16.6% of VoD households are choosing a cheaper ad-support plan, compared to 9.2% a year ago, according to Kantar’s latest Entertainment on Demand (EoD) data on the Australian video streaming market.

The report stated this is due to consumers fighting high-interest rates by looking to trim their discretionary spending on services such as video streaming.

The report also revealed that 7.8 million Australian households now subscribe to at least one VoD service, with penetration increasing from 74.3% in the previous quarter to 75.2% in Q1.

Net satisfaction with value for money for the whole VoD category fell from 27% a year ago to 21% in Q1 2024, as every major provider enforced some form of price increase over the last 12 months.

Average household spending on VoD has risen for the third quarter in a row, now hitting $45 a month across an average of three services. The need to save money remains the top reason for cancellation at 42% of churners, but other value-related cancellation reasons have seen a large increase in Q1, such as not being willing to pay a higher price and not wanting to pay after a free trial.

Boy Swallows Universe

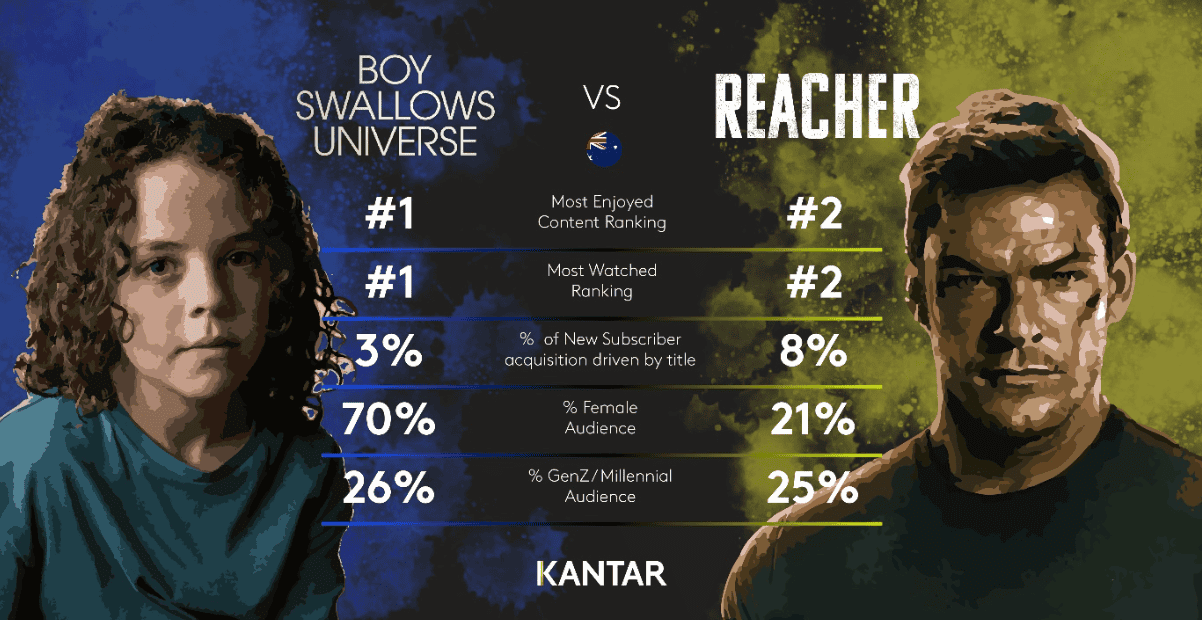

Netflix’s take on Trent Dalton’s semi-biographical book Boy Swallows Universe holds the top spot for most viewed and enjoyed title in Q1.

The show boasts an Australian cast and local production in Brisbane, helping Netflix improve its net satisfaction rating for local content, which is timely ahead of the government’s minimum local content quotas for streaming companies due to be introduced later this year.

Local content, and non-US content in general, has been growing in popularity among all VoD streamers – five out of the top 10 most enjoyed titles originated from outside of the US in Q1, up from four the previous quarter, while last year in Q1 the US accounted for all top 10 titles.

Kayo surges for Foxtel and Hubbl

Kayo has seen its highest-ever share of new VoD subscribers (10%) following the release of Foxtel’s new streaming aggregation platform Hubbl in March.

Those signing up primarily for AFL (24%) just beat NRL fans (18%), while those wanting to watch motorsport also increased in Q1, as the Australian F1 Grand Prix in March experienced record crowds.

The variety of sport on offer at the start of the year also proved a hit with existing Kayo customers, with retention rates rising from 84% last quarter to 88% in Q1, well above that of rivals Stan Sport (77%) and Optus Sport (81%).

Foxtel’s other major service Binge, however, suffered a drop in both new subscribers and retention this quarter, with the Black Friday $2 per month for three months offer ending in February/March, causing a hangover effect as churn increased by 2 percentage points to 20%.

See also: Hubbl in market: Is the ‘quantum leap in entertainment tech’ living up to the hype?