• Domain separation and listing timetable revealed: shares to trade in November

• New digital products launching promising deeper and more engaging experiences

Chief executive and managing director Greg Hywood said: “Today’s result shows Fairfax is in great shape. We have delivered strong value for shareholders through growth and transformation initiatives. The strategy we commenced five years ago has successfully maximised cash flows of our publishing assets and with that built growth businesses in Domain and Stan.

“For 2017, the Fairfax group delivered net profit of $142.6 million, up 8%, with earnings per share growth of 8.5%.

“Group operating EBITDA of $271m was achieved from revenue of $1.73 billion. This result was higher than the preliminary and unaudited range of $262m to $266m provided to the market in early July. This was due to a strong year-end from Metro.

“Domain delivered 19% growth in digital revenue notwithstanding a difficult listings environment in the first half. As the listings cycle improved, H2 digital EBITDA increased 20%.

“Our three publishing businesses are modern, cost efficient and sustainable across digital and print. In the context of the global structural change impacting upon the media industry, the fact that our publications remain profitable and sustainable is an outstanding achievement.”

Fairfax provided an update on the Domain separation and ASX listing:

• Fairfax Media plans to retain 60% of Domain, with 40% distributed to Fairfax shareholders.

• Conditional on shareholder approval and receipt of regulatory clearances (including ASIC, ASX and ATO) which are well progressed.

• Nick Falloon will be chairman of Domain. The Board recruitment process is under way.

• Domain shares are expected to commence trading in mid to late November.

Australian Metro Media highlights

“In our Australian Metro Media segment – which includes The Sydney Morning Herald, The Age, The Australian Financial Review, Digital Ventures and Life and Events businesses – revenue declined 9% and EBITDA was up 26%,” Hywood said.

“Metro publishing advertising revenue declined 17%,” Hywood said.

“Overall circulation revenue was stable, benefiting from the strong growth in paid digital subscriptions revenue which increased 21%. The Sydney Morning Herald, The Age and The Australian Financial Review have around 236,000 paid digital subscribers. All three titles delivered year-on-year growth. Declines in print circulation volumes were partially offset by cover price increases.

“Along with a flatter, more efficient operating structure, the centrepiece of Metro’s next-generation publishing model is cutting-edge product and technology development. We will have in market this calendar year a suite of new digital products which will deliver deeper and more engaging experiences, while sustaining a successful print proposition.

“New digital products will be launched for the SMH and The Age; shortly followed by the Financial Review and lifestyle mastheads, along with new apps for the SMH and The Age. We are focusing editorial on distinctive content to strengthen our audience and subscriber proposition.

“The new products will drive engagement, subscriber value and better outcomes for advertisers through new data-driven commercial solutions and advertising formats. The introduction of the new tech platform will allow for the retirement of legacy systems and cost rebasing.”

Digital Ventures

Hywood said: “Results from our Digital Ventures portfolio reflect the sale of Tenderlink in October 2016. Excluding Tenderlink, revenue increased 4% and EBITDA increased 8%, reflecting a challenging digital advertising market.

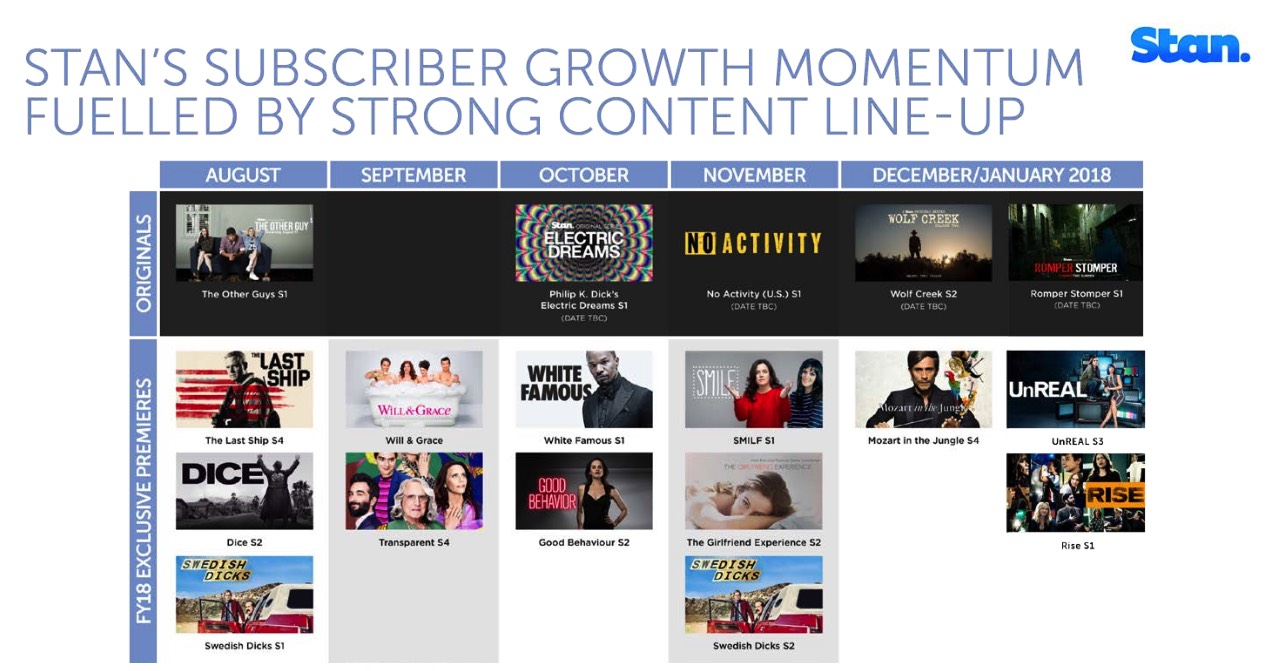

“Stan – Australia’s biggest deal in entertainment – is going from strength to strength. The number of active subscribers is approaching 800,000, with positive net subscriber additions through a period of phased price increases.

“Continued strong subscriber momentum underpinned an impressive 150% uplift in subscription revenue in FY17, far exceeding the increase in operating costs.”

Australian Community Media

Hywood said: “ACM’s total revenue declined 11%. The 12% decline in advertising revenue reflected 2% growth in agriculture-related advertising, offset by weakness in national and classifieds advertising. Excluding the impact of closures and frequency changes, advertising revenue reduced 10%.

“Circulation revenue declined, reflecting lower retail volumes.

“Other revenue growth of 12% benefited from a strong performance from Fairfax Marketing Services which provides commercial solutions for small to medium-sized businesses. Together with improved digital advertising, ACM’s total digital revenue delivered double-digit growth.

“The cost improvement of 9% reflected the achievement of the remaining transformation benefits and continued cost savings initiatives. This underpins ACM’s considerable cash flows which we will continue to optimise.”

New Zealand Media

Hywood said: “In New Zealand, total revenue was down 7% in local currency terms. Digital revenue growth of 29% was offset by lower print advertising due to weakness in retail, motors and leisure categories. Circulation revenue declined 5% for the year with stabilisation in the second half reflecting improvements in yield.

“We are appealing the New Zealand Commerce Commission’s decision to block the proposed merger of Fairfax New Zealand with NZME. This will be heard before NZ’s High Court in October.”

Macquarie Media

Hywood said: “Macquarie Media revenue was down 1%, which was broadly consistent with the market. Cost and operational synergies, together with licence fee relief in H2, delivered 26% uplift in EBITDA and improved EBITDA margin from 18% to 23%.”