The Australian Competition and Consumer Commission (ACCC) has approved the proposed merger of Nine Entertainment and Fairfax Media this morning.

IBISWorld senior industry analyst Jason Aravanis has explored the initial issues influencing the merger and what it will mean for the media industry as a whole.

“Fairfax has struggled over the past five years, with its revenue declining almost 17% since 2012-13. The company has tried to cut costs, announcing 115 job cuts in May 2017. Nine Entertainment hasn’t seen the same sort of declines, but revenue growth has been slow since 2013-14,” Aravanis said.

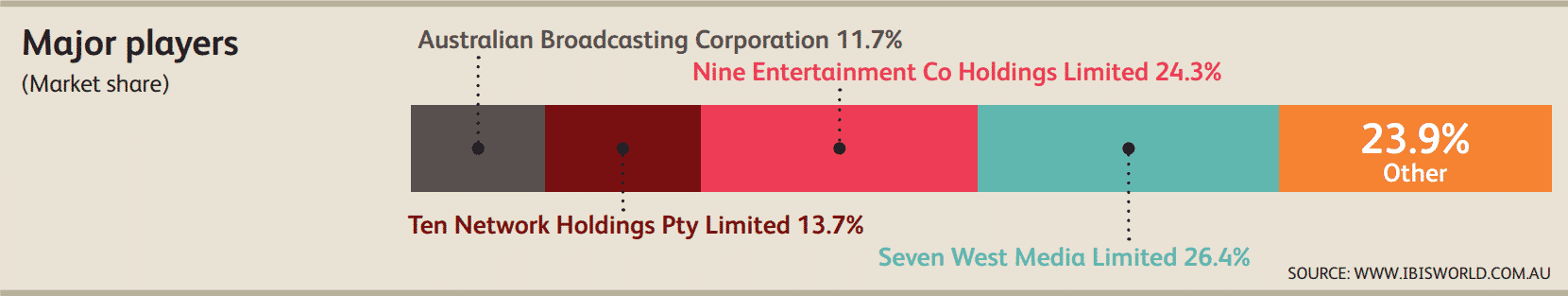

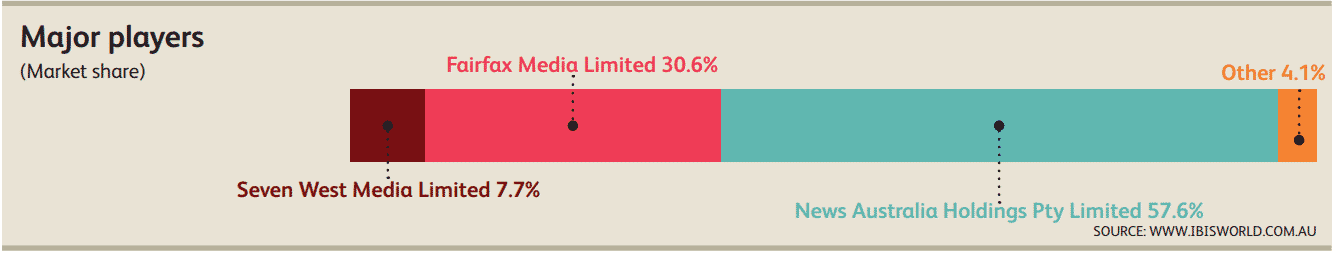

The new entity will be a combination of the second-largest largest newspaper publisher in Australia with the second-largest free-to-air television broadcaster in Australia. It will be 51.1% controlled by Nine Entertainment shareholders, and the new entity will be branded as Nine.

See also:

IBISWorld: Top Companies in Information Media and Telecommunications division, 2017

• Where did Fairfax and Nine rank last year?

“The new company is expected to generate almost $2.0 billion in revenue, making it the second-largest media organisation in Australia, behind the media holdings of News Corporation,” Aravanis said.

“The merger will have significant benefits for Nine, as it will have open access to Fairfax’s newspapers and online publications, as well as Fairfax’s Macquarie Media radio interests. However, the merger will have possible implications for how Fairfax operates, putting into question, for example, its regular investigative journalism partnerships with the ABC,” Aravanis said.

IBISWorld has found that over the past five years, the newspaper publishing industry has declined at an annualised 6.3% as circulation numbers have dwindled.

“Fairfax has underperformed compared to the overall industry. Free-to-air television broadcasting has declined by 2.8% over the past five years, as competition from on-demand online operators has increased,” said Aravanis.