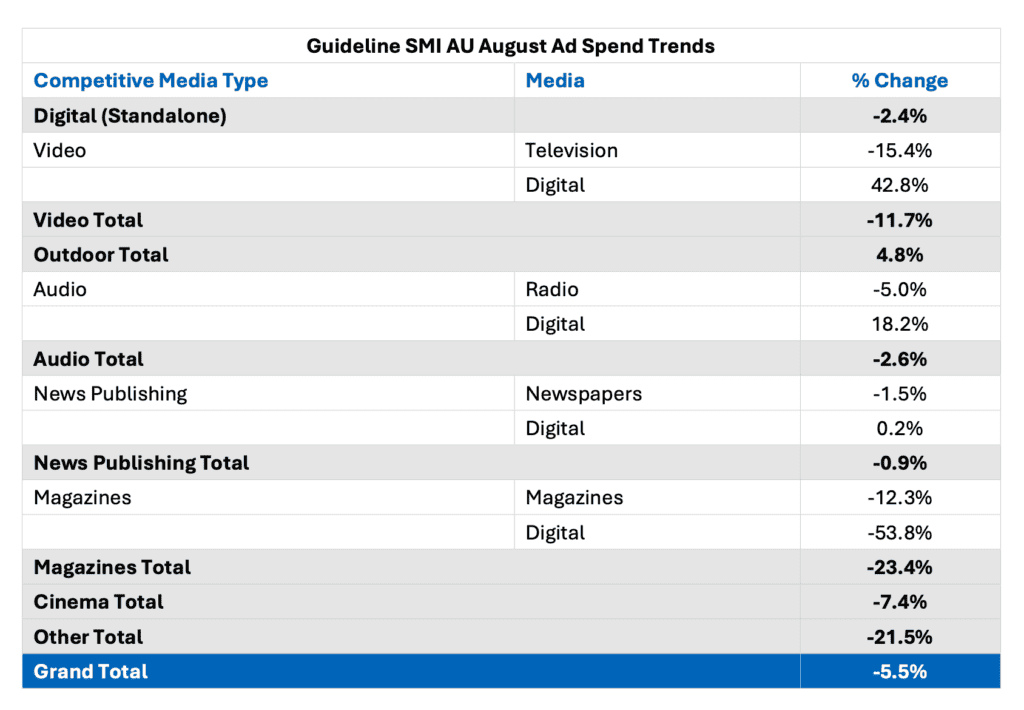

Australia’s media agency market received a further boost from the FIFA Women’s World Cup in August, with SMI reporting higher TV streaming and direct subscription TV ad spend in a market that was back 5.5% against last year’s record level of August ad spend.

Among the major media outdoor was again the best performer with bookings up 4.8% to a record August total, while total digital ad spend grew 0.5% to also be at a record level for August. Among other media, printed newspapers did well with bookings to metropolitan newspaper titles up 1.1% year-on-year.

SMI AU/NZ managing director Jane Ractliffe said the result also reflected the impact of the FIFA Women’s World Cup, with the value of bookings to TV streaming services lifting 14.3% year-on-year and direct bookings to subscription TV channels growing 14.7%.

SMI: Spend grows for Optus and Kayo

“The vast majority of growth among the BVOD and subscription TV services was within the sports-related content, with Optus’ streaming service quadrupling ad spend year-on-year and Foxtel’s Kayo platform doubling bookings (from a higher base),” she said.

“The impact was also clear within the product category data with ad spend from sports-related advertisers up 44% year-on-year and gambling ad spend lifting 21% with most of that higher gambling ad spend now moving to digital publishers as TV spend declines.”

Lower government category ad spend continues to weigh on the market with the total back 30% in August to again be the largest decline. SMI reported automotive brand advertising continues to rebound (+9.6% YOY), while Insurance demand lifted 12.9% and ad spend from the movies/cinema/theme parks category soared 63.3%.

See also: SMI July 2023 – Women’s World Cup drives ad spend, outdoor and cinema hot

FY 23-24 spend starts close to record level

Calendar year-to-date results show the market back just 2.7% from the record spend levels seen over the same eight months last year. Ractliffe said it was also worth noting a higher level than usual of late July bookings has now turned ad demand for that month positive (+2.5% to now be at a record July total), resulting in ad spend for the first two months of the financial year to be back just 1.7% against last year’s record level.

Meantime, Guideline SMI has also announced it will host its first Ad Spend Forecast Webinar to provide the market with insights on likely ad demand trends for 2024.

“As we’re now in the key media budgeting period, it’s important for the market to gain clarity on future ad demand so everyone can plan effectively,” Ractliffe said.

“Guideline SMI now has more than 16 years of monthly ad spend data in our databases and we have more than five years of experience in collecting and analysing the market’s forward pacings data so we are ideally positioned to provide the most robust forecasts.’’

The webinar, to be held on October 12, will detail forecasts for all major media and key product categories. Tickets are available here.