Gaming has a vast global audience and is a key driver of culture, yet in-game advertising spend remains stubbornly low, according to WARC Media’s latest Global Ad Trends report, Gaming: Advertising’s untapped opportunity.

Alex Brownsell, head of WARC Media, said: “Gaming is huge, both in audience and cultural impact, and its highly complex ecosystem spans devices and platforms defying conventional definitions of a channel. Gaming has long been heralded as a vital emerging opportunity for brands, particularly those wanting to reach younger audiences.

“However, in-game advertising spend remains low. This may soon change, with game publishers focused on improving ad monetisation. But evidence is needed to make the case for gaming as an advertising medium.”

The worldwide games market generates revenues of $183.9 billion annually and 3.4 billion people globally play games across age groups. Research by Newzoo has found that 72% of 35-54s and 46% of over 55s game at least once a week.

Nearly 90% of advertisers surveyed by the IAB agreed that gaming is a brand-safe channel as a result of improved tools such as fraud deduction, context and age rating, ads interactivity, and engagement metrics. Yet many marketers remain cautious of gaming as an advertising channel.

Enthusiasm around in-game ads peaked during the pandemic, but since 2021, the share of advertisers planning to increase spend on gaming has fallen by 20 percentage points, from 72% to 52%, per WARC’s Marketer’s Toolkit 2024 survey.

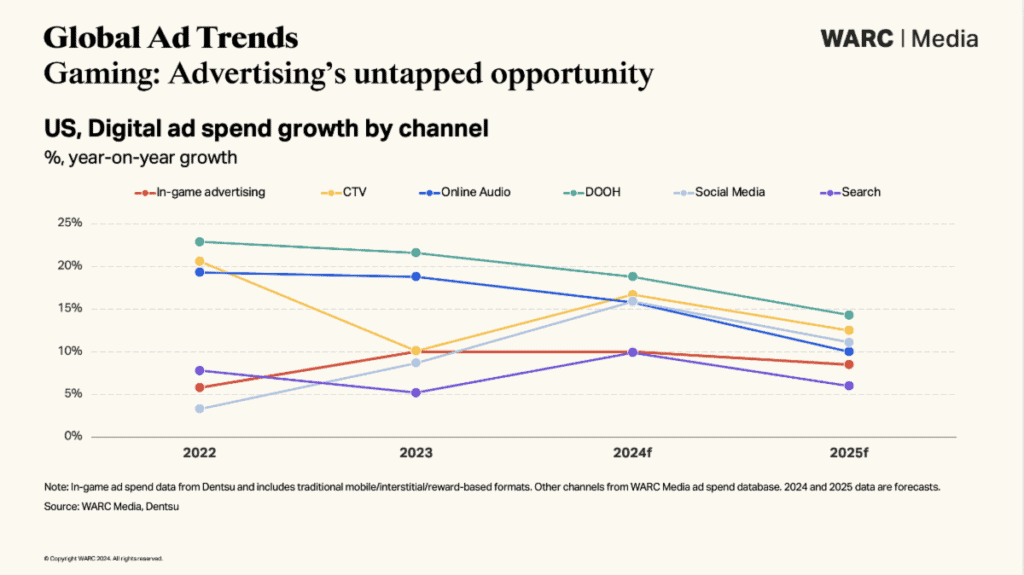

US advertisers are forecast to spend $6.7bn on in-game ads in 2024, up 10% year on year. This is equivalent to only 3.7% of total US digital ad spend, according to Dentsu.

WARC said the slow uptake of in-game ads is attributed to the gaming advertising ecosystem being so large, spanning devices, genres, formats, and market preferences.

Brands can choose between numerous touchpoints to reach gaming audiences, including creator content on Twitch, user discussions on Discord, and e-sports sponsorships, meaning they aren’t reliant on nascent in-game formats.

Jo Pereira, SVP strategy, media futures group, EssenceMediacomX, said: “Gaming is a whole entertainment ecosystem, not a channel, and is stealing share from entertainment platforms. However, clients haven’t grown up with gaming, and feel less confident with the opportunities.”

According to the report, while gaming companies such as Roblox are working to boost ad revenue, it may be ineffective without adequate support in other channels, particularly social, which is “key to facilitating discovery and engagement.”

Netflix has reportedly spent $1bn on its gaming business since launching three years ago, with game downloads up 200% since 2022. Investment in gaming content has helped even The New York Times to retain users with other digital platforms including LinkedIn and YouTube following suit.