News Corp has released its Fiscal 2025 (FY25) First Quarter (Q1) Earnings for the period ending 30 September 2024, including subscriber highlights for the Foxtel Group and financial results for the Subscription Video Services segment.

Commenting on the Foxtel Group at News Corp’s FY25 Q1 Investor Briefing this morning, News Corp Chief Executive Robert Thomson said: “At Subscription Video Services, revenue increased 3%, as growth in streaming more than offset declines in linear revenues. While this quarter was impacted by Hubbl costs as is normal with any product launch, those costs have come down sequentially, and we expect them to continue to fall.”

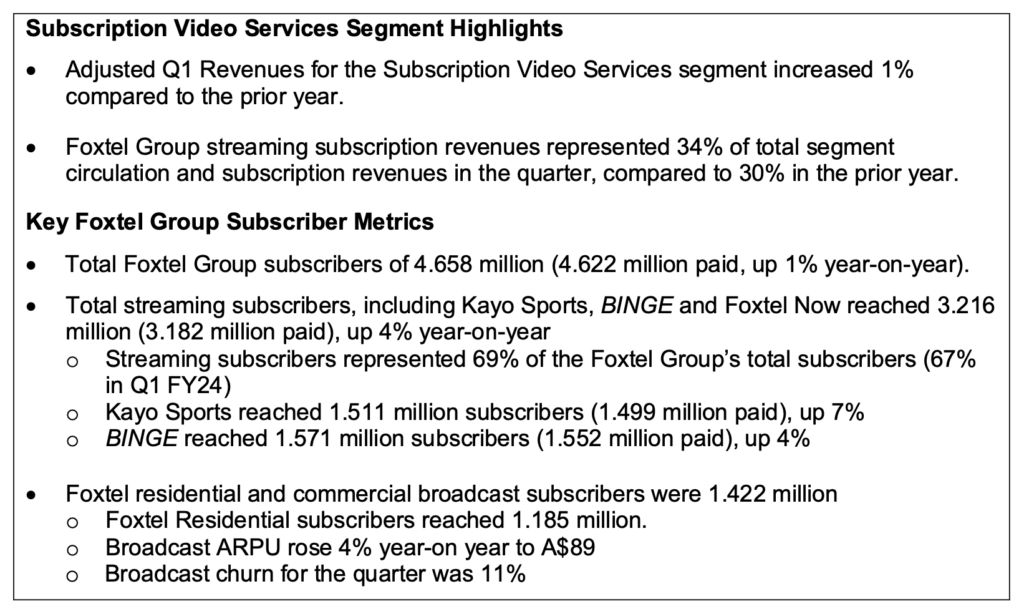

Speaking at the FY25 Q1 investor briefing, Thomson added: “Foxtel’s strength is reflected in its successful transition to streaming, which now accounts for nearly 70% of paid subscribers, while ARPU has continued to rise. Advertising on our streaming platforms rose over 45% and accounted for over 40% of Foxtel’s advertising revenues, with notable strength at Kayo, our sports streaming service. Meanwhile, broadcast churn of 11% fell 70 basis points sequentially, and broadcast ARPU rose 4% on prior year to A$89 (US$60).

“Sports are the cornerstone of Foxtel’s success, with record rugby league and Australian rules audience for the just-completed season, and a fascinating summer of sports looming. These trends drove strong free cash flow in the quarter and enabled the further repayment of shareholder loans.”

News Corp CFO Susan Panuccio added: “Revenues for the quarter were $501m, up 3% compared to the prior year. On an adjusted basis, revenues rose 1% versus the prior year.

“Streaming revenues accounted for 34% of circulation and subscription revenues, versus 30% in the prior year and growth again outpaced declines in broadcast revenues.

“Segment EBITDA in the quarter was $92m, down just $1m versus last year despite the inclusion of $11m of costs related to Hubbl for devices and marketing. Excluding the Hubbl investment, Foxtel’s profitability would have been higher for the quarter. For the quarter adjusted Segment EBITDA fell 3%.”

On outlook, Panuccio said: “At Subscription Video Services, the strategy remains to scale streaming products while retaining high-value broadcast customers through improved ARPU and churn measures and we continue to anticipate the rate of investment at Hubbl to be lower during the remainder of Fiscal 2025.”

See also: Foxtel Upfront 2025: Foxtel Group showcases 2025 content slate