Foxtel Media Upfront 2025 saw media buyers, agencies, and executives gather for the broadcaster’s outlook for the year ahead.

The Group’s chief executive, Patrick Delany, welcomed attendees to the evening, telling them: ‘Every year, we detail the transformation, how we’ve gone from a single product company with a set-top box to an IP-connected digital-led and entertainment company, and everyone (the presenters) that comes out tonight stands before you because we are now a digital sports and entertainment company.

“There’s no question about it, so we’re very excited to share tonight how we’re going to disrupt the Australian media industry again this year.”

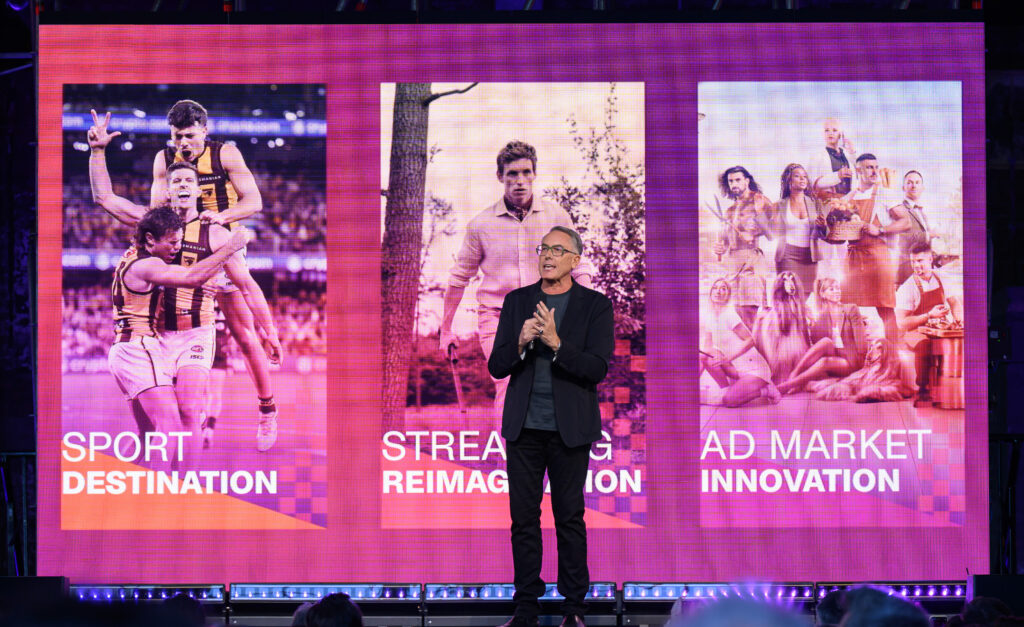

The overview of the evening included a segment on the success of sports viewing app Kayo Australia, the reimagination of of streaming platform Binge, innovation in the ad market and measurement, as well as the new Hubbl bundle.

Patrick Delany

Mark Frain, Foxtel Media CEO, followed and addressed the broadcaster’s “breakup” with OzTam and its “assertion of our unwillingness to collaborate them.”

“Now is not the time for more mudslinging, I do feel compelled for my team, our colleagues and our business partners to say this publicly. We have attempted many times over the last two years to find solutions with OzTam to address inaccuracies with the panel to drive a more future-facing agenda and to join as a shareholder for an equal voice,” he said.

“Unfortunately, the board and the shareholders said no, so we moved in a different direction one more aligned with the consumer shift to on-demand viewing and more aligned to our business shift, away from linear to digital.”

Frain said over the last year Foxtel Media has progressed through collaborations that aim to drive its business and industry forward. ” It’s not always easy more meetings, more opinions, more compromises, but comfort and growth don’t often co-exist and leadership choices are always not that popular. But our experience has proved collaboration is bringing greater accuracy, better results and, more importantly, new opportunities.”

Mark Frain

Mediaweek caught up with media buyers who attended the event to get their thoughts on offerings and what piqued their interest.

Lorraine Woods, Atomic 212°’s chief investment and trading officer, told Mediaweek the presentation focused on future-proofing its business while ensuring improved ROI for advertisers and agencies, and addressed challenges such as video ecosystem, data, measurement and effectiveness.

“We operate in a highly fragmented video landscape, and measurement and attribution continue to be challenging. It was promising to see Foxtel directly address these concerns by enhancing its data proposition and measurement capabilities, which will ultimately lead back to better attribution and understanding of effectiveness. These advancements demonstrate it is equipping its business with the necessary tools to stay ahead in this ever changing landscape, which is critical for both agencies and advertisers.”

She said that Atomic 212° will be interested to explore the new data offerings and push their potential for its clients. “The sophistication behind the Agile and CommBank IQ partnerships represents exactly what we seek when planning our video investments, effectively leveraging data to identify the highest opportunity for return and optimising this across platforms in real-time.”

“Collaborating with agencies to build smart, test and measure frameworks will be beneficial in understanding how their platforms can drive a better outcome for clients and, ultimately, could lead to more ad revenue for Foxtel if we get it right and prove campaign effectiveness. We have already been on this journey with them so looking forward to evolving it.”

Lorraine Woods

Woods noted the upcoming studies on video effectiveness will play a crucial role in shifting the conversation from reach to engagement and attention-based outcomes. She added that it will highlight the link between attention and sales performance will benefit the entire video industry.

She also noted the updates from Kantar would be “critical for the long term success of audience measurement” across Foxtel’s platforms.

“The TV landscape is undergoing a lot of change around currency and measurement right now. Accelerating these changes is crucial for Foxtel and agencies to use this data for our planning and buying. Without this, Foxtel’s growth trajectory could be at risk, especially given the increasing pressures of the competitive market.

Woods called the decision to stream live sports on Binge as a smart strategic move as the threat of emerging SVOD players make a deliberate play in this space. She said: “Live sports remains a major draw for audiences, and this move ensures Foxtel’s continued leadership in one of the most watched and valuable content genres.”

Woods also noted Foxtel’s continued its tradition of market-first innovation with the announcement of Hubbl and Netflix partnership and securing future subscriber growth and solidifying its place in the SVOD ecosystem

“Its partnership with TVBeat was another noticeable first, converting linear impressions into digital helping to improve performance across linear,” she added.

For Jessica Summers, investment director at OMD, she said the themes of commitment and collaboration with partners were consistently highlighted, as seen in its use of data sources such as Kantar and CommBank iQ, alongside the Video Futures Collective initiative and strong relationships with audience and advertiser partners.

She also noted that Foxtel emphasised its ambition to be the number one partner of choice in return. “It was refreshing to see such cohesive and unifying messaging as they set the stage for the year ahead.”

Summers said the dedication to their data and ongoing progress towards becoming the top digital sport and entertainment company stood out, as it boldly project that 52% of its 2025 revenue would come from digital around its key pillars of sport domination, streaming reimagination, and ad market innovation.

Jessica Summers

“It was clear throughout the event that Foxtel has a strong vision for the future of their sports platform, supported by exclusive rights to the first eight rounds of AFL and the reimagining of the KAYO platform to drive audience and advertiser growth. Their dominance in sports is a core strength, and it’s no surprise that they’re looking to extend this advantage across their portfolio, with Binge expanding its audience and engagement through the inclusion of both sports and news.”

Summers added that another major highlight was the announcement that Foxtel, Foxtel Go, KAYO, and Binge will all be available on a single platform by the end of the year.

“In a competitive market, this integration will give Foxtel a significant edge, enabling advertisers to easily visualise the combined performance of their campaigns and make more informed, data-driven decisions,” she said.

Avenue C managing partner, media, Daniel Cutrone told Mediaweek that Foxtel delivered a “strong case” that “instilled confidence despite turbulent content deals” of Max and HBO, while revolutionising its measurement standards in 2025.

“Whilst there was no mention of how the introduction of Max’ may impact the Foxtel Group in the long-term, both House of Dragon and The Penguin featured within their upcoming programming reels.

“Instead, the Foxtel Group focussed more on its original content from returning franchises of Selling Houses Australia, The Twelve, Colin From Accounts, as well new properties: Billion Dollar Playground and The Last Anniversary to name a few.”

Daniel Cutrone

Cutrone noted Binge’s addition of women’s domestic sport as well as news properties Sky News, CNN, CNBC, BBC. “This would uniquely place Binge as an Entertainment, News and Sports Streaming platform, without canabilising on Kayo subscribers with only 10% cross-over,” he said.

He said that Foxtel’s strength is firmly placed within Sport which was reinforced with its ongoing broadcast and tech innovations, breadth of commentary team, ad-free during live play, and its exclusive content strategy with the AFL Super Saturday to win over fans for longer.

“Overall, Foxtel has a challenging retention strategy ahead in 2025 – with even more competition than ever! Meanwhile as the business shifts its Linear TV metrics to a new single-source digital currency it may struggle in the short-term, that is until all the pieces are tried and tested to provide true de-duplicated scale and ROI across the entire group,” Cutrone added.

See also:

Foxtel Upfront 2025: BINGE to offer sport streaming via Kayo Sports, Hubbl launching Aussie-first bundle combining Netflix and Kayo

Foxtel Upfront 2025: Foxtel Group showcases 2025 content slate

Foxtel Upfront 2025: Amazon joins Video Futures Collective, new research projects into premium digital video advertising impact

–

Top image: Left – Mark Frain. Right: Lorraine Woods, Daniel Cutrone and Jessica Woods