• Cost reductions, not revenue growth, likely to drive future television M&A activity

The recent financial and ownership turmoil at the Ten Network has served to refocus attention on the challenging trading conditions which commercial television has been facing since the Global Financial Crisis (GFC), according to a new report from Bob Peters at Global Media Analysis.

Executive summary

The most current half-yearly results for Australia’s three commercial metropolitan television networks indicate that there has yet to be any sign of a reversal in the adverse financial trends which have been slowly eroding industry profitability for much of the past decade.

Despite still reasonably resilient aggregate viewer numbers, the industry’s profitability continues to contract, as the on-going growth in operating costs, particularly programming expenses, steadily outpace only minimal at best increases in advertising revenues.

While the rollout of free-to-air (FTA) television’s digital multichannels has been very popular with most Australian viewers, and therefore also successful at largely maintaining FTA usage levels amongst older viewers despite increasing competition from subscription television (STV) and subscription video on demand (SVOD) services, that strategic success has come at the heavy cost of exacerbating the pressure on programming expenses, at a time when television advertising revenues have experienced little or no growth.

Moreover, with the short to medium term expectations for growth in both overall domestic economic activity and total advertising expenditure in Australia presently being only modest, it is difficult to identify many factors which have the potential for improving the profitability of the commercial metropolitan and regional television networks any time in the foreseeable future.

Faced with such sobering financial prospects, it is understandable that the commercial television operators have long-lobbied the Federal Government for both further reductions in, or the complete removal of, commercial television licence fees, as well as a liberalisation in the existing media ownership limits.

While the Federal Government’s recently announced intention to abolish and replace the television licence fee should deliver some much-needed short term relief to the sector, going forward, the major financial driver of any future merger and acquisition activity involving a television network is more likely to be based on cost reduction, rather than revenue growth

Sobering Recent Financial Performance

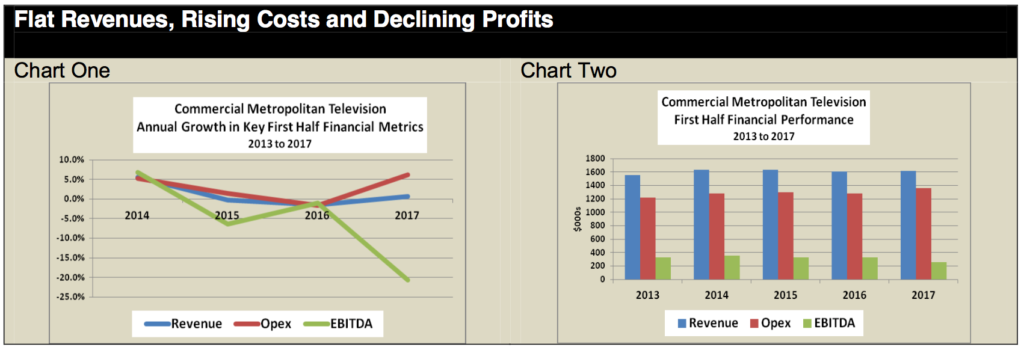

During the first half of the 2017 fiscal year, financial filings by the three commercial metropolitan television operators indicate that, taken together, total metro television revenues increased by less than 1% over the previous corresponding period, while their aggregated operating costs grew by about 6%, which resulted in a more than 20% decline in combined operating profits, as measured by earnings before interest tax, depreciation and amortisation (EBITDA).

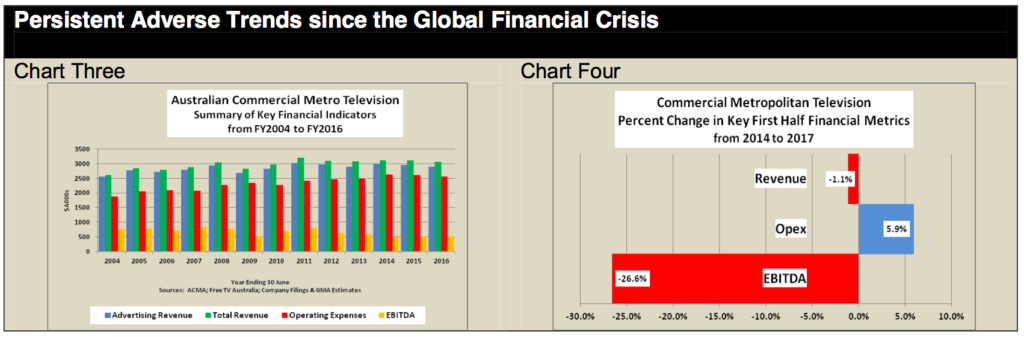

While metropolitan television’s financial performance in the first half of 2017 was particularly poor, as shown in Chart One, it was nevertheless in line with the adverse financial trends which the commercial television broadcasting industry in Australia had been struggling with since the global economic downturn in 2008, namely: stagnant television advertising revenues; still increasing operating expenses (particularly programming costs); and declining profitability, as shown in Charts Two and Three.

Chart Four shows that over the past four years, between 2014 and 2017, while first half metro TV revenues declined by 1.1%, operating expenses increased by 5.9%, which resulted in a 26.6% fall in EBITDA over that period. Similar trends are evident over a longer time frame, as shown in Chart Three, which covers the full financial years from 2004 until 2016.

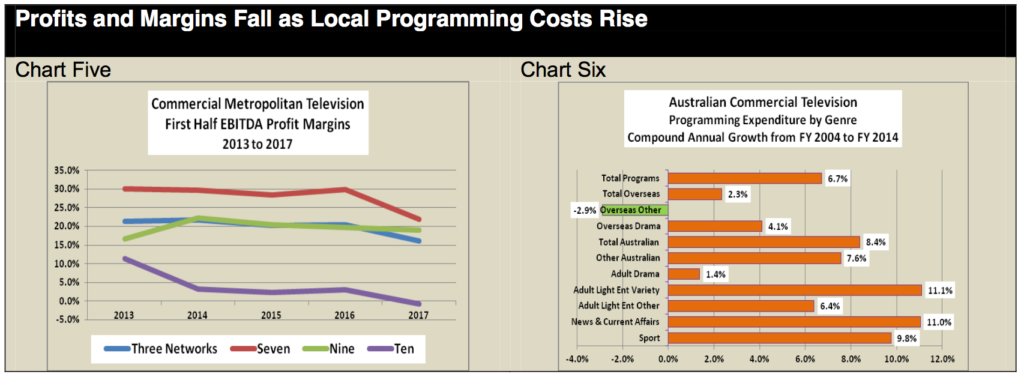

Although each of the three commercial metropolitan television networks have suffered from eroding profit margins, Chart Five shows that over the past four years the lower rating Ten Network has been particularly hard hit, with EBITDA turning negative in the most recent first half reporting period.

With flat industry advertising revenues, each of the three commercial metropolitan networks have been forced to rely upon cost control as their primary means of maintaining profitability, or at least of minimising earnings erosion.

However that has been difficult to achieve in some areas, such as programming, given that over the past decade there has been more than a three-fold increase in commercial FTA channel offerings, as well as increasing competition for viewers and content from both existing and new STV and SVOD services.

Chart Six, which is based on Australian Communications and Media Authority data, and which shows the increases in total commercial FTA programming expenses by genre which occurred between fiscal years 2004 and 2014, indicates that, over that period, locally produced content expenses grew by 8.4% per annum, while overseas-sourced content increased by only 2.3% per annum, resulting in a blended 6.7% rise in total programming costs.

In 2014, the three most expensive genres together accounted for 62.9% of total programming expenses. Local Sport topped the list with a 26.9% share, followed by local News and Current Affairs (18.2%) and Overseas Drama (17.6%).

Between 2004 and 2014, Australian produced content increased its share of total programming expenditure from 67.1% in 2004 up to 78.1% by 2014, while the share of overseas-sourced material fell from 32.9% in 2004 down to only 21.6% in 2014.

Subdued Future Financial Prospects

While the commercial FTA television industry has recently launched an interesting initiative, which is intended to improve the negative perception which many young media buyers reportedly have about the continuing popularity and importance of the sector with certain viewers, the current slow growth in the overall economy is likely to translate in to similar low growth in advertising budgets.

Thus, at least in the short to medium term, the industry will need to continue to focus on cost control in order to maintain profitability.

While the abolition of the television licence fees, which was recently announced in the Federal budget, will provide some much needed financial relief, that will only produce a once-off reduction in the industry’s cost base. While profitability over the next couple of fiscal years should be boosted by the licence fee removal, the underlying problems of stagnant advertising revenues and ever-rising costs will remain an on-going issue for the industry.

Should the Federal Government succeed in implementing some or all of its recently outlined media industry reforms in the near future, then any merger and acquisition activity generated by such changes is more likely to have cost reduction, rather than revenue growth, as its main financial driver, at least for deals which involve one of the major metropolitan television networks.

© 2017 Global Media Analysis All Rights Reserved