2023 appears to be a year that will see companies build on the growth, change and new innovations made throughout 2022.

While the last year wasn’t without its challenges, many companies in media, marketing, data, and technology are primed and ready to take on the new year.

As the industry gets back into gear for 2023, companies from across a broad range of sectors gave Mediaweek a peek into their crystal ball for the year ahead.

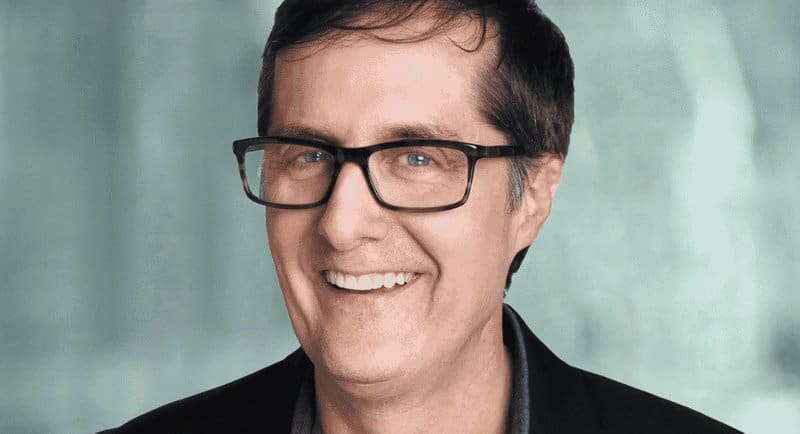

Jellysmack – Ezechiel Ritchie, general manager APAC

Ezechiel Ritchie

1. Creators will need to double-down on a multi-platform approach:

2022 was a difficult year for ad-supported businesses, which are the social media platforms our creators rely heavily on to make a living. I think those platforms can still expect a bit of a squeeze in 2023, amid slashes to advertising budgets due to the macro-economic situation. This will impact the CPM (cost per thousand impressions) on every platform. For this reason, we will see more creators expanding their presence across multiple social media platforms to minimise risk, diversify their revenue streams and reach incremental audiences. This approach will also enable them to tap into wider demographics and access better brand deals.

2. The short-form content monetisation battle is on:

Up until now, short-form content was synonymous with TikTok. This will change this year, and the competition will be fierce. Short-form content on platforms like Facebook and YouTube will become an interesting source of programmatic income for creators. Historically, YouTube and Facebook have been the two largest sources of revenue for creators, and we expect these two platforms to also have a strong presence in the short-form space. YouTube Short & Facebook Reels are already monetising, and results are promising – certainly better than the very limited monetisation opportunities for creators on TikTok; we’re hoping this will change in 2023.

3. Content creators will become business entrepreneurs:

Content creators will have easier access to capital to grow their business. At the moment, creators can unlock the revenue up-front that their back catalogue will make over the next five years and invest it in other business ventures. Some larger creators have already done so, including MrBeast to launch his own burger chain, and natural chocolate bar Feastables. This will level the playing field for many creators, and enable them to launch new ventures they could only ever dream of before.

TotallyAwesome – James Sawyer, managing director AUNZ

TotallyAwesome

James Sawyer, TotallyAwesome’s managing director of AUNZ, said: “As more and more Gen Zs begin to enter the workforce and wield increasing purchase power, CMOs need to ensure they have strategies in place to target a youth-audience to not only make up the gap of sales but capture brand loyalty that could last a lifetime.

“The teenage into early 20’s years are packed with numerous ‘firsts’ – first bank account, first car, first job and so forth – and are characterised by neurological growth that allows brands to engage with a receptive audience that is vocal about sharing positive brand experiences, has money and low overheads (relatively).

“Reaching this demographic with meaning will be key for marketers in 2023, as CMOs need to find new ways to grow and reach new audiences in a recessionary environment. The latest IAB Outlook Survey showed that customer acquisition is by far buyers’ top goal for 2023 media investments (61%) and a youth-audience offers a relatively untapped stream of new and potentially highly valuable customers. In fact, I call them the “growth generation”,” he said.

“This means over-indexing on channels where they spend most time, think content creators and influencers; the next generation get their news and brand associations from different places than their parents (TikTok, Snapchat, Instagram, gaming platforms and soon to be metaverse) and consequently require a different approach to digital advertising.

“To catch the under 18s it also means a different targeting approach to ensure regulatory compliance. However, with the imminent demise of the cookie and post Apple’s IDFA changes (recent reports suggest that over 75% of iOS users can’t be reached by audience targeting) many marketers are already embracing contextual advertising which marketing to a youth audience demands,” Sawyer added.

impact.com – Adam Furness, managing director APAC

Adam Furness

Impact.com’s Adam Furness noted the growing importance and integrality of creators to marketing teams. He said: “We are moving to a world where we will only buy brands, products and services we trust. We will only buy from people we trust. No trust, No buy.

“For younger consumers in particular (and remember the spending power of Gen Z is on the increase) the people they trust are creators with whom they feel an affinity.

“This will mean creators become an increasingly important communications channel for brands as the brand-consumer dynamic continues to shift away from more traditional forms of digital advertising. We’ll see brands putting even more emphasis on their creator marketing efforts, putting more value on long-term relationships with creators, and exploring new opportunities to use creator marketing, such as in the metaverse and other emerging channels,” he said.

“For CMOs in 2023 this will mean balancing the need to rapidly test and learn as more creators are brought into the marketing mix with the ability to prove value in a recessionary environment. The good news is that with the right tech in place, creator marketing is a highly measurable performance marketing channel where it’s possible to gain insight and performance metrics in close to real time,” Furness added.

InMobi – Richard O’Sullivan, VP and GM, ANZ

Richard O’Sullivan

InMobi’s VP and general manager of ANZ, Richard O’Sullivan shared: “When it comes to mobile marketing, we expect to see identity and addressability continue to be impacted by external factors such as changes to the Australian Privacy Act, Apple’s privacy frameworks for iOS and Google’s imminent depreciation of third-party cookies. Put simply, privacy will drive the agenda as businesses and governments seek to find the right balance when it comes to the consumer’s desire for both privacy and personalisation.

“We anticipate Google will further delay cookie depreciation to 2025 as a result of the industry’s underwhelming response to its Privacy Sandbox; at the moment, we understand that they just don’t have the footprint required to ensure revenue continuity.

“However, as it gets closer down the track, we will probably see a greater adoption of seller-defined audiences (SDAs) because of the pending disappearance of device IDs and buy-side audiences losing scale as those signals go away. As a result, we should begin to see a more unified publisher SDA source and more independent SDA-focused companies that don’t have their own SDK distribution. But SDAs lacking a publisher software development kit (SDK) will be seriously challenged and many will not survive,” he said.

“We also expect the changes in Apple’s SKAN 4.0 – more effective measurement of ROI and attribution – to help fuel digital native app growth and drive enablement and investment in performance marketing. In the expected bearish market to come, it’s easy to imagine a shift to mobile app marketing because of its immediate measurability.”

InfoSum – Richard Knott, general manager of ANZ

Richard Knott

Richard Knott, InfoSum ANZ’s general manager, said: “Against the backdrop of a series of critical Australian data breaches and new privacy legislation, marketers will be laser-focused on how to mitigate data risk whilst continuing to drive personalised, relevant and engaging marketing.

“This will require a new approach to data collaboration. Anywhere that trust is required in the process of data partnerships will be regarded as a point of possible failure. Consequently, the idea of a privacy-safe Identifier will give way to simply keeping identity privacy-safe.

“This will mean data collaboration will have to be managed without moving consumer data out of your environment, fuelling the growth of data clean rooms – which in turn will be accelerated with solutions like Google PAIR,” he added.

DoubleVerify – Imran Masood, country manager AUNZ

Imran Masood

DoubleVerify’s country manager AUNZ, Imran Masood said: “The third-party cookie is entering its twilight year with Google set to phase them out from Chrome in 2024. As a result, contextual activation will only become more important as advertisers seek tech that does not rely on persistent cookie tracking while still reaching relevant audiences.

“In the past, contextual advertising has primarily been used as a method of driving safety—for example, by using keyword avoidance to stop ads appearing alongside unsafe content.

“However, in 2023 this role will evolve, and contextual advertising will become a key part of outcome-driven activation.

“By using contextual segments, brands can ensure ads appear alongside content that’s relevant to their product and as a result are more likely to get consumers’ attention – in our recent ‘Four Fundamental Shifts in Advertising and Media’ Report, 69% of Australian consumers indicated they are more likely to pay attention to an ad if it’s relevant to the content they are consuming.

“In short: contextual segments are set to be a key tool for brands in the fast-approaching post- cookie era,” Masood added.

Meltwater – Upali Dasgupta, marketing director, Asia Pacific

Upali Dasgupta

Upali Dasgupta, marketing director of Asia Pacific for Meltwater, said: “As we head into 2023, we are entering the endgame for marketers to adjust their strategies and reconsider how to achieve and measure the success of their digital campaigns in anticipation of the death of third-party cookies.”

“First-party data will be the not-so-secret sauce every brand will look to gather. Pairing that with contextual marketing will be the major shift we will see to ensure campaigns are targeted to consumers based on their content preferences rather than just based on demographic data.

“What’s more, brands will need to invest in the value of having strong brand identities and leveraging in-depth consumer and audience intelligence to gain the attention, trust and loyalty of consumers,” she said.

“As new technology generates space for more digital communities and sub-communities, segmenting target audiences by their online habits will be the key to navigating a cookie-less future,” Dasgupta added.

Crimtan – Josh Wilson, commercial director JAPAC

Josh Wilson

Josh Wilson, commercial director JAPAC for Crimtan, said: “Amid economic headwinds, advertisers are seeking ways to maximise the return on their ad dollars by diversifying their investments across traditional and emerging channels, such as connected TV (CTV), DOOH, and audio. This indicates strong growth for programmatic in the coming year, with a focus on a connected media approach.

“With multiple platforms, brands have access to an abundance of data, which they can use to effectively target their audience and drive sales. However, many brands are still using this data in silos – the consumer data acquired from one platform cannot be applied to another platform. This can make the data unscalable and ineffective when trying to create seamless customer journeys.”

“With a sophisticated connected media strategy, empowered by data, and technology, such as dynamic creative optimisation (DCO), brands can deliver sequential messaging, showing a series of ads to potential customers that connect to tell a continual message or story. This way, brands can reach their audience with the right message at the right time in their customer journey,” Wilson added.

Scope3 – June Cheung, head of JAPAC

June Cheung

Scope3’s head of JAPAC, June Cheung said: “Sustainability and carbon emissions will be an additional metric CMOs will need to consider in 2023 and beyond. Collectively, there is a much deeper understanding of how changes to media buying actions can reduce emissions, so there will be greater scrutiny on the carbon cost of every digital campaign.

“CMOs will come under greater pressure from their boards to drive sustainable digital advertising practices, not only because it is the right thing to do but because it is drives business performance. More CMOs will discover that reducing carbon emissions actually delivers better media ROI and performance so will look for agencies who can deliver more effective and carbon-neutral advertising. Research by Ebiquity and Scope3 recently showed 15.3 per cent of advertising spend is wasted on inventory that creates no value but generates excessive amounts of carbon emissions.

“Investors, consumers and employees will put pressure on brands to ramp up their ESG efforts. A recent Dentsu and Microsoft study found 84% of global consumers say they would be more likely to buy from a company which practices sustainable media advertising, whilst a Gartner study showed 65% of employees are more likely to work for a company with a strong environmental policy. Brands are listening and beginning to make big changes. For example, Mars Wrigley Australia has announced plans to begin wrapping its core range of Mars, Snickers and Milky Way bars in recyclable, paper-based packaging from April 2023.

Criteo – Heath Irving, video specialist, APAC

Heath Irving

Heath Irving, Criteo’s video specialist for APAC, spoke of the power of Commerce Data on CTV. Irving said: “Connected TV (CTV) is now a must-have element of the wider marketing funnel, as it is unique among other advertising channels because it combines linear television’s storytelling capabilities with digital marketing’s targeting and measurement.

“Advertisers are realising that CTV can do so much more than just make up for the declining reach of linear. Driven by the power of commerce data, CTV can be a highly effective branding or performance channel and drive measurable site traffic, conversions and actual return on ad spend.

Irving forecast that advertisers in 2023 to be leaning into commerce data across CTV because it allows them to accurately target new and existing in-market customers. He also noted that it advertisers better understand the effectiveness of CTV activity both on online and offline sales with enhanced closed-loop measurement

On Shoppable CTV as the next big thing, Irving said: “As more streaming services turn to ad-supported options and look at ways to monetise their platforms, we will see CTV ads become even more relevant to the consumer., Marketers have the opportunity to target an engaged audience with relevant ads by utilising personalised advertising and, as technology continues to develop, shoppable ads will come into the fold.

“Imagine streaming White Lotus and seeing shoppable ads for the exact resort, fashion or experiences on your screen that you can immediately purchase while absorbed in the program. In 2023, we are going to see these innovations start coming to screens and viewers actively engaging with these new ways to shop – enabling every moment to become a commerce moment,” he added.

Criteo – Todd Parsons, chief product officer

Todd Parsons

Todd Parsons, Criteo’s chief product officer, noted that AI will be a driving force in marketing as every online moment becomes shoppable. He said: “Against a backdrop of increased consumer privacy and data protection, 2022 was marked by innovation to improve the quality of consumer shopping and buying experiences.

“Retailers led this charge by launching media networks and leveraging advertising to improve the value of their eCommerce sites and apps. Elsewhere, content itself became more shoppable as media creators got into the game of bringing commerce into live streams, gaming, and out of home.

“In 2023, there are no signs of these trends slowing. Commerce is officially everywhere, every moment spent online is now a shoppable one, and for brands that own a digital touchpoint with consumers, it presents a massive opportunity.

“AI will be the driving force behind this innovation, enabling retailers and content creators to support next-generation shopping that better senses consumer need and provides rich information about the right brands, the perfect products and most efficient ways to choose and purchase them,” he said.

“Because AI is tuned to use data differently than marketers have in the past, all of this can happen with less data, across a fragmented commerce landscape and with fewer potential intrusions to consumer privacy,” Parsons added.

Magnite – James Young, managing director Australia

James Young

James Young, Magnite managing director of Australia, said: “The removal of digital identifiers and increased privacy regulation presents an opportunity for industry-wide collaboration to create solutions that power advertising in a transparent and end user controlled manner.

“In the coming year, publishers will need to work even more closely with their technology partners to ensure they have access to the tools and controls to compliantly categorise, curate and activate their audience data as the market continues to evolve.

“Although there are many possible solutions which can solve the impending challenges ahead of us, I suspect there will be a need for further education across the industry to ensure that the changes in privacy are addressed correctly and efficiently, and not just as an excuse to add more tech tax in the ecosystem,” Young added.

Triton Digital – Stephanie Donovan, global head of revenue

Stephanie Donovan

Triton Digital’s global head of revenue Stephanie Donovan forecast that programmatic buying will dominate. She said: “The growth in programmatic buying of audio inventory has grown substantially — in the last 5 years we have seen it surge over 500%, in terms of Triton Digital’s marketplace, due to the efficiency by which buyers can reach a targeted audience at scale.

“Advertisers have signaled with their media budgets their preference for programmatic buying, but if inventory is not available in a programmatic exchange, publishers will miss out on revenue opportunities. Over the next year, we expect audio to continue to be of high interest to buyers; thus, ad spend via programmatic exchanges will continue to show significant growth as brands aim to reach an engaged, mobile audience.

“2023 will be another banner year for podcast advertising in terms of both volume and publisher CPM rates. Programmatic podcast advertising, projected to grow 30% year-over-year according to the Podcasting Global Market Report 2022, will once again lead all other audio channels,” Donovan said.

“We’ll see dynamic ad insertion (DAI) continue to steal the spotlight from baked-in ads, building upon 2022 momentum. Couple the flexibility to precisely message intended audiences with potential revenue growth opportunities, and we can expect programmatic to remain at the forefront for advertisers and publishers in 2023,” she added.

Triton Digital – Ben Masse, chief product officer

Ben Masse

Triton Digital’s chief product officer Ben Masse noted that marketing tactics will need to evolve in the year ahead. He said: “As we enter a post-cookie world, it will be critical to ensure the proper tools are used to activate and track advertising campaign effectiveness.

“Strangely enough, many ad tech providers are still operating as if we are still gravitating around a browser-centric world. However, we’re racing towards a world split between strong wall gardens from a handful of tech conglomerates and the open web.

“Yet, there is still too much focus on replacing cookies and MAID with persistent IDs. These IDs require registration, so it is not applicable to the non-registered open web, third party apps on connected devices, podcasts or broadcast.

“The industry isn’t adapting at the proper speed and many are still hoping for minimal impacts on how advertising is transacted,” he said.

“Publishers and advertisers need to work hand-in-hand on scalable and relevant approaches that are not reliant on tracking listeners on an individual basis, but embrace probabilistic cohort-based targeting and measurement, compliant with the new privacy laws and audience’s expectations,” Masse added.

–

Top image: Ezechiel Ritchie, June Cheung, Imran Masood, Upali Dasgupta, Josh Wilson and Stephanie Donovan