APN Outdoor Group and oOh!media have revealed they are to merge, creating one massive outdoor business which will dominate the outdoor landscape.

The companies have outlined the reasons behind the plan to the ASX:

• Creates a leading, diversified out-of-home and online media group in Australia and New Zealand with:

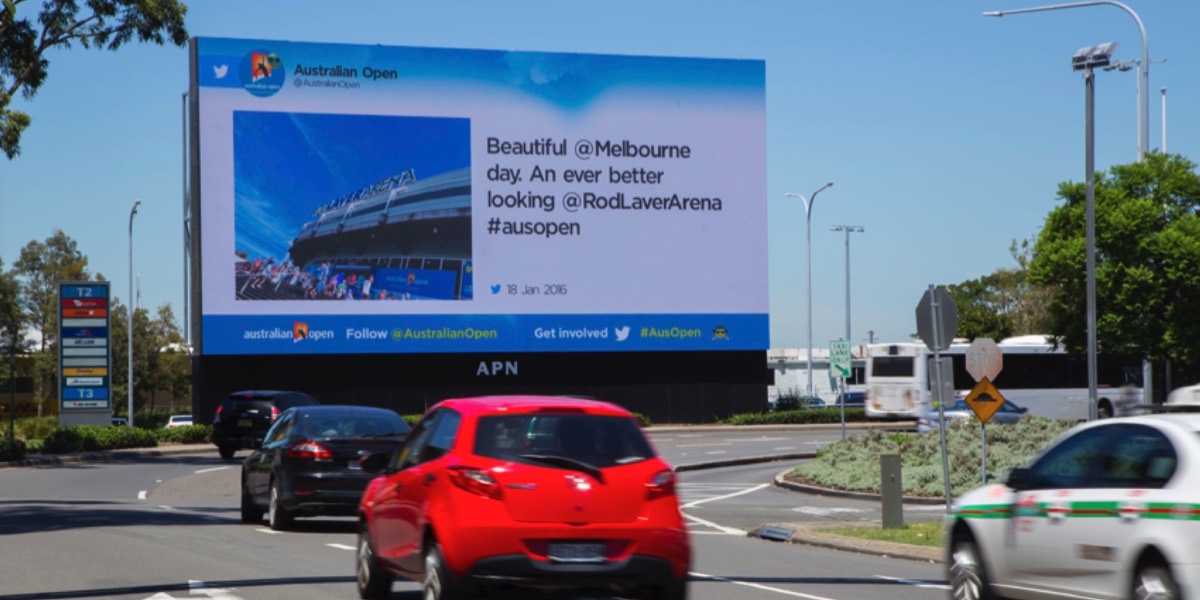

– a long-term and diversified asset base across classic, digital and online formats;

– a portfolio of industry-leading digital assets with opportunity to benefit from digital and content capabilities across an enlarged asset base;

– attractive offering for advertisers, with expanded audience reach and diversity; and

– enhanced ability to cross-sell media offerings across physical, mobile, online and social environments.

• Combines complementary portfolios and data capabilities with a service offering across key out-of-home formats and enhanced geographic presence.

• The combined business to benefit from continued sector growth as audiences increase.

• Combining leading management expertise and industry experience from both businesses.

Financial highlights

• Merged Group FY16 pro forma EBITDA of $171 million.1

• Significant value accretion to be shared by both shareholder groups. The merger is forecast to achieve cost synergies of at least $20 million per annum2, generating FY16 pro forma earnings per share accretion to APN Outdoor and oOh!media shareholders of 14.7% and 14.2% respectively.1,3

• Enhanced financial scale and balance sheet strength, with estimated December 2016 pro forma net debt/FY16 pro forma EBITDA of 1.2x.4 Transaction details

• Transaction to be effected via an oOh!media scheme of arrangement expected to be implemented on or around April 2017.

• An all-share (‘scrip’) transaction, where oOh!media shareholders will receive 0.83 APN Outdoor shares for each oOh!media share held.

• The Directors of APN Outdoor and oOh!media unanimously agree that the Transaction is in the best interests of their respective shareholder groups.

• oOh!media’s Board of Directors unanimously recommends that oOh!media shareholders vote in favour of the Scheme, in the absence of any superior proposal and subject to the Independent Expert concluding that the Scheme is in the best interests of oOh!media shareholders.

The new diversified out-of-home and digital media group in Australia and New Zealand will have a market capitalisation of approximately $1.6 billion. On completion of the transaction, expected to be around April 2017, existing APN Outdoor and oOh!media shareholders will own 55% and 45% respectively of the Merged Group. The Scheme Implementation Deed and the Scheme are subject to usual conditions precedent for a scrip merger, including:

• no regulatory intervention

• oOh!media shareholder approval

Doug Flynn will be appointed as the merged group’s chairman, Brendon Cook appointed as the merged group’s CEO and managing director and Wayne Castle as the chief financial officer. The current CEO of APN Outdoor Richard Herring will leave the merged business.

Michael Anderson, chairman of oOh!media, said: “The combination of these businesses will create an attractive media offering, supported by a passionate and experienced team. We believe the amount of cost synergies expected to be generated, and the resulting EPS accretion will create substantial value for both shareholder groups. We are pleased that the enhanced balance sheet strength and financial scale, together with increased funding opportunities, will support the merged group’s ability to pursue future growth and digitisation opportunities.”