Bob Peters from Global Media Analysis has been running the numbers on potential merger activity following the impending relaxation of media ownership laws. Below are some of insights about possible partnerships and the value of the commercial FM networks.

The most likely scenario is that Nine could merge with SCA, thereby creating a metro and regional TV and radio network across Australia.

There has also been speculation that Seven West Media and ARN would somehow eventually get together.

Assuming that CBS proceeds to take control of Ten, then it is questionable that it would wish to jump into radio here any time soon for at least three reasons, those being:

First, CBS would probably wish to focus all of its energies and those of Ten’s management on returning Ten to solid profitability;

Second, in the USA it has only just spun off its large CBS Radio division; and

Third, it is most unlikely that Lachlan Murdoch would wish to sell Nova to them.

Executive summary

When the existing two-out-of-three cross-media ownership rule is finally revoked, then each of the three highly profitable commercial metropolitan FM radio groups (SCA, ARN and Nova) will be amongst the most highly sought-after assets in any ensuing media match-making frenzy.

Unlike the larger newspaper and television groups which have been struggling financially in recent times, the metro FM radio broadcasters have continued to enjoy reasonable growth in advertising revenues, profits and margins over the past half decade.

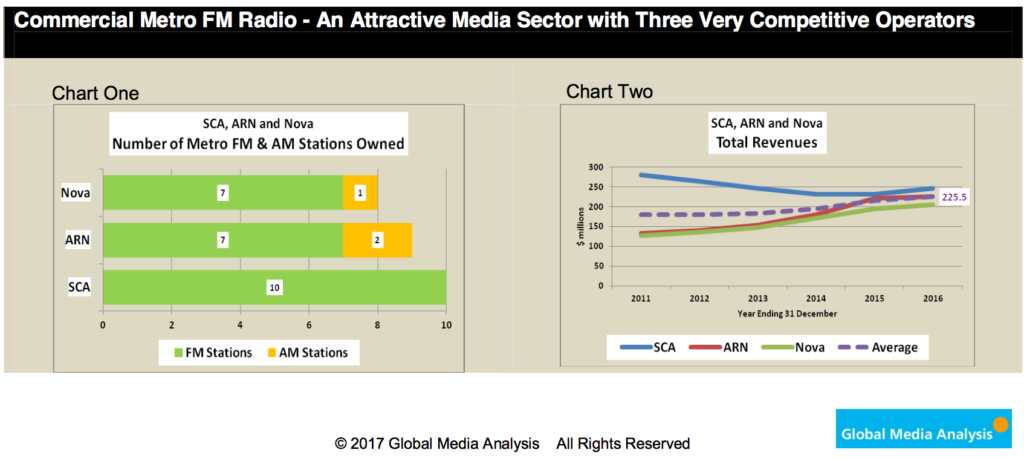

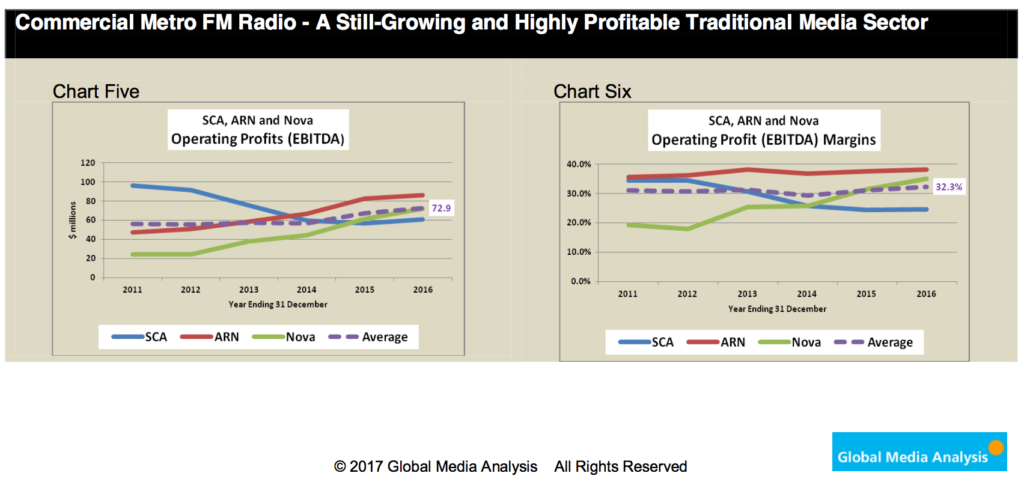

Between calendar year (CY) 2011 and CY 2016, the three metro FM radio groups in aggregate managed to generate 4.6% compound annual growth in total revenues and even higher 5.4% per annum increases in operating profits, which led to record profit margins being achieved last year.

In CY 2016, the average FM group realised $226 million in total revenues from which were generated $73 million in operating profits (EBITDA), which represented a 32.3% EBITDA margin and was a staggering result for a traditional media sector.

Given both their impressive recent financial performance and their still attractive future prospects, Global Media Analysis (GMA) believes that a valuation multiple of up to 10.0 times maintainable EBITDA would not be inappropriate for the metro FM radio sector as a whole.

Applying such a multiple to the sector’s aggregate EBITDA in CY 2016 gives the sector a valuation of up to $2.2 billion, or up to $730 million per group on average.

Exactly how that gross sector valuation amount might eventually get divided up between the three metro FM groups will ultimately depend upon how prospective purchasers or merger partners assess the comparative strengths, weaknesses and future prospects for SCA, ARN and Nova.

Some of those factors are considered in the remainder of this report.

Southern Cross Austereo (SCA)

Having lost significant shares of audience (from CY 2011), total revenues (from CY 2012) and profits (from CY 2011) to its two metro FM rivals, SCA’s metro radio operations, which recorded the lowest EBITDA of the three groups in CY 2016 (of $61 million), would probably be the lowest valued of the three metro FM radio broadcasters.

However, such an historically based analysis is probably a bit too simplistic because it fails to take full account of some of the unique characteristics and future financial potential of SCA’s two metro FM networks. When assessing SCA’s metro radio operations, important factors to consider include the following:

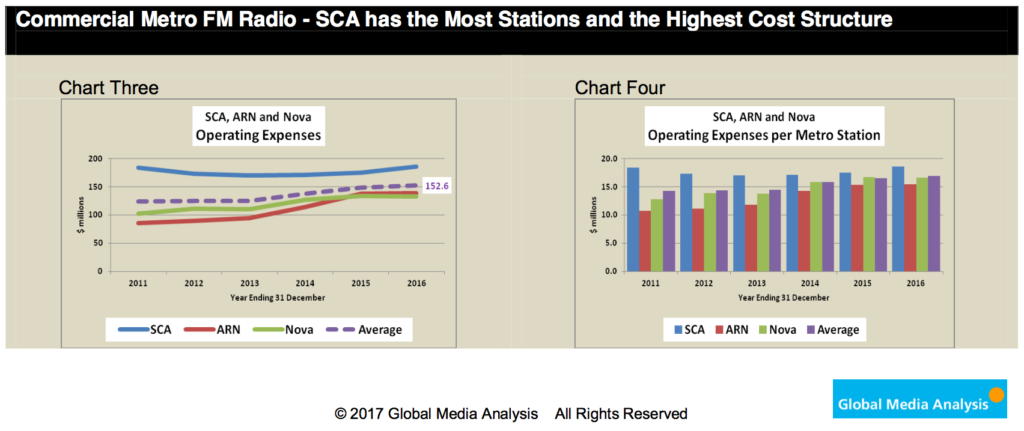

• With 10 FM stations, it has the largest number of metro stations, which assisted it in again attracting the largest number of average 10+ listeners to metro commercial radio in CY2016, after having lost that position to ARN in the two preceding years.

• SCA is the only group to have two separate all FM networks (Hit and Triple M) with each having stations in each of the five metro markets.

• After a protracted period of decline, the group has been in recovery mode over the past 18 months with increasing listener numbers, revenues and earnings. For example, in the most recent 12-month period ending 30 June 2017, SCA’s metro radio networks increased total revenues by 2.0% and EBITDA by 17.4%.

• Given its larger number of stations, SCA’s metro radio operations have been able to continue to generate greater total revenues than either of its two FM rivals, although that has also meant that it also has maintained a higher cost structure, both in total, and on a per station basis.

• Further significant financial improvements could be realised if the group can improve upon the still- well-below-par ratings performance at its once-flagship station Hit 104.1/2Day FM in Sydney, which between CY 2011 and CY 2015 lost almost two-thirds of its average listener numbers.

SCA’s metro operations have the greatest potential for future ratings and earnings improvements and therefore might be willing to attribute a higher valuation multiple to SCA’s recently reported metro radio earnings.

Assuming a highly contested bidding environment, GMA considers that SCA may attract offers of up to between $650 and $700 million for its metro radio operations on a stand-alone basis.

Australian Radio Network

The Australian Radio Network (ARN) will most probably attract the highest valuation in the forthcoming media industry consolidation process by virtue of it being the most profitable FM metro radio group for the last three calendar years, reaching a peak EBITDA of $86 million in CY 2016, and by consistently generating the sector’s highest profit margins, with a record 38.3% being achieved last year.

ARN reached that market-leading position by generating strong sector-best increases in total revenues (11.7% pa) and solid growth in operating profits (12.7% pa) between CY 2011 and CY 2016.

In CY 2014 and CY 2015, it also attracted the largest number of average commercial metro 10+ radio listeners, before being displaced by SCA last year.

There is also the potential for sizable future ratings and earnings improvement at stations KIIS 101.1 in Melbourne and 96fm in Perth.

However, the attractiveness to prospective purchasers or merger partners of linking themselves with the market leader might be tempered somewhat by the following considerations:

• Unlike SCA and Nova, ARN does not currently have a metro radio network with commonly branded stations in all, or even most, metro markets, although that remains a future possibility.

• Group average 10+ listener numbers declined in both CY 2016 and FY 2016 and increased only marginally in FY 2017.

• In the most recent 12-month period ending 30 June 2017, total revenues and EBITDA declined modestly by 4.5% and 7.6% respectively.

In view of the above-mentioned considerations, prospective purchasers or merger partners might apply a somewhat lower valuation multiple to ARN’s recent operating profits on the basis that they may have either peaked or stalled.

GMA considers that an acquisition valuation of up to between $750 and $800 million may be attributed to ARN in any forthcoming industry consolidation process.

Nova Entertainment

Nova Entertainment (Nova) has been both “the quiet achiever” of metro FM radio over the past five years and also an extremely astute investment on the part of its current owner, Lachlan Murdoch, who acquired full ownership of the group from the DMGT media group of the United Kingdom through his Illyria group of private investment companies in a two staged process.

Nova has been the second-most profitable metro FM group over the past two calendar years and arguably the fastest growing operator over the past half decade.

Between CY 2011 and CY 2016, it nearly matched ARN in terms of revenue growth (with a 10.1% pa increase) and over that same period it almost doubled ARN’s increase in EBITDA (at 24.1% pa), resulting in an adjusted EBITDA of $72 million in the latest year, based on GMA’s assessment of Nova’s corporate filings.

For the past three calendar years, the Nova branded network has attracted the largest average 10+ audience of any commercial metro FM network. In addition, its smoothfm branded station in Sydney was that market’s highest rating FM station in both CY 2016 and FY 2017.

However, Nova’s strong performance over the past half decade might lead some prospective purchasers or merger partners to question whether the group is now operating at, or near, its full potential and is without any obvious untapped avenues for substantial future ratings and earnings improvements.

For example, while Nova has developed the highly successful smoothfm brand in Sydney and Melbourne, it lacks stations (ideally broadcasting on the FM band) in Brisbane, Adelaide and Perth to extend that popular format into a second national metropolitan FM brand.

In the current environment, GMA considers that a valuation of between $680 and $730 million may be placed on Nova.