It is close to four years since Are Media pounced on the magazine brands previously owned by Bauer Media Australia and Seven’s Pacific Magazines.

Under the guidance of chief executive Jane Huxley the company has cultivated and grown its list of titles. Since then, it has ignited the interest in magazine brands, rebuilding digital and print products.

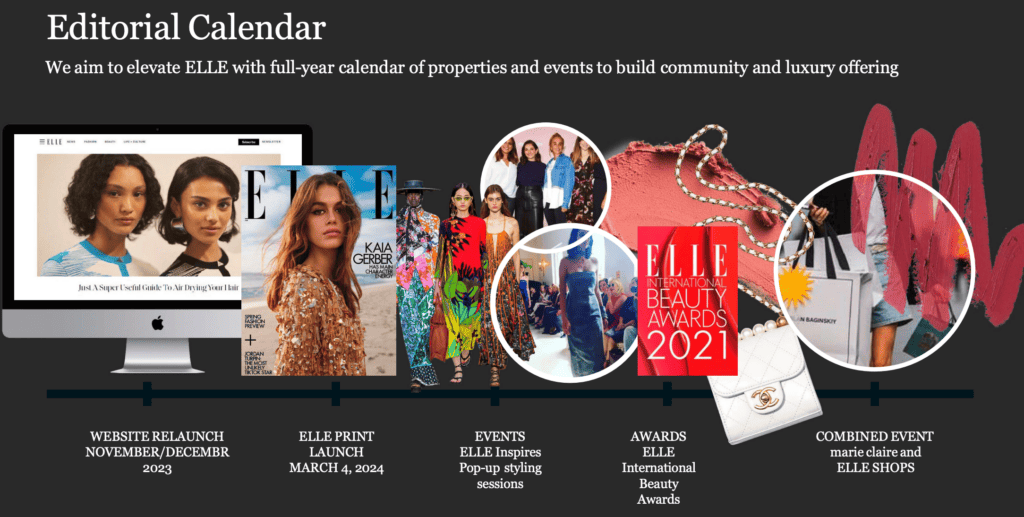

The latest example of how it is turning around a once-great magazine sector, Are Media next month brings back a print edition of Elle.

To learn more about the sector and Are Media’s strategy, Mediaweek spoke with Are Media director of content Sally Eagle.

Print resurgence

A good place to start is the audience returning to print. When quizzed about the audience for magazines, Eagle said it wasn’t just market hype.

“We had a 7% increase year-on-year for print,” said Eagle. “People are really enjoying picking up a product and reading it. We call it ‘me time’. Our audience is getting younger in print too. They are putting the phone down and looking at a print-oriented product.

“Print has been the heart of our business for some time. Like any business, we need to diversify our revenue. Print remains the core. Print content will always run on digital. But when we create content it doesn’t mean it will always appear in print first.”

That growth in circulation comes after Roy Morgan recently reported strong growth across its print magazines for the fifth consecutive quarter.

Eagle should be able to spot a trend in publishing. She started at the company in 2010 when it was trading as ACP Magazines. She then survived the Bauer Media Group ownership and is now key to the revival of the sector under private equity owner Mercury Capital.

Before the director of content role, Eagle was customer director looking after subscriptions, marketing, and the retail channel which included working with newsagents and supermarkets.

Prior to getting into magazines, Eagle worked as an accountant for PWC and also held down accounting roles at fashion houses Zimmerman and Giorgio Armani.

Are Media director of content, Sally Eagle

Are Media structure

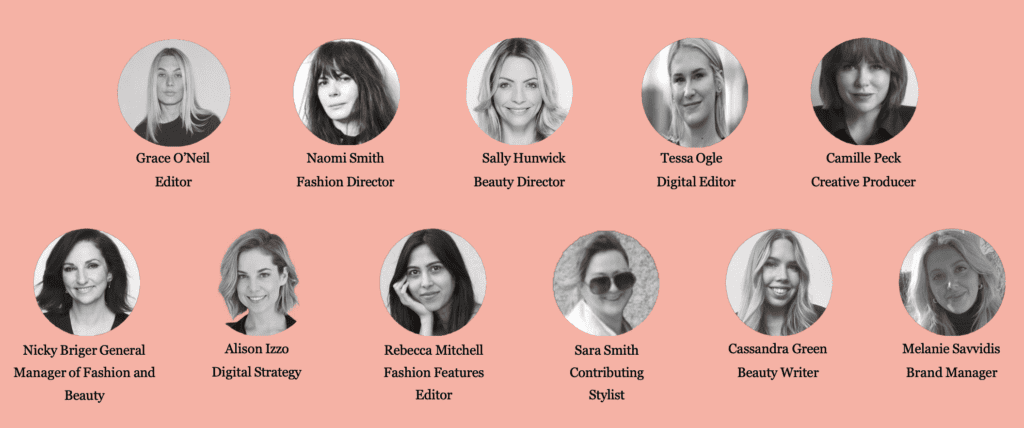

The brands at Are Media fall into one of four verticals: Entertainment, Lifestyle, Homes, Fashion & Beauty. Each of those verticals has a general manager who reports to Eagle. They are respectively Susan Armstrong (Entertainment), Nicole Byers (Lifestyle), Lisa Hudson (Homes) and Nicky Briger (Fashion & Beauty).

The combined content firepower numbers about 350 people.

Most of the brands have a print and digital element. The exceptions are Bounty, a parenting bag of goodies and Beauty Heaven, a beauty review database.

Who’s on first – print or digital?

Eagle: “As we move into being an omnichannel content company we have people from print and digital co-creating. When that is done we figure out which platform it best sits on. Maybe it will be social first, digital first, or should it appear in print first?

Digital versions of print products

Most of the Are Media titles are also available on magazine aggregation business Readly. What Are Media might miss on cover price there is compensated for in terms of reach for the brand and the advertisers in those digital editions.

Eagle also noted that direct digital subscriptions are growing for Are Media titles. “Those subscriptions are sold via our e-commerce platform Magshop. Not everybody wants a print edition of everything. Some titles are bought digitally, while some the readers prefer a paper version.”

She noted that ads in digital editions are fixed too. They are not automated but are a permanent part of the product.

New editors arrive and refresh their products

In the past few months there have been several key editorial appointments at Are Media.

marie claire: Georgie Abay

Elle: Grace O’Neill

The Australian Women’s Weekly: Sophie Tedmanson

Getting a job editing a title at Are Media sees the candidates going through several stages. One of those is presenting to the board about how you might want to do things differently.

“There is often nothing better than a set of fresh eyes on the content,” said Eagle. “We love it when we get new editors because it means they can stamp their authority on the title. It doesn’t have to be a shock makeover. Gentle changes are also very well received here.”

marie claire editor, Georgie Abay

The weeklies war

Once upon a time, the big celebrity weeklies were in separate publishing houses – Woman’s Day at ACP/Bauer, New Idea at Pacific and Who, originally part of Time Australia. Now they are all in the one company, how fierce can competition be?

“The titles all sit in our entertainment vertical, led by general manager Susan Armstrong,” said Eagle.

“There is a little bit of an overlap which we refer to as dual purchase at checkout. They now talk to slightly different types of people. The demographics and audience for the brands are well-defined. The editors are very clear about who their audience is.

“The weekly category performed very well for us throughout Covid and again did very well in 2023 too.”

Readership: Quantity or quality?

“This is such a big discussion all the time,” admitted Eagle discussing digital editions. “Page views vs engagement. For us, it is a balance of both. We know we have to have page views. The reason our audience comes to us is because we have quality engaged content.

“We look at other metrics like time on site, bounce rate, and making sure visitors are scrolling all the way to the end of articles.

“People know, for example, if they go to House & Garden, they will get a quality written article. Quality in our products has been one of our assets for decades. As well as print, we KPI our digital teams on having engaged audiences. We are not a 100% page view company and we never have been.”

Are Media entertainment weeklies

Sticker shock for magazine buyers

Some lapsed readers might be surprised how the cost of some print products has edged higher. Others where that hasn’t happened seem good value. How price-sensitive is the market for magazines?

Eagle: “Price plays an important part in the offering to consumers. In tougher economic times, magazines are an affordable luxury. Paying around $5 for a product that will give you three hours of me time is value for money.

“People really see the value in connection with the community in magazines. To have a rise in print sales indicates they remain good value as we are in a cost-of-living crunch.”

Diversifying revenues

The business model for different titles can be quite varied. “We launch branded marketplaces for brands where it makes sense. We might put more shoppable content in other brands. The reason for different models is that consumers deal with each of our brands differently.”

Don’t be surprised to see more brands either. “For us, it is all about growth and revenue diversification,” said Eagle. “We are very comfortable and confident about our brand portfolio at the moment. Diversifying the revenue is a strong focus as is protecting the core which is print magazines. We are looking to build out events amongst the entertainment vertical as research tells us readers want events.

“Events amongst the fashion and beauty brands are obviously also very important. Where we can’t get readers to events, video is becoming increasingly important – across all four verticals.”

Audience

“We reach nine in 10 Australian women every year. We also have the highest social reach of any publisher per capita in the world.”

Elle Australia team

Elle of a launch

Eagle reminded Mediaweek that March 4 is the day to head to the nearest magazine retailer to get the new Elle magazine. “We have just closed advertising and it’s smashed it out of the park.

“Part of the launch activity will be a range of six digital covers released simultaneously to promote the print product. The Elle website by itself continues to go from strength to strength. It has a very engaged audience and a strong email database. There are very happy digital advertisers attached to the brand.”