COMvergence has issued its annual global billings rankings and market shares (BMS) report based on Final 2022 media agency and group billings – including digital media spends.

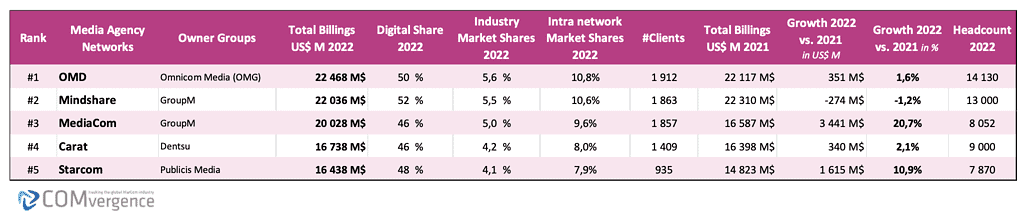

With a total 2022 billings figure estimated at $22.5B, and a growth rate of +1.6%, OMD stays as the top ranked media agency network worldwide. Closely behind, GroupM’s Mindshare placed 2nd with $22B (-1.2%), whilst MediaCom ranks 3rd with a total billings figure of $20B (+20.7%).

The merger of Essence and MediaCom, effective January 2023 under the name EssenceMediacom, will be reflected in the 2023 edition of COMvergence’s BMS report. Based on the 2022 billings figures, Olivier Gauthier, COMvergence Founder and CEO expects “EssenceMediacom to become the leading media agency network in 2023”

Top 5 Media Agency Networks Final 2022 Global

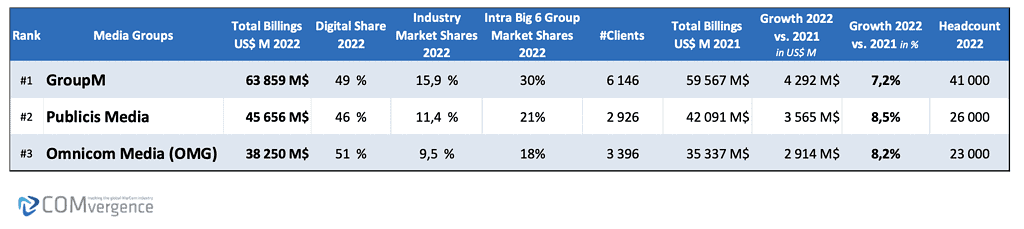

At the group level, GroupM remains a strong global leader with 15.9% industry market share and $63.9B in global billings (up by +7.2% vs. 2021). Publicis Media follows with $45.7B (up +8.5%). Omnicom Media Group rounds out the top 3 with $38.3B (up +8.2%).

Top 3 Media Agency Groups Final 2022 Global

In March 2022, the Big Six media agency networks/groups withdrew from Russia and ceded ownership of their agencies to local management teams. To provide the most objective gauge of the momentum the agency groups had last year (i.e., growth from new business activities and organic increases from existing client spends), COMvergence restated the global 2021 figures by excluding billings from Russia.

Key Takeaways

The 2022 total agency billings represent about 60% of the global (net) media spends which COMvergence estimates to be $401B [up +6.4%] across 46 markets, versus $377B in 2021. The remaining 40% is handled by smaller independent media and digital agencies, Chinese, Japanese, and South Korean local advertising agencies, and in-house advertiser teams (particularly in the digital/programmatic area).

The global billings managed by media agency networks owned by the Big Six holding companies plus major independent media agencies reached $253B in 2022. Combined they represent 96% of the global media investments studied by COMvergence and experienced an overall growth of +8% vs. 2021.

COMvergence estimates that digital reached 48% share of global spend in 2022 at $121B (per the digital spends handled by the Big Six and major independents). This is up from 43% in 2021 and 39% in 2020. Among the media agency networks, this ratio varies from 39% for Initiative to 63% for Essence. Differences are less significant at the group level, where the digital share ranges from 44% for Havas Media Network to 51% for OMG. Among the Big Six groups, digital media expenditures grew +16% year-on-year to reach $102.3B. Meanwhile, offline media spending fell -1% to $110.9B.

The present BMS study spans 107 independent local media agencies which represents a total 2022 billings figure of $25.5B (or about 11% of the total billings measured by COMvergence globally). Horizon Media (US) is by far the largest independent worldwide with a total 2022 billings figure of $7.7B. Horizon represents nearly one-third of the independent total billings. Local Planet is comprised of independent media agencies including Horizon Media (USA), Plus Company (Canada), Pilot (Germany), Media Italia (Italy), Zertem Group (Spain), among others. Local Planet shows a total billing 2022 of $11.6B, while Mediaplus, with 16 locally owned agencies studied globally, generated a total billing of $2.3B.

See Also: COMvergence Media Agency Billings & Market Shares 2022: OMD and Group M come out on top