SMI has reported strong growth in newspaper ad spend is the common early COVID-19 ad spend trend across the Australian and New Zealand media markets, although total media market trends vary markedly in March.

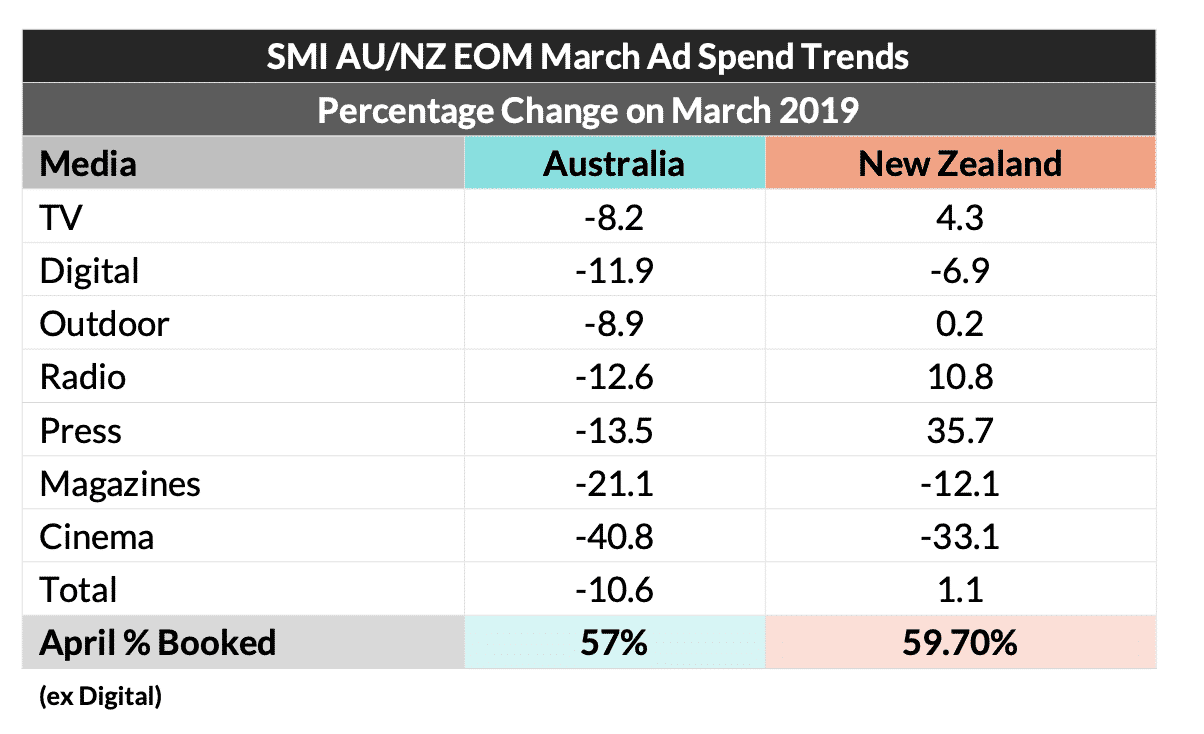

Australian media agency bookings are back 10.6% in March as a lower level than usual of late digital bookings failed to push the market into a single digit decline, as had been expected. However, if the figures were normalised for last year’s pre-election spike in political party/union bookings the market total is back 9.3%. But in New Zealand media agency bookings grew 1.1%, giving that market its third consecutive month of growth.

And as the first social restrictions began to take effect in late March here was some evidence of the market reaction in the SMI figures, with the most obvious being the growth in newspaper bookings.

Growth in Australian national newspaper bookings was the strongest in any media this month with the total soaring 30.2%, while in NZ total media agency bookings to newspapers lifted 35.7% to give that media its highest March ad spend since 2017.

SMI AU/NZ managing director Jane Ractliffe said as the COVID pandemic hit the NZ media was in a stronger financial position than Australia’s as NZ’s media has recorded a 4% increase in financial year ad spend while in Australia the market is back 6.6% over that period.

“This context is important as going forward we can see future confirmed bookings in NZ are already slightly above that evident in Australia, and that stands to reason as confidence in the NZ media market has been at a far higher level for the past nine months,” she said.

For the month of April, SMI’s forward pacings data shows that with a week of trading still to go the value of ad spend in the Australian market in April was 57% of that achieved in April 2019 (excluding digital) while in New Zealand the value of confirmed media was 59.7% of that reported in April last year.

“Those figures suggest that in both the Australian and New Zealand media markets we should see declines in media agency bookings of about 30% in April, although the final results won’t be known until we collect more data in just over a week’s time,” Ractliffe said.

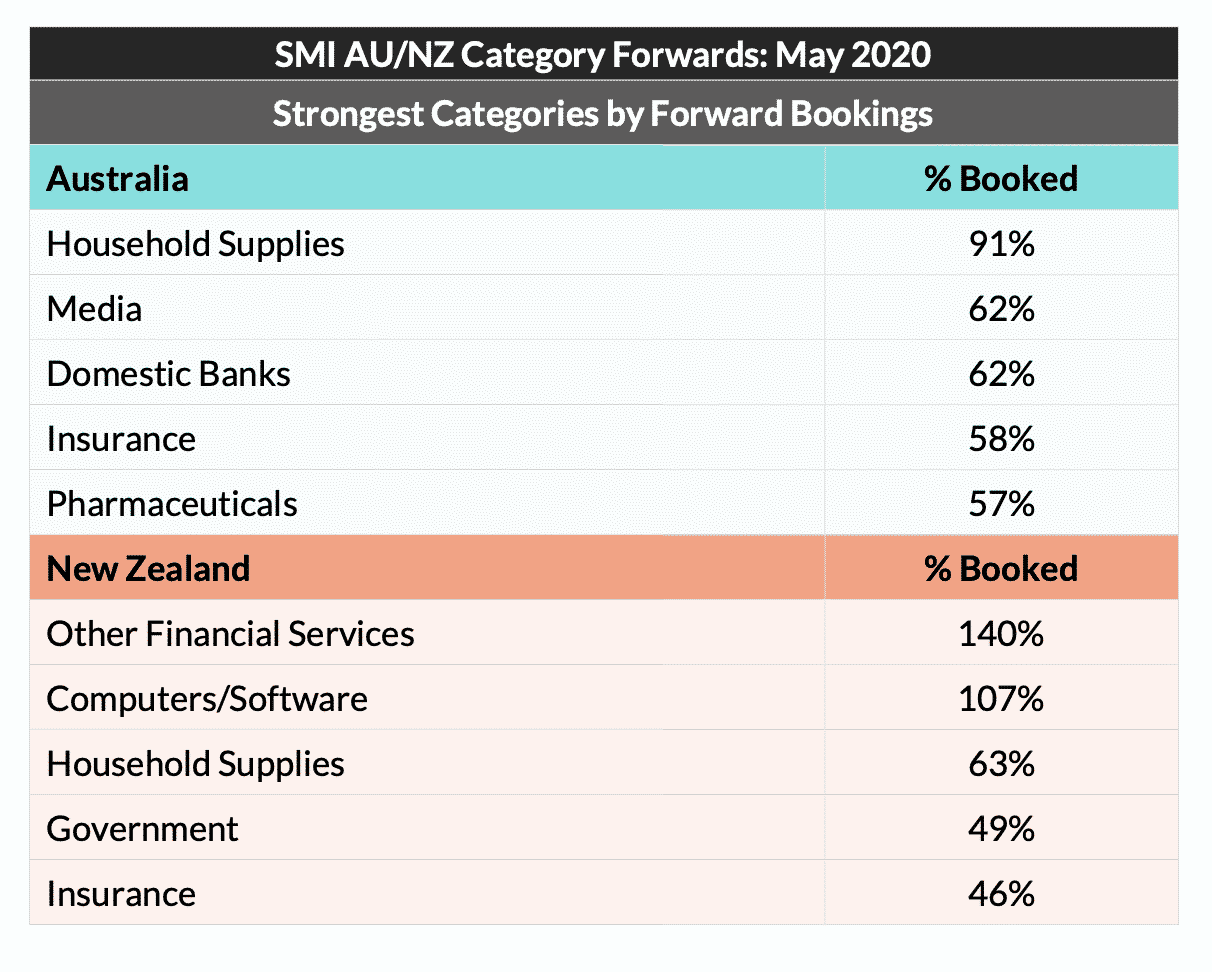

She added SMI already has some good visibility into the media markets for May, with 31% of the value of NZ’s May 2019 ad spend already confirmed and 28% of Australia’s May 2019 bookings guaranteed even before the trading month has begun.

“We can see many product categories are already showing bullish levels of media investment in May, suggesting the market looks set to improve on the April results,” Ractliffe said.

“In Australia, advertisers in the household supplies category have already guaranteed 91% of last year’s total investment for May and in NZ ad spend from the other financial services category is already 40% above that recorded in May 2019,” she said.

This month, SMI has unveiled three new premium retail product sub categories: Supermarkets/Convenience Stores, Alcohol Retailers and Shopping Malls/Operators, bringing the total retail-specific categories on which SMI reports to nine.

Ractliffe said SMI was now working on new breakdowns for domestic bank ad spend, with six new premium sub categories to be released in May. They are Brand/Sponsorship, Consumer Banking, Business Banking, Institutional Banking, Home Loans and Savings/Deposits.

Meantime, SMI has now provided three extra COVID ad spend updates to the market outside its usual fortnightly data releases and will continue that extra service over the coming months.

“It’s never been more important to have the facts about how advertising demand is tracking and we want to ensure all our media and advertiser stakeholders continue to have an accurate view of the market on which to make important decisions in this unprecedented time,” Ractliffe said.