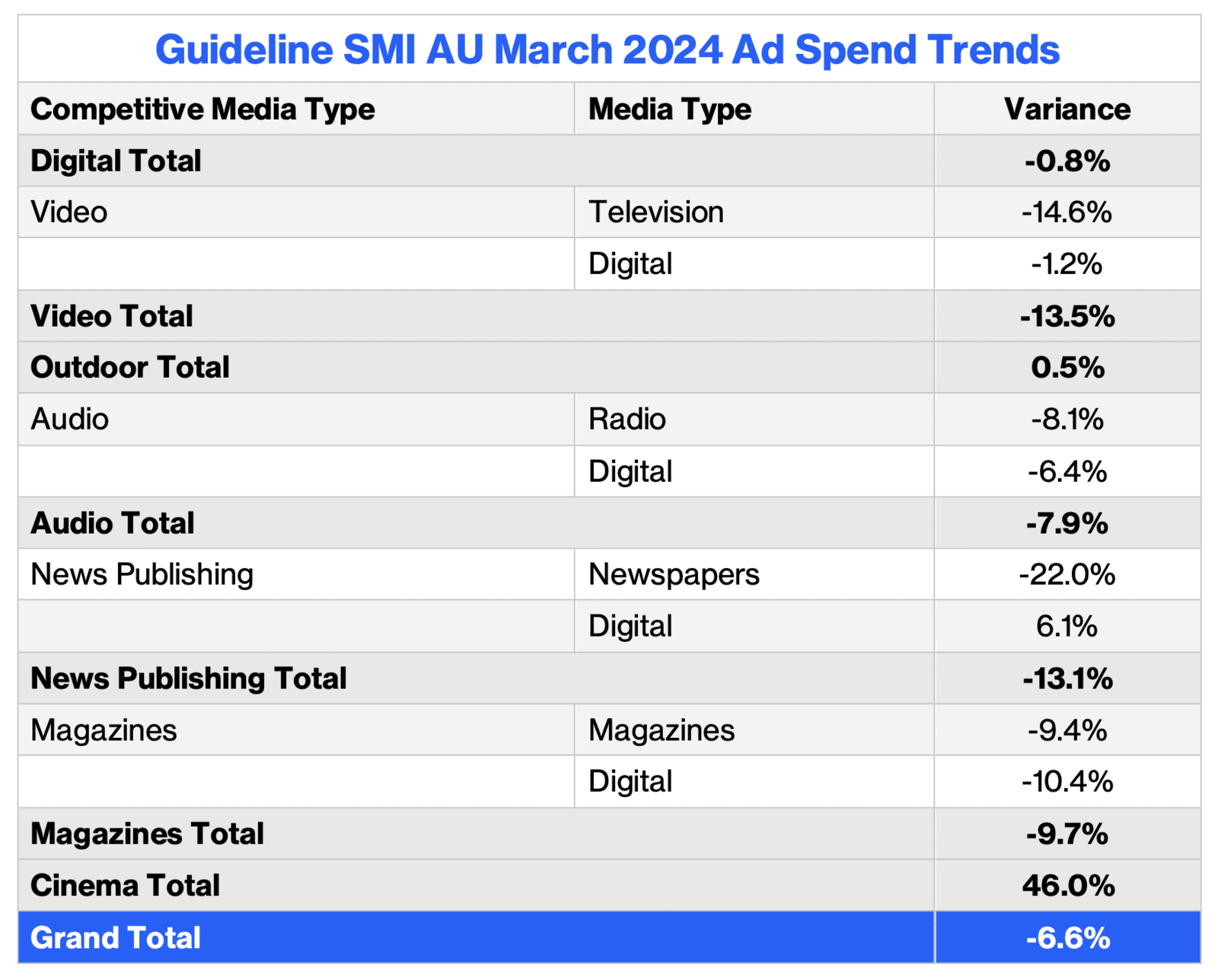

The ad spend market fell 6.6% during March, partly due to Easter’s timing this year, according to newly-released figures from Guideline SMI.

Despite the softer demand, cinema and outdoor reported strong results, with year-on-year growth of 46% and 0.5%, respectively.

Jane Ractliffe, Guideline SMI APAC managing director, said the Australian ad market continues to differ from international markets, with both the US and Canada reporting the third consecutive month of growth in March.

“As only the government and auto brand categories lifted their Australian media investment by more than $5 million in March, it seems as though most marketers are adopting a more cautious approach to their ad budgets in the first half of this year,” she said.

“March demand was at least in part impacted by the timing of Easter (last year, the holiday was entirely in April), but even so, we saw only 35% of categories grow investment, and at least some would also be waiting to see how the market evolves after the July Olympics.”

Ractliffe highlighted Guideline’s US database reported a 4.5% increase in March ad spend and Canada grew 2%.

She said the growth in government ad spend in Australia this month (+36% YOY) was mostly due to the Tasmanian election, but that growth was offset by large declines in ad spend from the communications and travel categories.

Q1 bookings were back 3.7%, but outdoor experienced a record level of Q1 ad spend (+1.4%) while digital (+2.7%) and cinema (+8.4%) were also in positive territory.

In contrast, most other markets are reporting positive Q1 results: up 6.5% in the US, 2.8% in the UK, 8% in Canada, and 3.7% in China.

Guideline SMI has previously forecasted a year of growth for Australia’s ad market, with the combination of state elections, the Olympic Games, and the easing of supply chains predicted to contribute to a strong year.

See also: “Very hard not to grow” Guideline SMI predicts growth for Australian ad market in 2024

—

Top image: Ractliffe