem of signed-in logged-in users with data that we can utilise to target you. Nine radio is becoming another component of that large digital network that we have.”

Nine Publishing: Balancing Print and Digital

Digital subscribers were a key driver of growth for Nine, with active subscribers of Nine’s mastheads The Sydney Morning Herald, The Age and The Australian Financial Review increasing by 66% across the year. There was a decrease in print subscriptions and a retail sales fall of 6% as readers shifted to digital platforms for news.

This increase resulted in double-digit growth in revenue from subscriptions along with revenue from digital platforms. Digital ad revenue grew by 10%, despite the end of the legacy Google sales agreement in February 2021.

When asked about the balancing act of traditional publishing verse digital platforms, Sneesby said that Nine hasn’t given guidance or benchmarks for digital and traditional subscribers or circulation on newspapers.

“The profitability of a digital subscriber for us is greater than a traditional print publication, but when we look at our long-term plan we don’t see a world at the moment where it goes anywhere. We will continue to see it be an important part of the total publishing business and publishing proposition.”

Nine offers a buyback

Nine’s board announced its intention to conduct a buy-back scheme of up to 10% of its shared capital. Snneesby said this was the right time as it also allowed Nine to continue investing in the company.

“With this balance sheet, you’ve got plenty of optionalities. We didn’t just announce a buyback of 10% of our capital – we continue to reiterate that in doing this buyback, our balance sheet remains with the capacity to continue to pay dividends in the range of 6% to 8% and continue to have the capacity to make organic or inorganic investments.”