When Seven and Foxtel first emerged as Cricket Australia media partners with cricket rights in April 2018, it was branded as cricket’s new era.

Things were different then. As former rights holder Nine moved from cricket to tennis in summer, Foxtel launched a dedicated Fox Cricket channel promising 1,000 hours of cricket with no ads.

Leading Seven’s cricket investment was former CEO Tim Worner who walked away from the cricket negotiations in 2018 with no digital rights to show matches on 7plus. Back then it didn’t look like an obvious misstep.

At the time Worner explained to Mediaweek: “I have been very clear about saying we are going to do deals that make financial sense. To go and get the digital rights in this deal would not have made financial sense.”

Foxtel was loaded up with streaming rights and just a month after announcing Fox Cricket later in 2018, the platform revealed plans for its $25 monthly sports streaming service Kayo.

During the 2018 rights negotiations, Foxtel had an audience of just over 2m. The success of Kayo, and more recently Binge, has seen the Foxtel audience nearly double to over 4m since then.

Cricket rights on the move? No way…

There was just no way News Corp could let Foxtel leave the Cricket Australia negotiations without a continuing role as a cricket broadcaster.

At times it looked like Foxtel was out though. Much of the negotiations were played out in the media which at different times was carrying headlines that the cricket rights were headed to Paramount and at other times that Nine was back in the game.

“We don’t play things out in the press,” Foxtel chief executive Patrick Delany told Mediaweek after confirmation he had secured a new rights package. “We quietly work behind the scenes whether it’s during the season or during the rights negotiations. There were others who were very loud about their technology and their chequebooks.”

Foxtel CEO Patrick Delany and Australian Test Cricket captain Patrick Cummins

Top: Delany and Cummins with Fox Cricket’s Adam Gilchrist

One of the things Foxtel hasn’t been forthcoming about is the exact breakdown of how much it is paying. Given that Cricket Australia claimed $1.512b across seven years and Seven is paying 13% less, Foxtel must be paying more. Around $30m annually according to some reports.

That amount helps secure the future of Kayo Sports for at least seven more years.

“The amount we pay and the terms we pay on are confidential,” Delany told Mediaweek. “Although there is some time until a new rights agreement will take over, the negotiations will come around pretty quickly.”

Delany stressed Foxtel was always deep in the negotiations. “Cricket is important to us. The group now is a sports business and it is highly seasonal. Having the cricket to plug the summer months is very, very important for the business.

“From all of our data, the crossover from AFL and NRL to cricket is so strong. We needed cricket to continue our very strong momentum. It was a sport that we felt we just couldn’t let go.”

There were plenty of reasons that News Corp needed to retain the cricket – the biggest one perhaps that it was the oxygen needed to keep Fox Cricket alive.

Secondly, and arguably even more critical, cricket is the glue that keeps many Kayo Sports customers on a financial drip feed for 12 months of the year.

Delany: “The Kayo subscribers can be likened to a hive of bees. There are customers coming in and out of Kayo all the time. It depends on the strength of the cricket for some subscribers. When England or India are playing in Australia it really booms. With some other teams, it is not quite as strong.”

As to what platforms cricket fans prefer, Delany explained: “The new age cricket fans prefer Kayo while the older viewers choose Foxtel.”

Although the expanded BBL and WBBL season gives Fox Cricket a lot more content, Delany hasn’t been campaigning to stop a rationalisation of matches.

“Not at all. I was very glad to see them go. I have advocated for the last five years that the [BBL] season was far too long. In the middle of the summer it is hard for the fans to know what is going on. We have been strong advocates for a shorter season. Fewer matches will make it more of an event. The length of the current season diminishes the value of each game. With fewer games there might be the ability to broadcast more matches in 4K as we spread the production costs.”

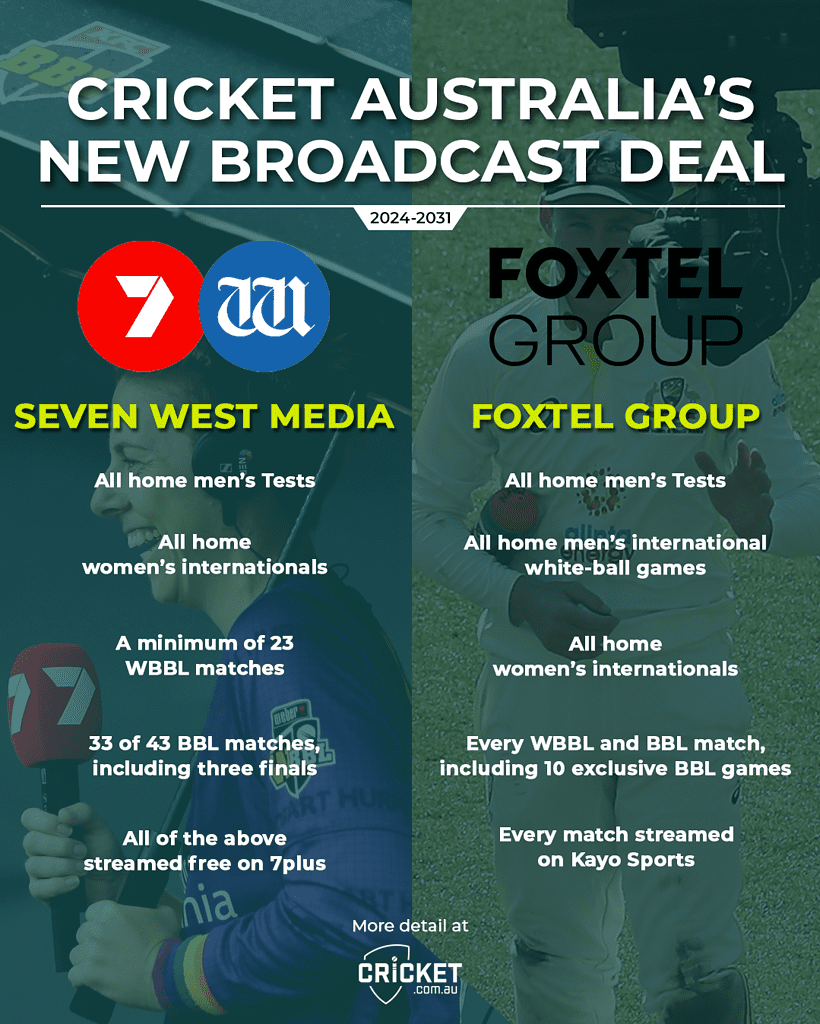

As well as also paying more, Fox Cricket also lost some of its exclusive BVOD rights with Seven getting streaming rights for all its BBL/WBBL matches.

Delany commented: “We don’t necessarily have to have that exclusivity now given the huge momentum we have at Foxtel with the growth of the Kayo Sports subscribers. Every game of every domestic competition live with no ads is enough.”