By Bob Peters, Global Media Analysis

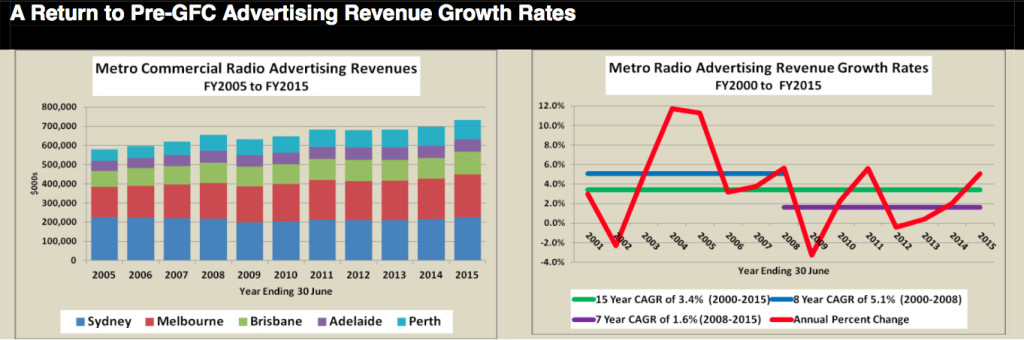

Fiscal 2015 was a surprisingly good year for metropolitan commercial radio with advertising revenues growing by a robust 5.1% to reach a record $732 million. Moreover, that revenue rebound has continued in to the current financial year with aggregate metro radio ad revenues up by 6.9% during the first two months of the 2016 financial year, despite a still-subdued overall economic environment.

FY2015’s growth in ad revenues was metro radio’s highest for four years and was comparable to the average annual increases which the sector had enjoyed between FY2000 and FY2008, a period of buoyant economic activity which immediately preceded the commencement of the global financial crisis (GFC).

Metro radio’s ad revenue performance in FY2015 was particularly impressive when compared to the 0.8% decline in metro television advertising revenues and the even larger mid-to-high single digit percentage decline in metro newspaper print advertising revenues over that same period.

Unlike metro TV and newspapers, metro radio’s ad revenues are now comfortably above pre-GFC levels, unaffected by the structural concerns which appear to have retarded renewed advertiser support for radio’s two larger traditional media competitors.

To date, Perth and Melbourne have experienced the strongest post-GFC recoveries, with FY2015 ad revenues being 21.2% and 20.5% respectively above FY2008 levels.

Record Revenues and Robust Growth

Metropolitan commercial radio generated $732 million in advertising revenues in the financial year to 30 June 2015, according to statistics compiled by Deloitte on behalf of Commercial Radio Australia. Those revenues represented an unexpectedly robust 5.1% increase on the previous year, given a slower growing overall economy and only modest 1.6% increases in both potential and cumulative metro radio audiences over the same period.

The ad revenue growth experienced by metro radio last fiscal year was particularly impressive when compared to the revenue performance of its two larger traditional media rivals over the same period. During FY2015, metro TV’s ad revenues declined by 0.8%, while the ad revenues generated by the print editions of metro newspapers continued to decline by mid-to-high single digit percentages.

While metro radio ad revenues have now increased in five of the past six years since FY2009’s GFC- induced 3.3% revenue decline and are now a comfortable 12% above pre-GFC peak levels, the same cannot be said for radio’s two main traditional media rivals.

Structural concerns have kept metro TV ad revenues stubbornly close their pre-GFC peak levels, while metro newspaper ad revenues have continued to fall and are therefore well below their pre-GFC levels.

Individual Metro Market Trends

All five metro markets enjoyed ad revenue growth in FY2015, however the increases were significantly greater in Brisbane (+7.1%), Melbourne (+6.2%) and Sydney (+5.3%) than they were in Adelaide (+2.2%) and Perth (+1.9%).

The recovery from the GFC in the various metro markets has been quite disparate, with ad revenue growth in Perth and Melbourne (up 21.2% and 20.5% respectively) significantly out-performing the increases experienced in the other three markets.