The chief executive officer of the Foxtel Group, Patrick Delany, unveiled a management restructure last month. The changes were made to allow the senior team to better play to their strengths and to maximise the new revenue streams unlocked by streaming.

Mediaweek sat down with the TV chief in his office at Foxtel HQ in Sydney to hear about the shuffle and the future of the TV business.

Patrick Delany has now been with the Foxtel Group for over two decades after starting his career as a lawyer before moving into TV management. Delany came to the role following previous chief executives including Kim Williams, Richard Freudenstein and Peter Tonagh.

In his rise through the ranks, Delany revealed his best job, previous to his current role, was as chief executive of Fox Sports: “The Fox Sports era, for me, was a lot of fun,” he told Mediaweek. “The sports deals are always pretty hectic, but there’s no doubt building that team over there, which is a fabulous sports production team and brand, was probably my favourite job.”

Foxtel executive shuffle

Changes to the management of Kayo and Foxtel Media was the main headline. “I call it a determined restructure about the future of the company,” explained Delany. “We see sport and advertising as the two big growth levers that we’ve got. We think Binge deserves its own management. With Foxtel Media you’ve now got the two best salespeople in the country, Julian Ogrin and Mark Frain, working together.

“One of the big evolutions at Foxtel Group is having 66% of all customers on digital. We can take advantage of the opportunities that offers. I’m particularly excited about the future of advertising. We’ve got a lot of digital hours being watched and a lot of digital subscriptions. What we need to do now is open up digital inventory, be able to insert digital ads into channels – digital ads that otherwise would have been fixed to that inventory.”

See Also: Foxtel executive shuffle: New operating model impacts Kayo, Binge, Foxtel Media

Up and away: Foxtel financials

Delany explained turnover is driving back up towards $3 billion annually. “Revenues rank us as the biggest media company in Australia. The story is different now because the input costs are getting larger and are from different areas. Foxtel launched as a cable and satellite business and we had double distribution costs. We are driving hard now to get everyone on a satellite. Not everyone wants that and we now pushing some people off the satellite onto IP.

“If you look at our customers, Foxtel customers are older, and they have been with us quite a long time. And they pay a reasonably rich amount of revenue into the company, whereas the streaming customers, although very important, can still be pretty fickle. They come and go, but they pay real money. The bottom price on Kayo is $25 which is not a pittance and Binge has a range of products.”

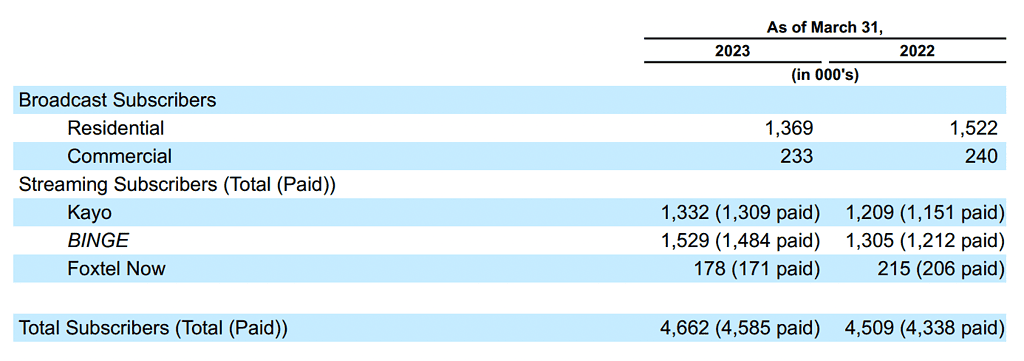

Foxtel subscriber numbers as at March 31, 2023

Set-top boxes here to stay…for now

While streaming customers only need to download an app to get started with Kayo, Binge or Flash, Foxtel customers still get a set-top box.

“We are buying very few set-top boxes,” noted Delany. “We’re still having to buy them because our churn rates are below what we projected. We’d hoped to be able to circulate set-top boxes between those that churn and those that come. But we’re still having to acquire them. And we are retiring some of the very early models. We’re trying to give our Foxtel premium customers the best content and the best gear.”

As to the question of devices, Delany thinks there will always be something whether it be a TV itself or a small device on the back of the TV. “When you look at aggregation it is unlikely that premium apps will allow other apps to incorporate them. It’s giving up too much control.”

Foxtel customers still like watching linear TV and they love recording programs, said Delany.

“Channels certainly skew to live sports and news, but otherwise on demand is certainly here to stay.”

Bundling is the future

Delany talked about trends at entertainment companies around the world and said there is much talk about aggregation and bundling.

“In the next 18 months to 24 months, we’ll probably start bundling up, for the first time, Kayo and Binge for example.

“Having considerable expertise in the company on aggregation through the Foxtel business, gives us some confidence in reading the play that aggregation will become a feature of life going forward. Subscribers to the myriad streaming services find it difficult to get streaming services to the TV, difficult to find their favourite shows and difficult to track their subscriptions. They are no longer getting discounts anymore either. These things are coming through strongly in our research.

“All of our streaming partners on the Foxtel box are liking being on the Foxtel box because as they are included in packages there is less churn and more reliability.”

When asked about getting a cut of all reseller transactions, Delany replied, “We have business arrangements with all of them.”

Foxtel brands: Binge continues to offer $10 package

“The arrival of ads on Binge has allowed us to offer HD quality for $10. The market rules what you can and can’t do. It is not FTA TV so you can’t run that sort of ad load and you can’t run the ad load of some of the Foxtel channels. At the moment it’s supplemental and we will see how we go with that. It has bedded in quite well and we are happy with the progress. There has been quite a lot of people moving up to the next Binge tier and a little bit of churn. Plus a very good response from advertisers.”

Delany said the size of the streaming services customer base is bigger than the quarterly paid subscriber numbers.

“We’re finding from season to season we are getting less people that are turning the system off. The game is about re-engaging with people that have been subscribers in the past, then getting brand new ones too.

“Binge is only three years old and Kayo is five. We expect that we can continue to grow at the current rates. Kayo was up about 10% year-on-year and even higher for Binge.

In the current era of inflation, Foxtel feels the market is less sensitive to price rises. “In general, streaming services need to make money, not lose money so prices will go up.”

With close to 5m Foxtel Group subscribers, Delany noted that is more than one in every two homes. Penetration that is much higher than when there was just one Foxtel product.

Future of streaming

It is hard to know what is next, offered Delany. “We are still in the middle of digital disruption. When you look at the consumer experience people are no longer willing to sign contracts and wait for installers. There is lots of experimentation with things like advertising and FAST channels are part of that as well.

“We are happy with the premium sport we have now for the medium to long term. They are the sports that make Australia different. We are really looking to season 2025 in the AFL where we can do our own graphics and commentary and we get Super Saturday.

“At Binge the two partners that get quoted most are NBC Universal and Warner Bros Discovery. In fact, there is a multitude of other suppliers which is why I think people say Binge represents the best value. It has a very diverse group of high-quality suppliers.

“Here I would like to mention Brian Walsh whose contribution over 25 years was immense. Especially in the last three to four years he really hit his straps with some of the Australian productions like Colin From Accounts which is close to being a worldwide hit with success in the UK and US. The company is very proud of our productions and the subscribers are loving them.

“Over the years we’ve spent far more on production than we’re required under law. We are the only regulated pay TV company in the country. We’ve made a choice in terms of content mix between overseas and local which we feel is the right mix at the moment.”

Too many streamers in Australia?

“There are almost too many players on everything in Australia for such a small population.” When asked about the local success story Stan, Delany said: “Binge and Stan both offer a very different experience for subscribers. Mike Sneesby and his team have done an extraordinary job. We were late to streaming and our first step, Presto, didn’t resonate with consumers. But Binge has certainly proven to be successful.”

Foxtel will continue to sit alongside the streaming options, confirmed Delany. “The strategy of the company has not changed in five years. That is to maintain Foxtel, to grow through streaming, and to be the most efficient company we can be. We run a multi-brand strategy.”

Foxtel Group content partners

As to how Foxtel and Binge might look if Warner Bros Discovery launches Max in Australia, Delany responded. “It is unclear whether they will. In relation to both Warner Bros Discovery and NBC Universal, they have both made a lot of money in this market without lifting a finger. They remain strong partners of ours and we have built-in provisions that whichever way they decide to go, we’re still a partner.”

What is Project Magneto?

“This will be a separate unit to Foxtel and it is a platform to aggregate streaming,” Delany replied. “It will be important for Australian media businesses. We have the jewels in the Australian content crown in Binge and Kayo which form a good hub around which to aggregate. We are in some very constructive conversations with our colleagues in free-to-air to bring them along with us. To unite as an Australian broadcasting industry to make sure we’re not left behind is important.

“At the same time there is a demand from all of our international partners that stream who say they’d like to be on a platform like that where discounts are offered. [For consumers], discounts would be offered for the more content they took.

“It’s new technology that Australia has not seen that we’ve licensed from Comcast and Sky. Comcast is using it for a similar use and that is a streaming aggregator in the US. Sky is using it for pay TV where they are giving subscribers the opportunity to pay for the device.

“We won’t be using it for Foxtel, but for a new business that aggregates. It’s a large project because there is all the licensing and equipment to buy plus we are also building a new back end. It will be quite a different way of viewing TV as it converges free-to-air, pay TV, streaming and internet into one place and makes everything easy.”

Infinity and beyond

Delany outlined some of the goals to maintain momentum: “The first one is the continuing building of revenue, to have five straight quarters where we’ve built revenue. Hopefully, when we get to the end of the financial year we will have two financial years where we’ve built revenue – that’s the definition of a turnaround. We’ve got consistent management with a great management team. We’ve got consistent growth in subscribers.

“We have chosen to renew premium content and we have more outlets to monetise that content. In the last five years we have been very good at containing costs and maintaining efficiency. We established a transformation office in 2019 and it continues to operate as the business evolves.”