GroupM recently updated its 2018 and 2019 ad investment forecasts. GroupM slightly downgraded 2018 global growth expectations from 4.5% to 4.3%.

2019 growth projections are also whittled from 3.9% to 3.6%, with total new investment anticipated to reach US$19b instead of the US$23b earlier predicted. [Recent US dollar appreciation versus just about every other currency helped suppress this growth.]

Stress on the auto category stood out in feedback from GroupM’s worldwide network, as did the absence of any rebound in CPG investment with traditional media.

GroupM’s futures director Adam Smith said: “GroupM’s still strong but slightly fraying 2018 view ties to macro questions: tighter money, China’s slowing growth, and the potential for pricey trade wars. Real interest rates are edging up globally, but serious potential problems remain limited to a fragile five – Argentina, South Africa, Brazil, Turkey and Venezuela.”

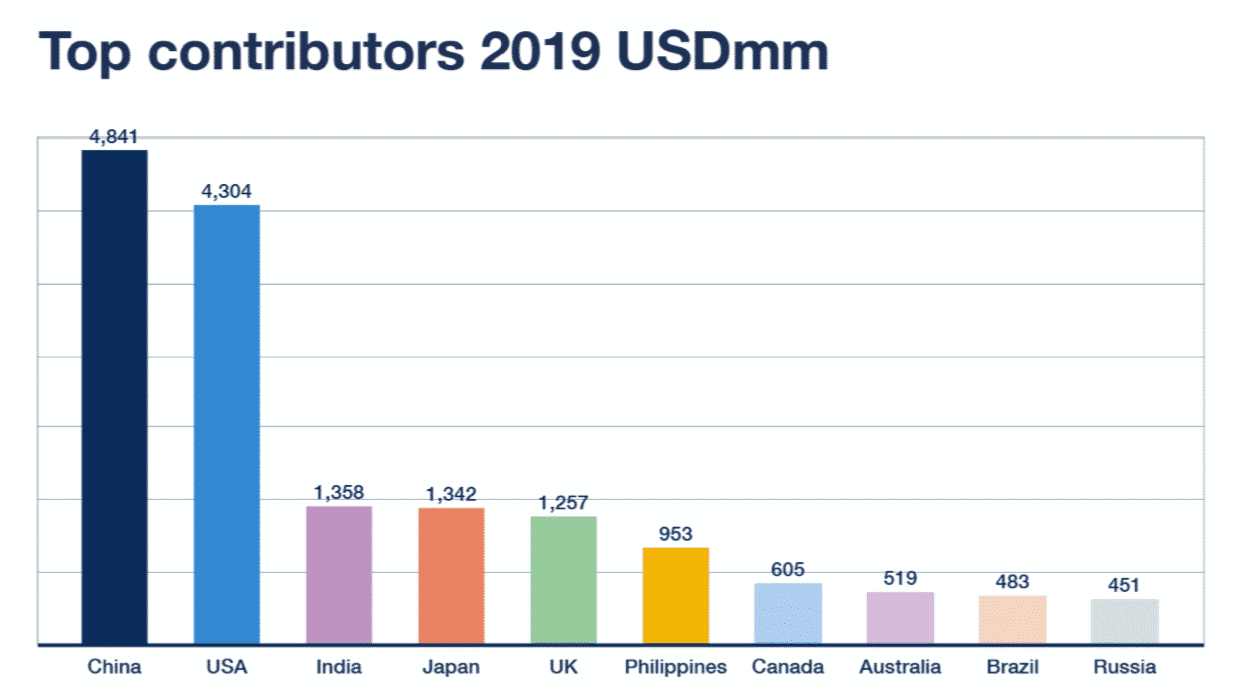

GroupM forecasts that 10 countries will provide 83% of all 2019 growth.

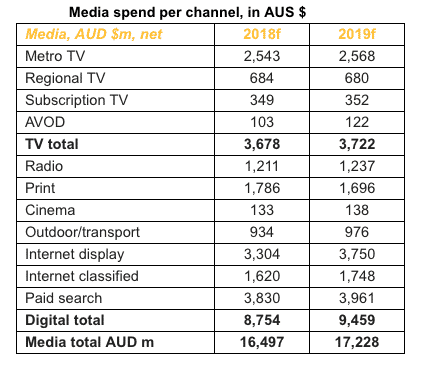

GroupM is forecasting adspend in Australia to reach AUD$17.2b in 2019 – growth of 4.4%.

For 2018, ad spend is expected to reach $16.5b – growth of 5.6%.

Australia is the eighth largest market in the world and one of 10 countries expected to provide 83% of all ad spend growth in 2019.

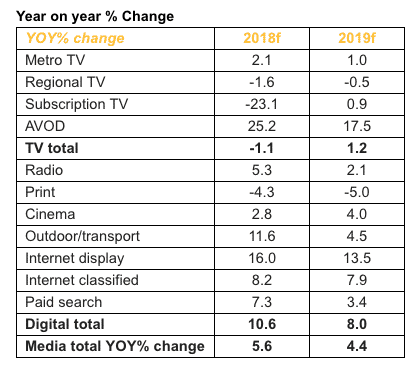

Just two media channels – regional TV and print – are expected to see decline in 2019. [See chart below]

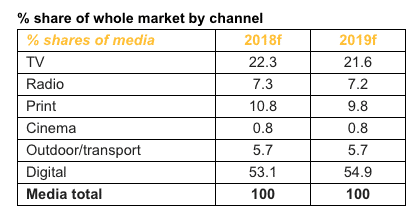

Total TV is set to return to growth for the first time since 2013 and is expected to grow 1.2% in with AVOD delivering greatest growth.

Total digital is expected to grow 8% with the greatest growth coming from display advertising.

Growth in outdoor is expected to slow in 2019.

The top five categories with the biggest growth in spend are computers (+24%), accommodation, gambling/gaming (+18%), communications (+16%) and appliances (+16%).

The four categories with the biggest falls in spend are pharmaceuticals (-17%), real estate (-10%), insurance (-7%) and motor vehicles (-6%).