In a note accompanying the ad spend outlook, Dentsu International has noted:

The global response to the evolution of the COVID-19 pandemic will play a decisive role in how forecasts ultimately play out.

Below are a few highlights from the report and some detail of the Australian forecast.

Ad Spend Trends in 2022

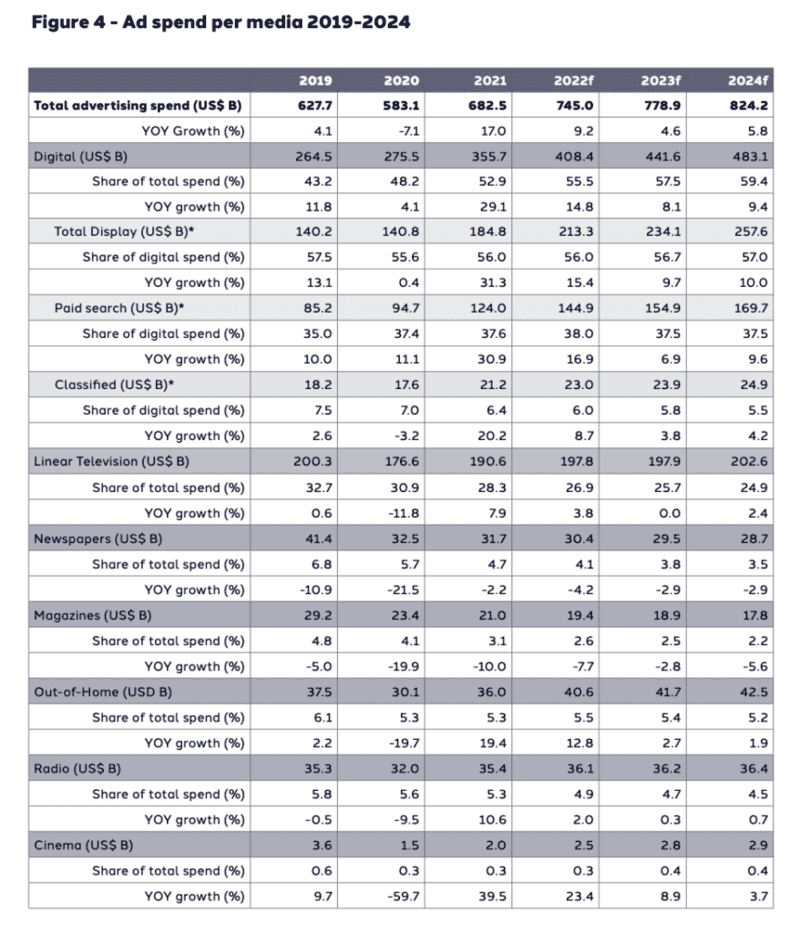

• Forecasts show global growth of 9.2% in 2022, with the advertising market reaching US$745.0 billion, exceeding the 2019 prepandemic spend levels by US$117.2 billion.

• Growth in 2022 is nearly three times the growth of 3.4% in 2011 – second year post recovery from the global financial crisis.

• Digital spend is forecast to account for a 55.5% share of global spend in 2022 and is predicted to increase to 59.4% share in 2024. Social (21.4% YOY growth), Video (18.9% YOY growth), and Search (16.9% YOY growth) are predicted to lead digital growth.

Dentsu International global ad spend % forecasts

2021 +17.0%

2022 +9.2%

2023 +4.6%

2024 +5.8%

Dentsu International Australian forecast

2021 $18.6b (YOY growth +17.6%)

2022 $19.7b (+6.1%)

2023 $20.5b (+3.9%)

2024 $21.2b (+3.6%)

(As part of the global report, the Australian forecast numbers were in US dollars. We have calculated AUS$ using US$1 = AUS$1.42)

Digital and Linear Television continue to be the two powerhouses driving global spend, yet with opposite dynamics.

Following a 29.1% increase in 2021, Dentsu is forecasting Digital investment to grow by 14.8% in 2022, fuelled by Video, Connected TV, Programmatic and E-commerce. This will bring the Digital share of spend to 55.5% (US$408.4 billion) of the total ad spend – meaning that the Digital share of spend will become twice as big as the Linear Television share of spend (26.9%) for the first time.

In 2021, Linear Television spend increased by 7.9% – the highest rate since 2010, when the market re-bounded from the global financial crisis. In 2022, Dentsu forecasts Linear Television ad spend to grow by 3.8% to reach US$197.8 billion. However, unlike Digital and despite staying in high demand, Linear Television share of spend is on a declining trend as Connected TV and VOD grow.

Out-of-Home (OOH) and Cinema will both see double-digit growth in 2022 (respectively 12.8% and 23.4%), with OOH even exceeding 2019 prepandemic spend levels.

Dentsu also forecasts Radio to grow, yet at a slower pace (2.0%). Conversely, ad spend in Newspapers and Magazines will continue to decline. Overall, all these channels will keep losing ground to Digital in terms of ad spend share compared to the 2019 prepandemic state of play.

OOH ad spend was severely impacted in 2020, falling by 19.7% from its 2019 level. However, spend increased by 19.4% in 2021 as restrictions were eased and footfall returned. OOH has recovered stronger than other media and in terms of share became the third largest at 5.3% in 2021, overtaking printed newspaper ad spend share at 4.7%.

Download the Dentsu Global Ad Spend forecast here.

See also: Dentsu insights and predictions in 2022 media trends report