Fairfax Media has announced its results for the half-year to December 2017.

Key Highlights:

• Digital subs for SMH, Age and AFR up 50,000 to 283,000

• Fairfax to exit 35% of NZ print publications through sale or closure

• Streaming update: Stan’s subscriber base closing in on 1m

Statutory Results:

• Revenue of $877.1 million, down 3.9% from the prior corresponding period.

• Net profit after tax of $38.5 million, compared with $83.7 million in the prior corresponding period.

Underlying Results (excluding significant items):

• EBITDA of $146.9 million up 1.3%.

• EBIT of $119.8 million down 5.5%.

• Net profit after tax of $76.3 million down 9.9%.

Chief executive and managing director Greg Hywood said: “This is a good result we are presenting to the market today. It shows the solid performances of our businesses – virtually across the board – and demonstrates the strength of the Fairfax Media portfolio.

“Fairfax is strongly positioned due to the success of growth and transformation initiatives we have implemented over the past five years. Domain’s digital growth is continuing, Metro publishing has delivered increased earnings, the radio business is showing the benefits of the merger and Stan is going from strength to strength.

“Group revenue of $873 million was a modest 3% lower than the prior year.

“Our ongoing cost and efficiency focus delivered a 4% reduction in expenses, notwithstanding continued investment in growth initiatives at Domain and Stuff.

“Net profit of $76.3 million was down 10%, with earnings per share of 3.3 cents. This result reflects the increase in minority interests associated with the separation of Domain from 22 November 2017 and the improved Macquarie Media results.

“We will pay an interim dividend of 1.1 cents per share, 100% franked. We note Domain declared a 4 cents per share dividend for the half.

“Our balance sheet is strong with a net cash position for Fairfax’s 100%-owned entities.

“We will take advantage of opportunities arising from media consolidation as and when it occurs. Any decisions we take will be in the best interests of our shareholders.”

Domain Group

Despite the departure of CEO Antony Catalano, Hywood stressed: “Domain is underpinned by a first-class management team, currently led by executive chairman Nick Falloon. Domain’s strategy is well established and its implementation continues apace, building on the achievement of breadth and scale.

MORE: Nick Falloon delivers Domain financials, reports on CEO search

“Domain delivered 22% digital revenue growth. This was supported by residential depth revenue growing 24% and strong performance from developers, commercial and transactions. Print revenue declined 12% reflecting the transition to a digital business.

“Our 60% stake in Domain remains a key strategic asset and its strong fundamentals underpin our great confidence.”

Group publishing

“Our three publishing businesses are profitable and generating valuable cash flows. Each has benefited from an ongoing emphasis on digital publishing, a continuing focus on cost and efficiency, maximisation of print earnings, and development of new revenue opportunities.

“We have progressed our recent positive discussions with News Corp Australia to seek industry-wide efficiencies in printing and distribution. We have had successful collaborations around shared trucking and printing titles for News in Queensland.”

Australian Metro Media

“Metros are in good shape – the best they’ve been in recent history. And there’s more to come. Initiatives to deliver rapid innovation across consumer products and advertising are well under way – and we haven’t let up on driving cost efficiency.

“Metro’s impressive 11% decline in costs – largely from savings in staff, technology and print production – more than offset the decline in revenue of 9%. Publishing advertising revenue declined 15%.

“Overall circulation revenue was modestly lower, benefiting from strong growth in paid digital subscriptions and increases in cover prices, offset by declines in print circulation volumes.

“Net paid digital subscriptions for The Sydney Morning Herald, The Age and The Australian Financial Review recorded their strongest reported uplift in four years, increasing by almost 50,000 from August 2017 to more than 283,000. We are encouraged by positive trends in consumers’ willingness to pay for trusted and quality content, as evidenced by strong trends in Australia and overseas markets. All three titles delivered growth, with the Financial Review delivering a particularly strong B2B uplift.”

Australian Community Media

“ACM’s total revenue declined 9%, with stable contribution from agricultural-related advertising offset by weakness in local and real estate revenue,” Hywood said.

“Digital revenue increased 20%. Circulation revenue declines reflected lower retail volumes. Other revenue increased 11%, benefiting from a strong performance from Fairfax Marketing Services, which delivers full digital marketing solutions to regional clients.

“ACM is well managed with operating costs improving by 7%, building on the 9% reduction in FY17. During the half, six community titles and one speciality magazine were closed, with positive EBITDA contribution to be reflected in the second half.”

Stuff

Hywood said: “The recent renaming of the New Zealand business as Stuff recognises the tremendous power of the Stuff brand, the increasing role it plays in everyday Kiwi life and its position as the centrepiece of a significant digital growth opportunity.

“Digital revenue growth of 33% benefited from strong growth from Stuff Fibre and Neighbourly, offset by lower print advertising. Total revenue declined around 5% in local currency terms. Digital and non-print revenue now represents 17% of Stuff’s total revenue.”

“We are announcing today a plan to exit around 35% of our NZ print publications through sale or closure. The rationalisation of these smaller community titles and free inserts will deliver additional EBITDA contribution over a full year – and bring forward the time when increases in digital revenue outweigh declines in print.”

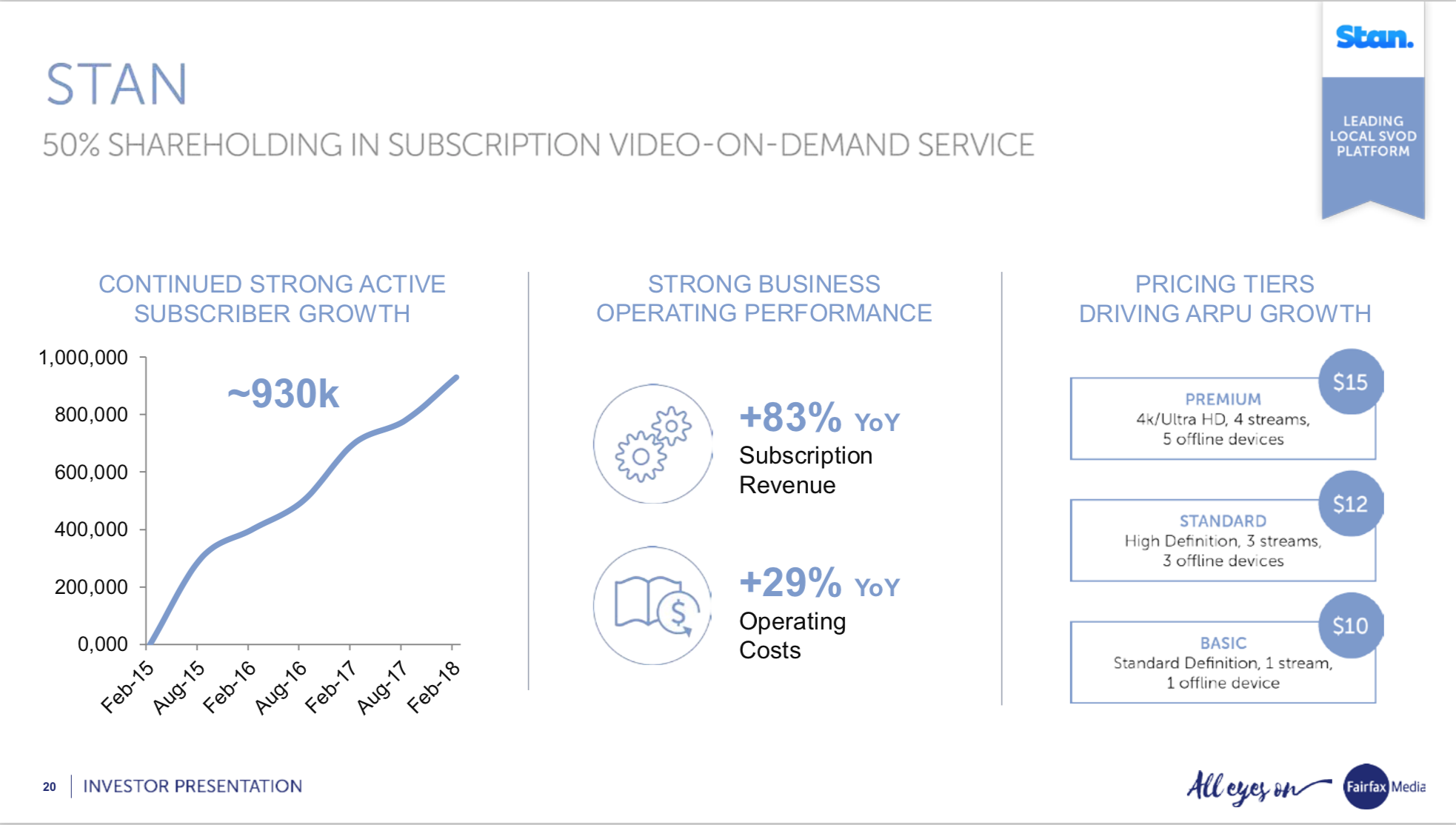

Stan

“Stan’s strong active subscriber momentum continued and delivered a subscriber base of impressive scale at around 930,000. Subscriber growth, combined with the first price increases since launch three years ago, underpinned 83% growth in subscription revenue. The strength of the operating model is reflected in revenue growth far outpacing the increase in operating costs.”