Reporting season has just closed as we move into autumn, and today we look at SCA’s LiSTNR and regional TV business.

The results across the media sector showed generally how media companies had adapted to the market lockdowns in the past six months and then benefited as Covid restrictions were eased.

Mediaweek reported on the results of radio and TV group Southern Cross Austereo (SCA) last week. Today, chief executive Grant Blackley gives us some further insights.

See also: Southern Cross Austereo: Half-year revenue flat, but EBITDA up 16%

Blackley started talking about the TV result and the improved profit.

“The change of affiliation – from Nine to 10 – meant that revenues for TV were always going to come back. We actually ended up delivering 27% growth in television EBITDA.

“The decrease in TV expenses is linked to affiliation charges. That is a very solid effort for TV.”

Radio remains the main game for the broadcast group, accounting for three times the revenue that TV brings in.

“The core audio offering for our group earned an extra $20m,” explained Blackley noting an audio improvement of 11.5%.

Blackley said the jump in audio expenses [+14%] was principally an increase in the investment in LiSTNR. “We are still focussing on cost containment across the company. Our group operating expenses were down by $6m to $213m. That also includes increased investment in digital audio. The four areas of investment are capability, content, marketing and technology. We have a leading product in LiSTNR that is developing at pace and we announced in the results that in the last year we have now accumulated 500,000 registered users in a short space of time.

“We reported for the six month period that our digital audio revenue grew by 36% which was actually a little below our expectations. It was directly impacted by the extended lockdowns in Sydney and Melbourne.

“We are confident that moving forward that we will start to see an increased revenue.”

LiSTNR v iHeartRadio

Blackley noted how LiSTNR compared to the digital audio revenues from HT&E. “We are reporting revenue basically two times what HT&E is reporting. LiSTNR is predominantly Australian content and we have huge audience supporting it with a premium content and sales model. We are attracting the lion’s share of the money coming out of the sector.”

Data from the two competing company reports have SCA with $10m digital revenue in the half, with HT&E reporting $1m a month over the 12-month period.

Asked if podcasting and digital audio revenues were a long game, Blackley replied: “Not particularly. We launched LiSTNR 12 months ago and have developed income across our digital portfolio of $20m across that time. In the development phase, it can be a long game, but now we are in market with a world-class product, user signups are climbing with scale and the revenue is following.

“We are forecasting that globally [digital audio] could now start to grow between 35%-55% and possibly even higher if the marketplace returns to normal with Covid behind us.”

Key radio programming

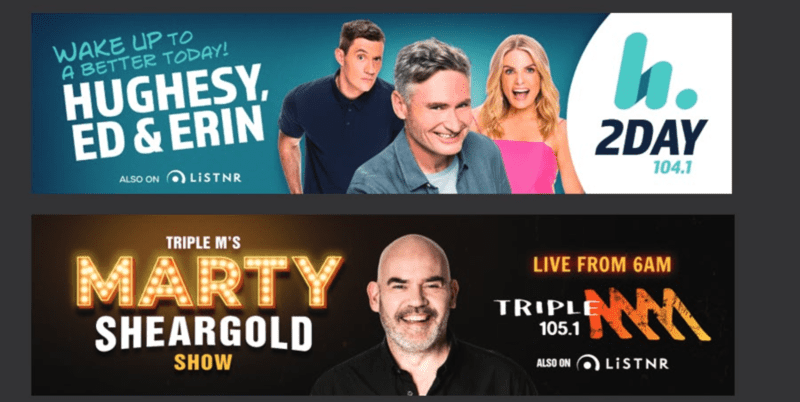

In the analysts presentation for the half-year result, SCA highlighted the importance of 2Day’s Hughesy, Ed and Erin and Triple M Melbourne’s Marty Sheargold. “We are very proud of both of those formats from the talent to the production. The problem has been due to the lack of audience mobility, we haven’t seen the levels of trial and awareness we could normally expect.”

Blackley is confident those new programs will lift when more regular listening patterns resume. “We are seeing some good signs with regard to the digital streams which are increasing week-on-week. Marty has an outstanding podcast that is performing exceptionally well.

“We know there is some adoption of the product, what we need is that to grow when people return to commuting and things like the school run return.”

Competing national networks

More people might be now comparing the national reach of SCA and HT&E following the latter’s acquisition of the Grant Broadcasters’ stations. “We support HT&E’s acquisition of Grant Broadcasters,” said Blackley. “What is creates is two strong and viable national networks. It provides stronger education in the marketplace for agencies and advertisers of the benefit of a national network.

“We have been doing that heavy lifting for years. Now we are being helped by Boomtown and HT&E.”

Blackley noted SCA and HT&E compete more in specific markets in Queensland than anywhere else. They also compete in Hobart, while there is very little overlap in NSW and Victoria.

SCA outlook: Conditions will improve

“We have to be conservative under the current conditions,” explained Blackley. “We are at the early stages of coming out of Covid. We saw a very strong bounce in consumption and revenue when we first came out of some lockdowns in late October 2021. Omnicom subsequently wrecked Christmas which deferred the deferral of some radio campaigns.

“We do believe conditions will improve, but we need borders open and people returning to previous routines. Supply chain issues need to be resolved at the earliest opportunity and people need to feel comfortable investing.”

10 rebrands as Paramount

Blackley said he was happy to see his TV affiliate partner bring the FTA business and the newer streaming business closer together. “They are intrinsically linked. I much prefer Paramount to ViacomCBS. There seems to be a level of simplicity, it is very clean. They need to continue to invest in the broadcast business to drive it forward. It is also the key marketing platform to develop the digital assets.

“What they have is no different to SCA having a very strong radio broadcast network, albeit a digital network, promoting the virtues of LiSTNR. There are many parallels between what we are both doing.”