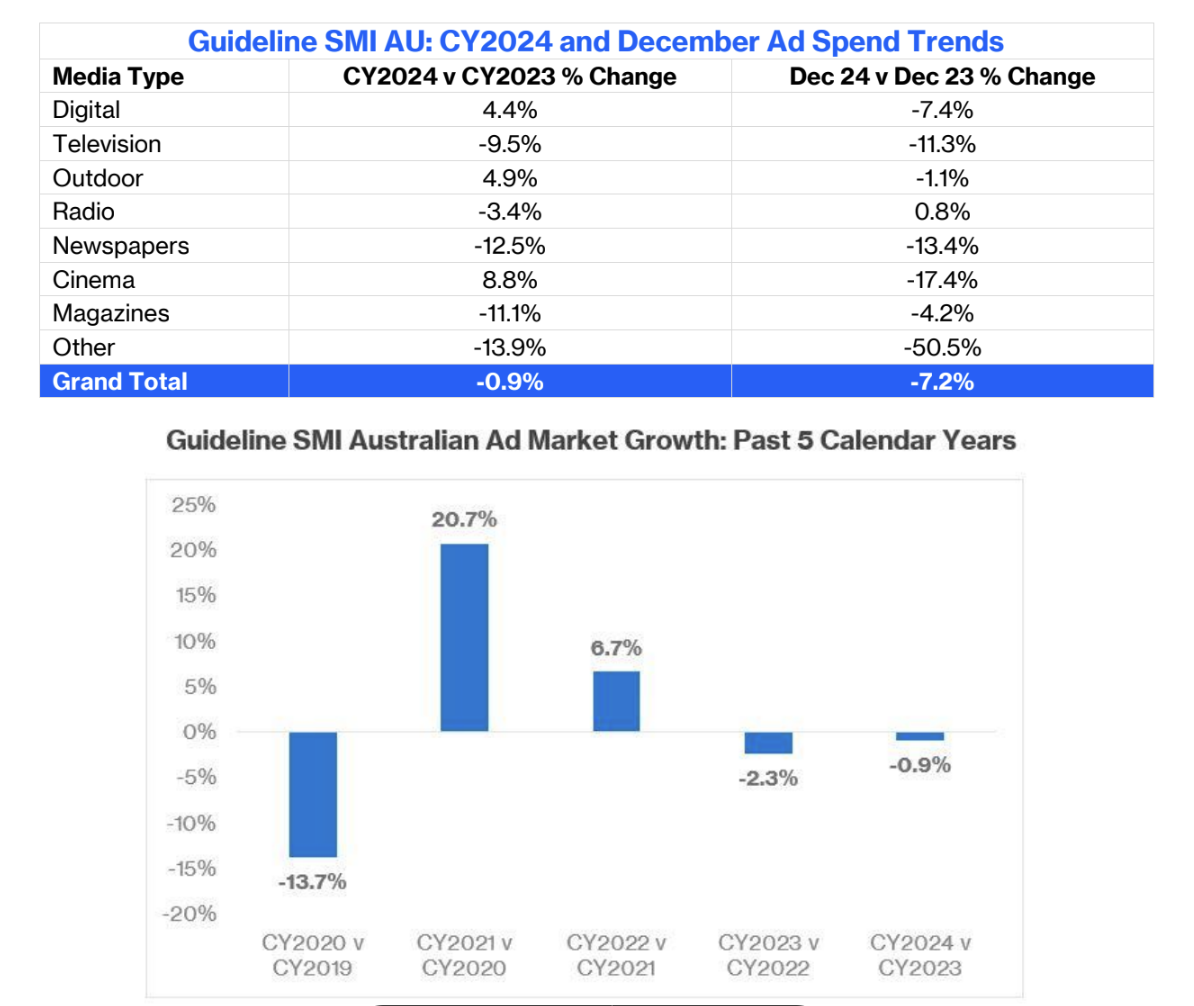

Australia’s advertising market closed a challenging calendar year in 2024 with flat growth, as total agency bookings declined by just 0.9% for the year, according to the latest data from Guideline SMI. Despite this overall stagnation, digital and outdoor media achieved record market shares, while cinema recorded impressive growth.

Guideline SMI APAC managing director Jane Ractliffe said that agency bookings continue to highlight key media trends, with video sites and streaming services emerging as the biggest growth drivers. Ad demand for video/streaming services surged by 17.8% compared to CY2023, while digital radio experienced a similar boom, growing by 17.4%.

“The increasing spend on video/streaming sites has shifted the landscape significantly. For the first time, video-based campaigns have overtaken display ads as the largest ad format, with video growing 12.4% while display ad spend fell by 3.4%,” Ractliffe explained.

Retailers played a significant role in the video ad surge, particularly Chemists, which led the charge alongside Food/Produce/Dairy and Toiletries/Cosmetics brands. Within the Toiletries sector, Skin Care ad spend drove the majority of gains.

December highlights: Government ad spend soars 67.5%

The month of December saw an overall decline of 7.2%, although Ractliffe anticipates late Digital bookings will mitigate this figure. Notably, Government advertising expenditure skyrocketed by 67.5% year-over-year (YOY), reinforcing expectations that Government ad demand will remain strong in the first quarter of 2025, ahead of the anticipated Federal election in May.

Across CY2024, Government ad bookings increased by 18.2%, making it the fifth-largest product category. Retail retained its position as the dominant category, growing slightly by 0.9%, driven by a 16.6% jump in Chemist ad spend, which helped counterbalance a 16% drop in Online Retailer ad investments. Auto brand advertising rose by 4.4%, whereas Insurers cut media spend by 3.3%.

Media Performance: Digital, outdoor, and cinema shine

Digital advertising grew by 4.4% for the year, with social media (+9.4%) trailing only video sites in terms of growth. However, linear TV ad spend fell sharply by 9.5%, although regional TV performed better with a more modest decline of 3.2%. Radio advertising also dipped by 3.4%, with Regional Radio proving more resilient, decreasing by just 0.3% YOY.

Outdoor advertising expanded by 4.9%, reaching a record 15.4% market share. Large brand campaigns were key growth drivers, particularly in the ‘Posters’ segment. Bank Brand/Sponsorship bookings jumped by 18.4%, while Insurance Brand/Sponsorship campaigns saw a remarkable 41.4% increase.

Cinema emerged as the best-performing medium in the December quarter, growing by 6.1%. digital and outdoor, however, reported slight declines of 0.5% and 1.7%, respectively. Over the first half of the financial year, overall ad demand dipped by 1.9%, but digital (+2.8%), outdoor (+2.3%), and cinema (+10.3%) continued to outperform the broader market.

Outlook for 2025: Election spend and digital investment to drive market

With Government advertising already trending upward in preparation for the Federal election, CY2025 is expected to see continued investment in digital, outdoor, and cinema.