The Australian digital advertising market enjoyed a strong comeback in Q4, recording a 29.7% growth in digital ad spend from Q3 to reach $2,935 million and a 20.3% year-on-year increase from the same quarter in 2019. The data, which is drawn from the IAB Australia Online Advertising Expenditure Report (OAER), shows that all advertising categories have achieved growth for the second consecutive quarter as the industry rebounds after the pandemic induced declines earlier in 2020.

Gai Le Roy, CEO of IAB Australia commented: “Digital advertising saw a robust comeback in the second half of the year with an extraordinarily strong December quarter with marketer demand flowing across all inventory types. The combination of delayed marketing spend, traditional seasonal uplift, news of a COVID vaccine and increased consumer online media & commerce behaviour all contributed to the stellar quarter.”

Digital a adspend Q4 highlights

Both general display and search showed strong year on year growth up 26.8% and 21.1% respectively. The strong investment in display lifted its share of the digital ad spend to 41% compared to 39% in December. All display formats saw an increase compared to the prior year showing strong diversified investment for the quarter. Again, video advertising investment led the way with a 41% increase compared to the same quarter last year.

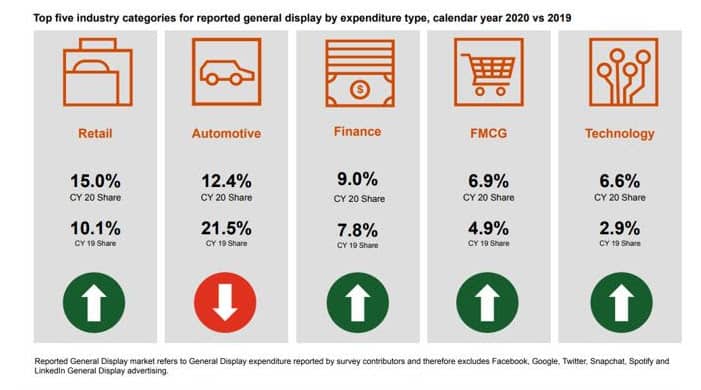

Advertising by retailers held a record share of digital ad spend, representing 18.5% of the market compared to 11.7% for the prior year. Investment by auto advertisers continued to lag the rest of the market with share from 23.7% in 2018, then 14.7% in 2019 to 10.8% in 2020.

Calendar year highlights

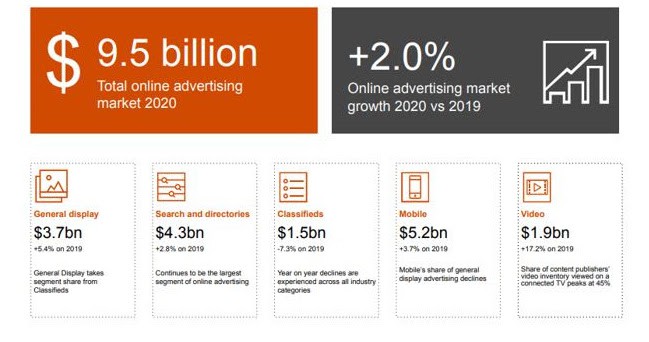

Total investment in digital advertising for calendar year (CY) 2020 reached $9.5 billion, up 2% from CY 2019.

Growth was suppressed by the impact of the pandemic on classified listings digital ad spend, which declined 7.3% year-on-year. However, the display market saw a 5.4% increase supported by another strong year for digital video investment, which was up 17.2%. Search advertising rose 2.8% to reach $4.3 billion which represents 45% of the total digital ad market.

Content publishers saw more of the inventory purchased through programmatic methods with programmatic RTB, PMP and guaranteed representing 44% of display revenue generated in 2020 compared to 36% in 2019. CTV share of video continues to increase, up from 35% to 45% of content publishers’ video investment in 2020 compared to 2019.

Throughout 2020 retailers lifted their investment in digital ad spend with this advertiser category now representing a 15% share of display investment up from 10% in 2019. Other categories to significantly increase share were Technology and FMCG. The two categories that had the largest decrease in share were travel and automotive.

See also: Nicole Bence appointed Chair of IAB Australia board