A brutal leap straight from the treat-yourself mindset of the pandemic into a cost-of-living crisis has left consumers re-assessing their core values and what they value from brands, a groundbreaking six month study has revealed at Nine’s Big Ideas Store today.

With two seismic events happening in the past three years, there is a once in a generation shake up of values currently at play, with the research from Powered and FiftyFive5 revealing shifting values amongst consumers across five different categories.

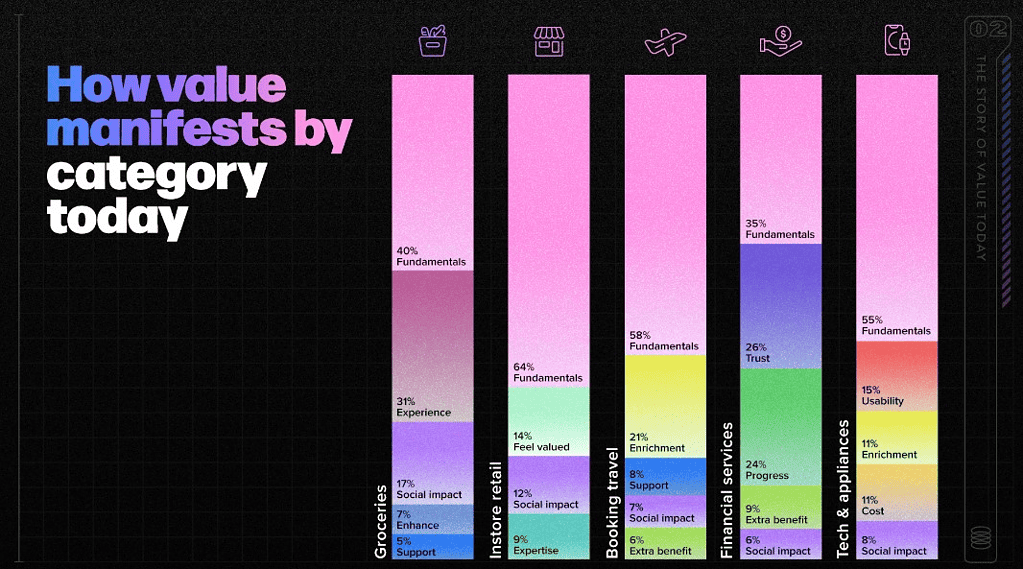

With the study looking into what consumers value from brands and how they felt brands were delivering on matching these, the study delved into the Groceries, Instore Retail, Travel, Financial Services and Tech & Appliances categories and what value looks like not just today but what are predicted to be the main drivers of value into the next decade.

While 2023 may have a strong focus on price point, what consumers value from brands is shifting. The research illustrates consumers are currently placing value in brands that offer ‘security’, ‘trust’ and ‘reliable information’. A panel featuring McDonald’s Director of CBI & Strategy Colin Glynn, FiftyFive5 Director Hannah Krijnen, The Sydney Morning Herald and The Age journalist Jessica Yun and Powered’s Content Partnerships and Client Experience Director, Sarah Stewart, discussed today what the value equation is for brands.

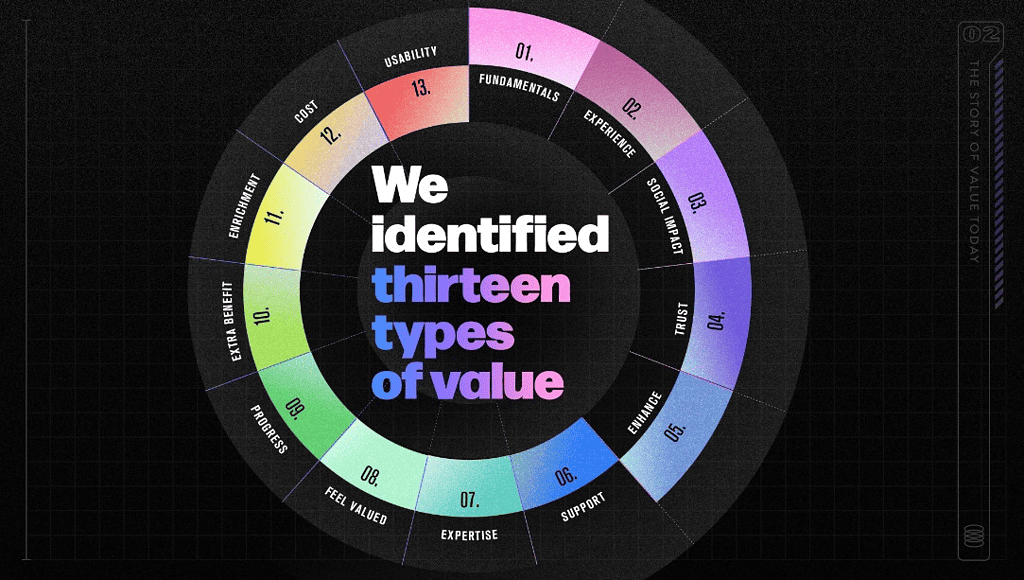

While value is hard to define and it’s in the eye of the beholder, the study identifies 13 different types of values ranging from cost, trust, fundamentals, social impact, enrichment, progress, usability to experience, extra benefit, feel valued and expertise among others.

With more than 1000 consumers studied, the research breaks down each category to reveal new insights benchmarked against each of the 13 values to help brands understand what key audiences are thinking, what categories are performing well and how brands can respond to this changing landscape.

One of the standout findings was that fundamental values ranked highly for each category but significantly, social responsibility exists in some way across all five categories. With consumers currently living aside political instability and cost of living, we are in a time that “is sink or swim for brands”, according to FiftyFive5’s Hannah who says consumers want a reason to back brands, who in turn, need to prove they are doing what they say they are doing.

“To be able to robustly and rigorously through these methods show that values do appear differently across these categories; that we can actually pin that down to significantly different and distinct is really important,” said Hannah. “I suspected something like fundamentals to be there for every category, but to see social impact rise to the point where it’s another consistent type of value expected to run across all categories is a big shift. The expectation of brands doing something beyond the transaction, or beyond the product I’m delivering to you, is now so important.”

With fundamental values of reliability, simplicity and affordable prices listed as high for the travel category for example, price tops in-store retail, while values encompassing safety and security top the finance category. But even during an economic downturn, value is also driven by enriching lives and supporting connection to our communities, as well as being sustainable and having a positive impact on the world.

“What this highlights is that it’s such an exciting time for brands to move the conversation beyond price and injecting value into whatever the offering is. The way we’ve approached it is to have a long term, holistic value strategy that includes price but also a lot of other levers and then playing within that framework,” said Colin.

When the research examined what would be more important value drivers in 2030 than 2023, the majority of respondents talked about the desire for more stability. While the cost-of-living crisis is a focus now, the greater expectations of brands on offering value beyond their core product and service is likely to increase.

“We talk a lot about the mental load of domestic lives at the moment,” said Hannah. “How as a brand can we help lift some of that burden to become easier, more intuitive and seamless. As a consumer it’s about what’s the easiest path to take and a beneficial path.”