Seven West Media has reported the company’s financial results for FY17. Commenting, the managing director and CEO Tim Worner said: “Our results reflect a tough market, one that continues to change at pace, but a pace that we must match in our transformation.

“Despite these tougher conditions, we continue to lead in the core markets in which we compete, while at the same time making the necessary and sometimes difficult decisions in the transformation of our business. On the financials, our underlying EBIT was within guidance provided at the announcement of our financial results for FY16. Operating costs continue to be a focus with operating costs down $20 million (excluding Olympic Games, licence fees and 3rd party commissions).

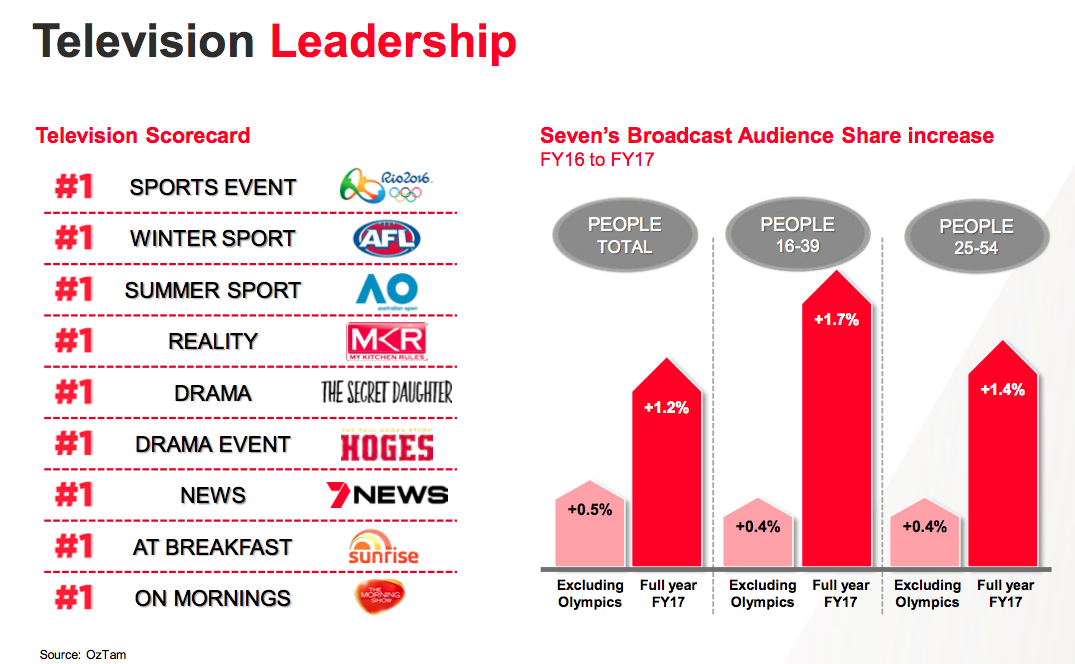

“This year we marked our 22nd consecutive half of ratings and revenue leadership in metro broadcast television. We also expanded our leadership in content creation and distribution across new delivery platforms with over 45% share in live streaming and AVOD catch-up revenue. We have continued to invest in creating our own content and we are growing our productions business globally, delivering a further 11% revenue growth in the year.

“The West has successfully integrated The Sunday Times and PerthNow into the business and has rapidly improved the digital offering of the business.

“Pacific, which has faced material revenue pressure, is accelerating its transformation. We are also investing in new business where we’re leveraging the power of our assets to help growth with very pleasing results.

“This period we have booked a material impairment in the carrying value of our assets. This reflects the current challenging market conditions which have led us to revise our market growth assumptions, impacting the carrying value of intangible assets.”

Worner was speaking on an analysts call this morning along with CFO Warwick Lynch, commercial director Bruce McWilliam, chief revenue officer Kurt Burnette, chief digital offer Clive Dickens, Pacific CEO Gereurd Roberts and, dialling in from Canberra, group chief corporate and regularity affairs Bridget Fair.

A ket feature of the results presentation was highlighting how the company would be fuelling future growth. The focus would be on expanding content production capabilities in Australia and overseas, leverage audiences across new revenue streams and capitalising on digital innovation and new investments.

Results

Seven West Media reports an underlying profit after income tax, excluding significant items net of tax of $166.8 million, on total revenues of $1,679.4 million.

EBITDA of $306.7m is down from $363.5m in the corresponding period with EBIT of $261.4m.

Seven West Media Limited reported a statutory net loss of $745.0m for the year ended 24 June 2017. This compares to the previous year statutory net profit of $184.3m.

Seven West Media recorded significant items of $988.8m in the period, including the impairment of intangibles, equity accounted investees, other assets including fixed assets, restructuring costs, onerous contracts and net loss on disposal of investments.

The reduction in the carrying value of the television assets represented the largest proportion of these write-downs. Softer free-to-air market conditions and a revision in growth assumptions for the market outlook have impacted the carrying value of the television licence and certain sports rights. In the prior period, FY16, significant items of $32.9m related to restructuring costs.

A final dividend of 2 cents per share (fully franked) has been declared.

Outlook

Management earnings guidance for FY18 is for underlying EBIT to be 5% lower than FY17. Advertising conditions have been challenging. However, the company expects the broadcast metro market to outperform FY17 and is targeting increased share. Seven Studios is forecast to exceed this year’s performance and revenue from our 100% owned digital products is projected to double again. The company is targeting cost savings in the financial year to more than offset the AFL uplift in FY18 with a further incremental cost savings to be delivered in FY19 on FY18.