Morgan Stanley sees “a lot of merit in putting 2x FM radio groups together”, according to a report the investment bank has released as the potential deal between ARN and SCA looms.

See Also: ARN and Anchorage’s ambitious dream to carve up SCA broadcast assets closer to realisation

LiSTNR is critical to the deal, it said, forecasting the platform to generate positive EBITDA in FY25e of $3.6m and positive FCF in FY26e.

“We expect LiSTNR will continue to growing top line and profitably meaningfully over the medium term.

“As a result of revised earnings estimates, we also revise our base case valuation for LiSNTR to $105m, based on a 2x EV/Sales multiple on FY25e revenues of $52.5m”

The report makes it clear that “Fundamentally, we see a lot of merit in putting 2x FM radio groups together. But a central problem is the media rules, which prevent the maximum cost-out potential.

“If the proposal goes ahead, we expect ARN would close its iHeart app… and shift all the talent + all content (podcasts) + all cross promotion of both radio groups into LiSTNR as a single audio streaming platform – that we believe would make both strategic + financial sense.”

In its argument that LiSTNR has been undervalued in previous deals, the report makes three key arguments.

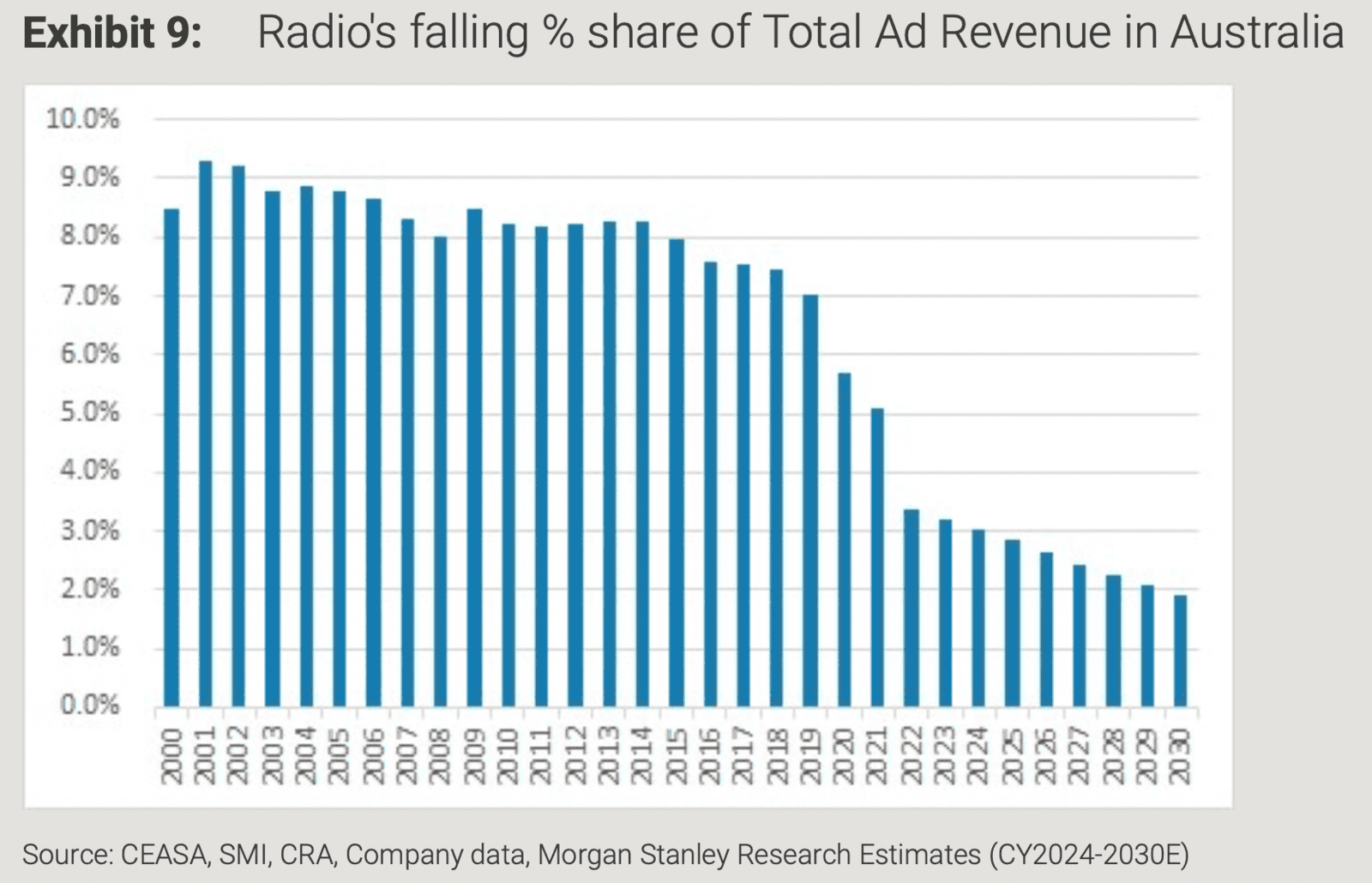

The first is that traditional radio listenership is falling and its audience is aging without being replaced. As a result, the report argues that radio revenues look to be in “permanent structural decline”.

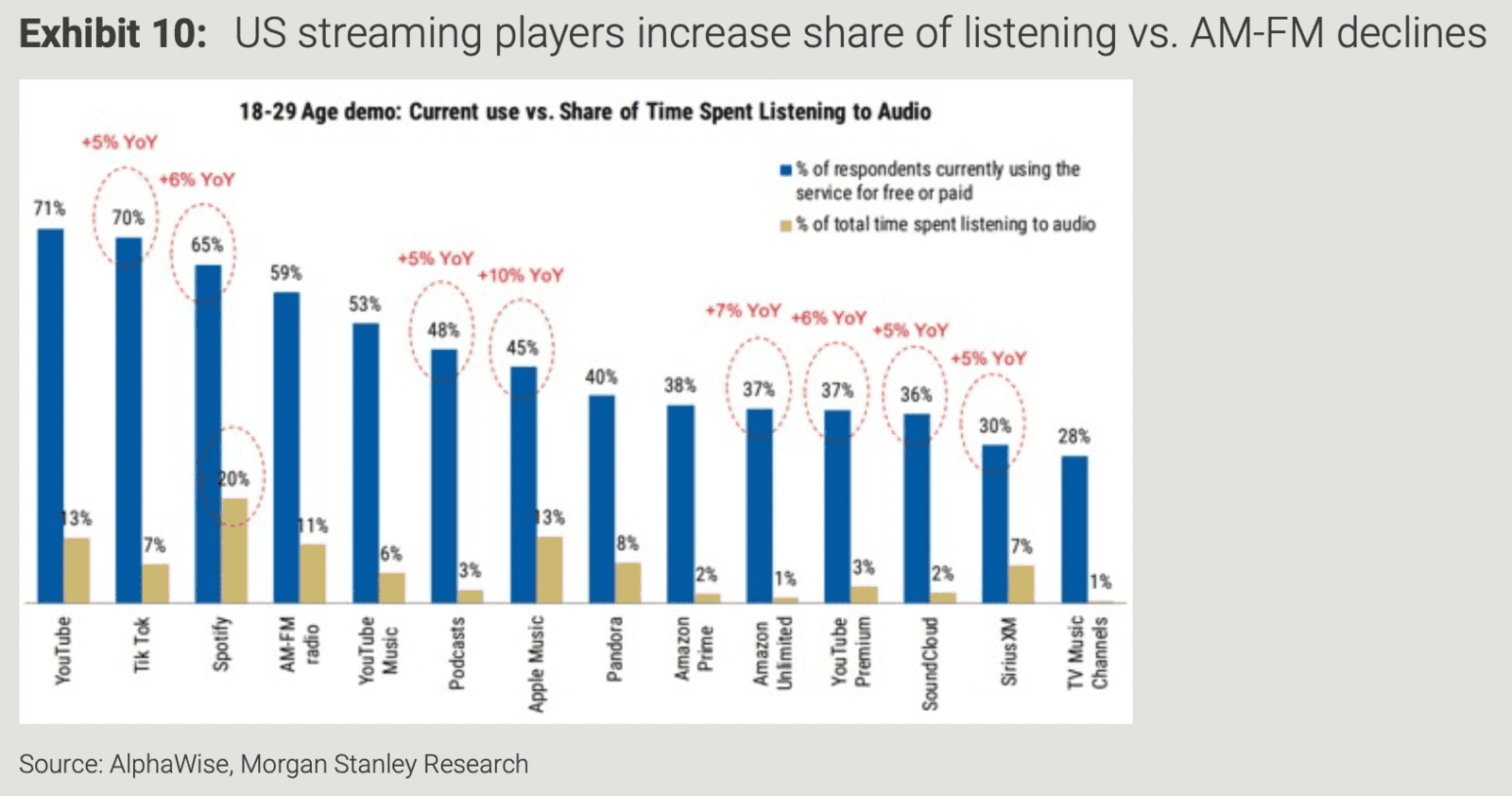

“Radio’s share of consumer time continues to decline, as the overall population, but in particular younger demographics choose newer technologies for their audio/music consumption (e.g. Spotify, YouTube, Apple Music).

“Put simply, as the aggregate time spent-with-radio falls, this inevitably means Radio’s share of total advertising budgets in AU will also fall, and continue its already declining trajectory.”

The report does make the point that this doesn’t mean there is no value in radio audiences for advertisers today, and “we expect traditional radio will continue to attract a sizeable amount of revenue for years to come, but it will continue to decline”.

The second argument is that streaming audio platforms have grown significantly over the last decade in Australia and continue to grow, both in terms of users, subscribers, and time-spent.

“Global players dominate the digital streaming market… critically, LiSTNR is the largest local competitor to these global players in Australia, albeit at a smaller scale with ~2m registered users. But it presents a rare opportunity for a local radio company to compete, thus, in our view, it has strategic value, particularly because it could scale-up. We have a positive fundamental view of LiSTNR, as a product and as an advertising platform.”

LiSTNR could grow users, revenues, and EBITDA even faster if owned by a larger media group, rather than just Southern Cross Media Group, according to the report.

“Scale matters in a digital world. If there were multiple radio (or wider media) groups promoting LiSTNR this should boost registered users, not just because of brand awareness, but because of the benefit of having more proprietary digital content, which could assist making LiSTNR a larger player in the digital advertising market, better able to compete against the global competitors.

“An enlarged LiSTNR, with more ad inventory to sell, would likely be better positioned to build an even more sophisticated range of ad products and ad tech stack and with the benefit of more 1st party data.”

Ultimately for shareholders, the report says the prospect of an ARN and SCA deal “could deliver some revenue and cost synergies for the new Co overall, as well as for LiSTNR,” however, not as substantial as if there were no media ownership rules in place.

“But, that is the reality of the current landscape, and we consider the prospect of media ownership laws being relaxed in the near term as relatively low.”