Australian digital advertising market has recorded its strongest year-on-year growth, according to data from the IAB Australia Online Advertising Expenditure Report (OAER) prepared by PwC.

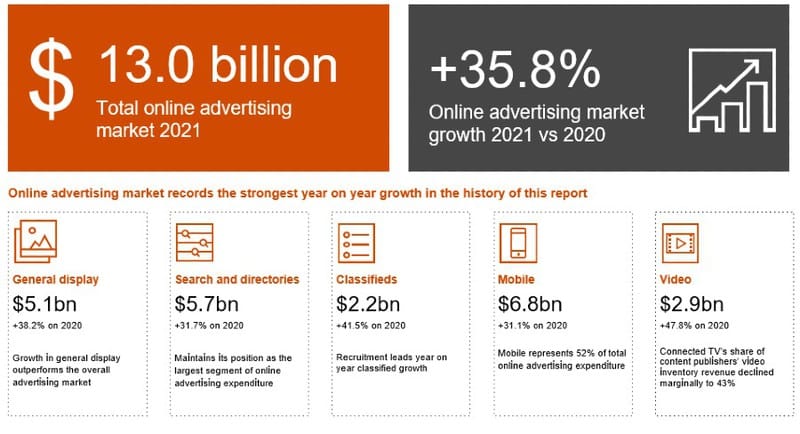

Total online advertising in 2021 grew to almost $13 billion and achieved 35.8% growth, following two years of slow growth in the industry at 2.4% for 2020 and 5.6% growth for 2019.

Video advertising achieved the biggest growth in the market, up 48% year on year to reach $2.9 billion.

General display advertising was up 38.2% to reach $5.1 billion, search and directories increased 31.7% to reach $5.7 billion, while mobile saw a 31.1% uptick and achieved $6.8 billion.

Classifieds, which had been the hardest hit digital advertising revenue over the last couple of years, experienced a strong bounce back in 2021, achieving $2.2 billion and a 41.5% increase on 2020.

The retail industry held the number one advertiser category throughout 2021, representing a 16.3% share of the general display market, which is up from 15.6%.

The auto category dropped back in share from 12.9% to 10.7% in 2020, but there are indications of a slightly stronger auto investment in early 2022.

Although the overall share of investment in content site inventory via programmatic didn’t experience a major change for 2021, with total programmatic spend stable at 42%, investment via programmatic guaranteed (PG) increased significantly, reaching 13% in 2021, up from 11% in 2020 and just 7% in 2019.

Gai Le Roy, CEO of IAB Australia, said: “The exceptional growth in the Australian digital advertising market in 2021 has been driven by a combination of two key factors.

“Businesses have accelerated their digital transformation and investment over the last two years, but we’ve also seen a resurgence in marketing spend by businesses to drive economic growth as we exit COVID lockdowns and restrictions,” she added.

December Quarter Results:

• Online advertising revenue for the final quarter of the 2021 calendar increased 21.3% compared to the December quarter in 2020, to reach $3.58 billion.

• Classifieds bounded back with an increase of 43.4% supported by strong employment, real estate, and second-hand car market.

• The general display market was worth $1.47 billion up 21.3% versus the comparative quarter in 2020. Video inventory represented 55% of all money invested in the general display category and was up 25% versus the December quarter in 2020.

• Connected TV represented 43% of content publishers video investment followed by desktop at 32% and then mobile at 25%.

• After a few false starts, travel industry ad spend increased in the December quarter to reach 4.5%, almost doubling the share in December 2020, but still at half of the spend share it had in 2019.

–

Top image: Gai Le Roy