The IMAA, the national, not for profit industry association for independent media agencies launched last year.

Since then it has continued to grow its membership base and make a series of big announcements, including its trade credit deal and a number of new media partners.

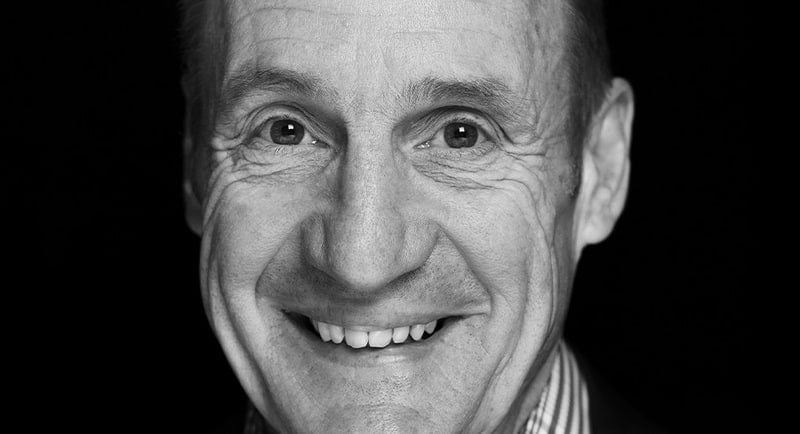

Mediaweek has been profiling members of the IMAA – previous features can be found here. This week we spoke to Stephen Forth, the CEO of Claxon.

“The agency was started four years ago, by two entrepreneurial business people. One was a CEO of a finance company, and the other set up a number of fitness gyms,” Forth told Mediaweek. “They built the agency as a business which is quite an unusual thing. Normally, you build an agency, and you fumble your way through but these two actually put all the structure, the systems, the cadence, the dashboard, and the reporting. So it’s a very well structured business.”

Forth joined Claxon with over 30 years of experience that included leading the digital and business transformation with international brands including, Clemenger BBDO, Sapient Nitro, Sapient Razorfish, Publicis Sapient and most recently, AKQA in NZ and across APAC. He has also worked with leading holding companies such as Omnicom and WPP, as well as key media platforms such as Nine Entertainment and News Corp.

“They decided about four years in to take the business to the next level, but they didn’t have the experience. So, they wanted to get someone in who has got that more rounded agency experience, which is me. They approached me, and here I am. The next three to four years are about accelerated growth, and part of that, of course, is acquisitions and global expansion.”

After opening its doors in Robina, QLD in 2017 with one client and one employee, Claxon has shown aggressive growth which has been reflected in a series of major hires that the agency has made this year in addition to Forth:

• Upesh Thapa, Head of Data and Insight

• Ray O’Sullivan, Chief Revenue Officer

• Teagan Peake, Operations Manager

• Michael Jeffriess, Chief Financial Officer

• Phillippa Netolicky, Chief Growth Officer

• Daniel Willis, chairman to lead Project Globe M&A

“We’ve attracted some significant people and experienced people. So, our stage for growth has now started.” said Forth.

When asked about what type of growth the agency is pursuing, Forth said that they are looking to continue to add more high value clients to their roster.

“The type of clientele here for three to four years is very much in the startup area, and probably more SMEs (small-medium enterprises). We’ve now successfully won a couple of high-value clients, more tier two, tier-one type class. We’ve picked up a couple of bigger clients that we wanted, and we’ll continue to target those high-value clients.”

Forth said that Claxon plans to continue to expand their product in 2022 in many different areas as part of their roadmap for the future, including in crypto and branding.

“That roadmap really covers the advisory area. We are looking to grow a crypto blockchain advisory. With a lot of commerce clients, we are going to have enterprise advice in those areas. We will always continue to expand our brand footprint and our brand offering as well.”

Claxon is also in the process of a cap raise as it looks to continue to add to its aggressive growth and expansion by making more acquisitions.

“We’re doing a cap raise at the moment, which is going to fuel our growth. We’ve got Deloitte as our advisor, so you don’t do those things without some degree of seriousness and professionalism. The type of company we are after is creative, experience design, data analytics, digital that’s the type of businesses we’ll be targeting to buy.”

IMAA

Claxon is part of the IMAA, which Forth said had been of value to the fast-growing agency both educationally and financially.

“Any association is only as good as the members and the activity that it brings forward. What I’m finding thus far is that Sam (Buchanan, IMAA GM) seems to be running a pretty good operation, always surfacing up some good learnings, and opportunities. For me, bulk deals are of huge value. When you’re independent, you don’t quite have the depth of money for some of the holding companies do. So he’s setting up some pretty good opportunities.”