The eighth edition of Deloitte’s annual Media Consumer Survey continues an examination of how Australians are consuming different media and entertainment.

Here some edited highlights:

Streaming platforms and content choice exploding

The proliferation of content across over-the-top (OTT) services has continued over the past year. At the time of writing, there are more than 12 TV and movie services, as well as eight music streaming services, available in Australia.

Gamers have a choice of more than 12 platforms and subscription services across computer, console, and mobile devices. With further launches in Australia confirmed for the coming year, this number will continue to rise, leading to more distributed content if rights remain exclusive, or less unique content libraries if rights are shared across multiple services.

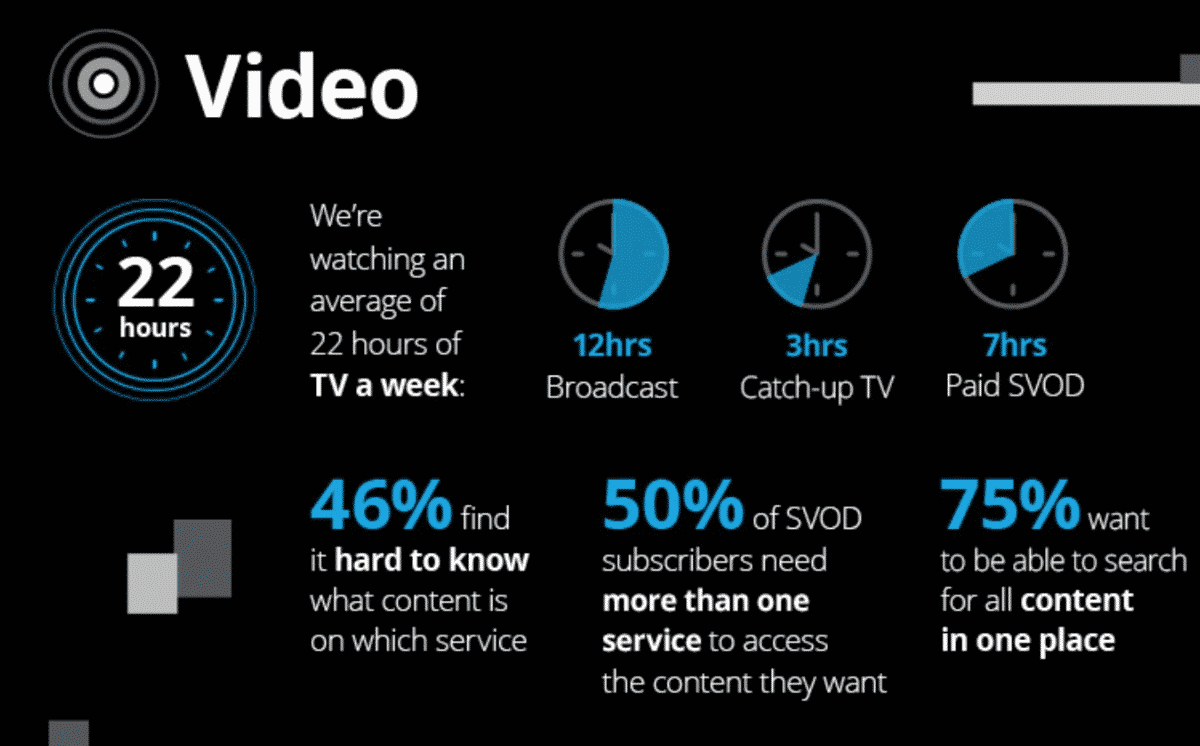

Half (50%) of subscription-video-on-demand (SVOD) subscribers say they now need more than one streaming service to access video content they are looking for – on average subscribing to one and a half paid video streaming services. As the number of available OTT content services grows, consumers will be forced to make hard choices across their preferred content providers, potentially leading to frustration as ‘choice’ transitions into ‘trade-off’.

Our quest for simplicity has set the scene for a potential new digital entertainment battleground – aggregation. We’re feeling the strain of the complex content environment, where 46% find it hard to know what content is on what service, and 75% want to be able to search for all content in one place.

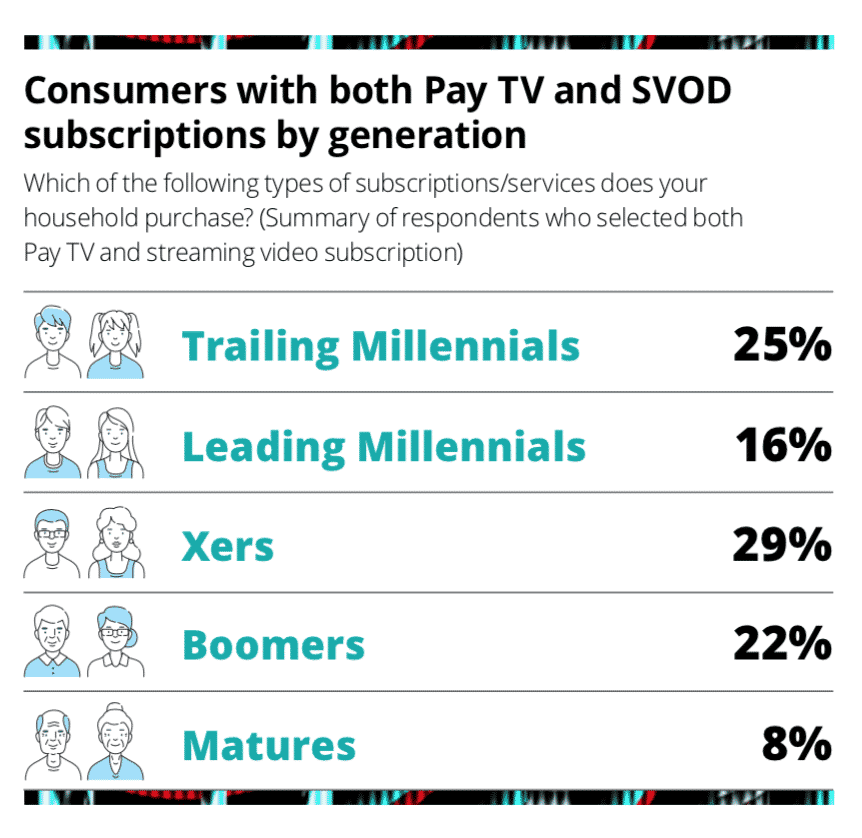

Pay TV providers, telcos, and digital giants such as Amazon and Apple are perfectly positioned to evolve their existing value propositions and capitalise on the opportunity. Sixty-seven percent of respondents with a pay TV subscription also hold a subscription to a video streaming service and 23% of all respondents bundle OTT media devices such as Fetch and Telstra TV with their broadband services.

As the content landscape grows more complex, two divergent groups of consumers will likely emerge. Those with narrow consumption needs who will entrench relationships with their preferred provider, and those with distributed consumption needs who will see value in the role of an aggregator.

Audiences continue to grow more discerning in how their data is used. The push for greater transparency and increased data privacy raises the question of just how much information we are willing to exchange for a personalised experience and what role advertising can play in the content environment. There’s work to do in building consumer comfort levels with data sharing; 78% of respondents believe companies are not taking adequate steps to protect their personal data. The use of data for targeted advertising plays into this concern, although respondents had more general reservations about the presence of advertising in their video subscriptions.

Watching content ad-free is the most commonly valued attribute of SVOD, with 89% of respondents agreeing.

Podcasting and consumer listening habits

Podcasts have steadily grown in popularity and this year we explore media consumer listening habits for the first time.

Forty-four percent of all respondents identified themselves as podcast listeners, with Trailing and Leading Millennials the highest users (59% and 57% respectively). Alongside popularity in younger consumers, 67% of high income earners listen to podcasts. Those who engage tend to do so actively, where 47% of podcast listeners consume at least one episode each week, with 20% listening to three or more podcasts each week. It’s a format that relies heavily on word of mouth for discovery, with over half of listeners identifying friends and family, and social media in their top three ways to find new podcasts.

When it comes to genres, 36% of podcasters listen to news and current affair podcasts, making it the most popular, followed by comedy (28%). A quarter of listeners are tuning in to true crime – a genre synonymous with podcasting thanks to the success of podcasts such as Serial and The Teacher’s Pet. Across all age groups the strongest driver for listening to a particular podcast is to learn something new (39% of all listeners), particularly among Trailing Millennials (44%) and Xers (43%).

Spotlight on… news and magazines

This year sees a drop in the number of respondents owning newspaper and magazine subscriptions, now at 15% and 8% respectively compared to 17% and 11% last year. This appears to be driven by a continued reduction in Millennial readership from last year for both Trailing Millennials (7% this year down from 13%) and Leading Millennials (6% this year down from 18%).

Hard copies of both news and magazines remain resilient among subscribing readers – those willing to pay for a newspaper subscription still prefer the physical print version (59%) over the digital version (24%). This varies across age groups with Millennials open to both online and print (37% and 41% respectively) and Boomers preferring hard copy over digital (68% and 19% respectively).

Our reluctance to pay for news has stayed in line with last year’s data, with 64% of respondents again stating nothing would entice them to pay for news. This sentiment has held steady or increased slightly across most age groups. However, Trailing Millennials are more willing to pay for news than they were last year when 60% claimed nothing would entice them, compared to 47% this year.

In depth news analysis, brand trust, and unique content that can’t be accessed for free are the main drivers for willingness to pay.

Most subscribers have held their subscription for more than three years – 57% for newspaper and 55% for magazines. This has been consistent since 2015 (59% and 54% respectively) indicating publishers continue to rely on a consistently loyal base of subscribers.

This year, the proportion of respondents using social media as their primary news source has dropped to 15% from last year’s 17%. However, Leading Millennials are increasingly turning to social media for their news – 27% this year, up from 22% last year and 18% in 2017.

When over-the-top becomes OTT

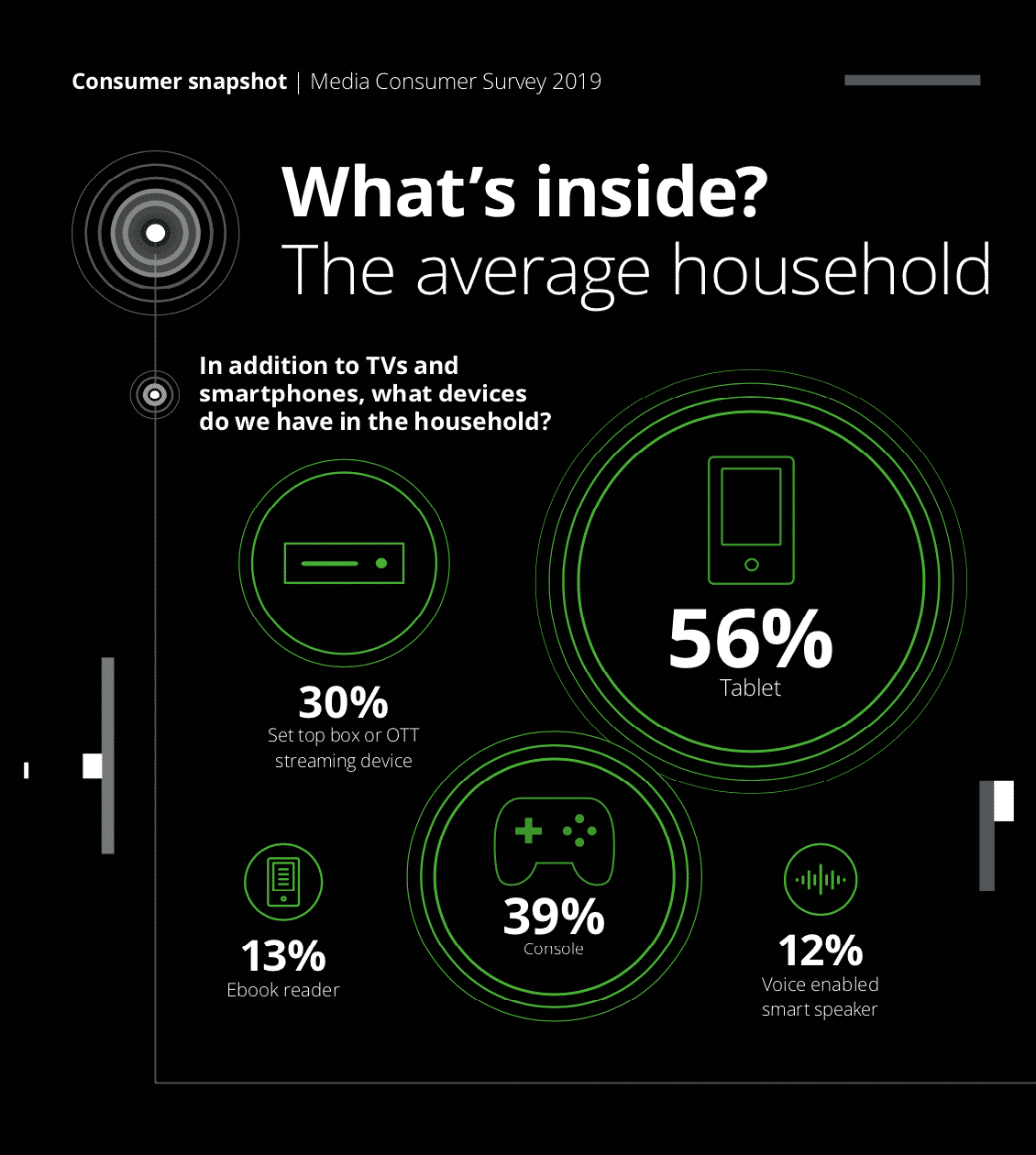

Australians are spoiled for choice when it comes to OTT digital media and entertainment. Consumers can create their own tailored entertainment ecosystem through a collection of free-to-air catch-up TV, streaming video and music services, OTT set-top-boxes, and a number of new platforms integrating this complex assembly of subscriptions.

At the time of writing, there are more than 12 TV and movie and eight music streaming services available in Australia. There are also several new service launches in Australia announced for the upcoming year. This will continue to increase, leading to more distributed content if rights remain exclusive, or less unique content libraries if rights are shared across multiple providers. Sports content has always been distributed across different free-to-air and pay TV channels in Australia, and now we have the addition of OTT apps such as AFL Live and NRL Live Pass, as well as dedicated sports streaming apps such as Kayo. Gamers have the choice of more than 12 platforms and subscriptions services across console, computer, and mobile devices.

With this proliferation, consumers are enjoying a golden age of content availability. But are we approaching a tipping point? Will the vast choice become too much, and the ability to consolidate, streamline, and converge content become the new digital entertainment battleground?

All in one place to all over the place

For consumers, the landscape is fragmented, with content spread across an expanding variety of services. Households increasingly hold multiple subscriptions to access the content they want.

Half (50%) of SVOD subscriber respondents say they need more than one streaming service to access the video content they’re looking for, and on average they now subscribe to one and a half SVOD services. The original appeal of services such as Netflix or Spotify was boundless choice, all in one place. But the number of services has steadily increased, and as rights shift and new services launch, content is becoming even more dispersed.

This creates challenges for consumers in both experience and expense. Consumers are regularly moving between services, sometimes as holders of multiple subscriptions and sometimes as they switch one for another. For respondents who have cancelled or switched streaming services in the past, 19% have done so due to wanting content from another service. Multiple subscriptions means multiple apps, multiple devices, multiple bills. And the expense for consumers is mounting. For a household wanting Disney content for the kids, the latest seasons of Game of Thrones and Stranger Things, English Premier League soccer matches, and access to ad-free music and podcasts, this could mean paying upwards of $70 a month across multiple services. It’s a price tag not far from the pay TV prices of simpler days, where consumers could pay one provider to access packages of entertainment content. It’s also a model that could well see a resurgence as consumers once again seek convenience in both experience and pricing.